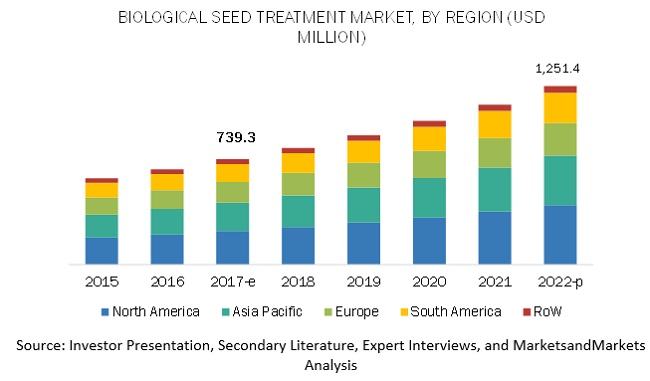

The biological seed treatment market size is projected to reach USD 1.7 billion by 2025, and it was valued at USD 0.9 billion in 2020. It is expected to grow at a CAGR of 11.9%. The market is influenced by the adoption of sustainable agricultural practices, along with strong investments being made by major market players in the research and development of these products. The agricultural and environmental benefits associated with these biological seed treatment solutions are the major factors contributing to the growth of this market globally. Beneficial microorganisms and plant extracts are projected to act as important tools that could help reduce the usage of synthetic fertilizers and chemical pesticides, thereby reducing investments by farmers and environmental risks.

Biological Seed Treatment Market Growth Drivers:

- Increasing Demand for Sustainable Agriculture: Consumers and farmers alike are increasingly prioritizing sustainable agricultural practices. Biological seed treatment methods, which utilize natural resources and reduce the need for chemical inputs, align with the growing demand for environmentally friendly farming.

- Rising Awareness about Crop Protection: With a heightened awareness of the importance of crop protection, farmers are seeking effective and safe solutions to safeguard their crops against diseases and pests. Biological seed treatments, often derived from beneficial microorganisms, provide a natural and eco-friendly alternative to traditional chemical treatments.

- Government Initiatives and Regulations: Governments worldwide are implementing regulations and initiatives to promote sustainable agriculture and reduce the environmental impact of farming practices. Incentives and support for the adoption of biological seed treatments play a pivotal role in driving market growth.

- Advancements in Biotechnology: Ongoing advancements in biotechnology have led to the development of innovative biological seed treatment products. These technologies enhance the efficacy of seed treatments, making them more appealing to farmers seeking improved yield and crop quality.

- Improved Crop Performance and Yield: Biological seed treatments not only protect crops from diseases and pests but also contribute to improved plant growth, root development, and overall crop yield. As farmers witness tangible benefits in terms of productivity, the adoption of biological seed treatments is expected to rise.

- Growing Organic Farming Practices: The global trend towards organic farming has fueled the demand for biological seed treatments. Organic farmers, in particular, prefer natural and non-synthetic solutions to maintain the integrity of their organic produce.

- Collaborations and Partnerships: Increased collaboration between seed treatment companies, agricultural research institutions, and biotechnology firms has accelerated research and development efforts. Partnerships enable the sharing of expertise and resources, leading to the creation of more effective biological seed treatment solutions.

Biological Seed Treatment Market Driver: Environmental concerns associated with chemical seed treatment

The demand for biological seed treatment has significantly increased as a result of high awareness of their potential and growing attention to the environmental and health risks associated with conventional chemicals. Chemical seed treatments are detrimental to the environment and pose a serious risk to pollinators. The neonicotinoid class of insecticides is considered highly toxic to honeybees. Microorganisms employed as active substances in pest management are recognized as generally safe for the environment and non-target species, in comparison with synthetic chemicals.

North America region’s increasing preference for high quality produce

The increasing agricultural practices and requirement for high-quality agricultural produce are factors that are projected to drive the biological seed treatment market in this region. The government policies adopted by developed countries for the ban on key active ingredients are the major factors encouraging the growth of this market in North America region. Hence, North America is projected to be the fastest-growing region in the global market. R&D investments for the development of biological seed treatment and the installation of new production capacities by key players are projected to drive market growth in the next five years.

Biological Seed Treatment Market Share:

Key players in this market include BASF SE (Germany), Bayer AG (Germany), Novozymes A/S (Denmark), Syngenta Group (Switzerland), Corteva Agriscience (US), Valent BioSciences (US), Verdesian Life Sciences (US), Plant Health Care (US), Precision Laboratories (US), Koppert Biological Systems (Netherlands), and Italpollina (Italy), These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities, along with strong distribution networks across these regions.