https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=43153327

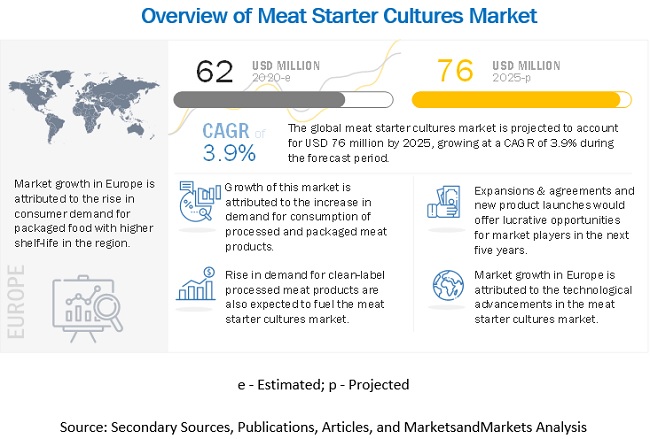

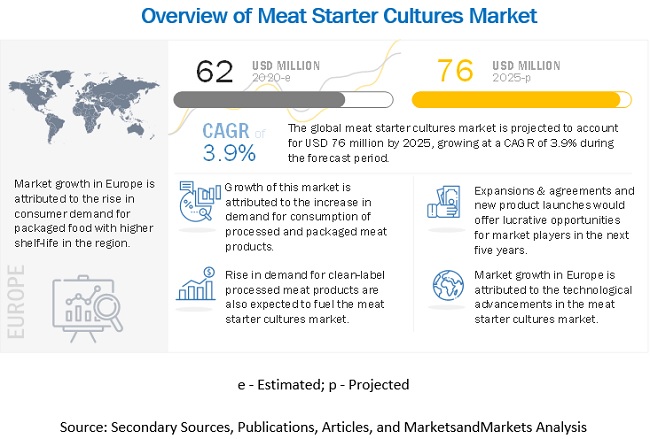

According to

MarketsandMarkets, the "Meat Starter Cultures Market by

Application (Sausages, Salami, Dry-cured meat, and Others), Microorganism (Bacteria,

and Fungi), Composition (Multi-strain mix, Single strain, and Multi-strain),

Form, and Region - Global Forecast to 2025" size is

estimated to be valued at USD 62 million in 2020 and projected to reach USD 76

million by 2025, recording a CAGR of 3.9%, in terms of value. The functional

properties of meat starter cultures and their benefits while incorporation in a

wide range of applications are driving the global meat starter cultures market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=43153327

Restraints: Stringent government

regulations for the use of starter cultures in processed meat products

Stringent regulations have proved to

be a major hindrance stifling the market for

starter cultures. Some of the global organizations involved in

providing regulatory norms include the World Trade Organization (WTO), European

Food and Feed Cultures Association (EFFCA), and other regulatory bodies. The

regulations for starter cultures as listed by the different organizations

include the following:

World Trade Organization

The World Trade Organization (WTO)

has laid down stringent rules and regulations for the import and export of

living microbes. The manufacturer has to obtain an environment clearance

certificate, quality certificate, and some other related certifications before

manufacturing microorganisms at the industrial level. Since the starter culture

industry involves high risk with respect to the health and environment, it

would not be easy for new manufacturers to enter the starter culture market.

There have been special regulatory measures present for companies to discard

the culture and biological effluent after the production.

European Food Safety Authority &

Qualified Presumption of Safety

The uses of bacteria must conform to

the general food safety standards, such as the European General Food Law

(European Parliament and the Council, 2002). The European Food Safety Authority

(EFSA) had announced five ‘generic’ approaches for the safety assessment of

microorganisms in food with a history of safe use. This approach includes a

qualified presumption of safety (QPS) in food. QPS derives basic knowledge of

the microorganisms that includes its pathogenicity, taxonomy, familiarity, and

application in food. The Scientific Committee of EFSA indicates that a thorough

knowledge of the microorganism is sufficient for awarding the QPS status for

numerous species from the groups of lactic acid bacteria and yeast.

By application, the

market is segmented into sausages, salami, dry-cured meat, and others (such as

pepperoni and other processed meat products). The meat sausages segment, akin

to most other non-processed fresh meats and meat preparations, comprises

perishable food products, and most sausage manufacturers have been looking for

additional safety or longer shelf life, either in terms of less spoilage or

delayed oxidation. Meat starter cultures are used to provide additional safety

and delay spoilage by shifting the uncontrolled fermentation that spoils the

meat to a controlled fermentation by safe bacteria. Meat starter cultures

ferment the sausages and preserve their flavor, texture, color, and increase

their shelf-life by averting wastage.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=43153327

The European region

dominated the meat starter culture market with the largest share in 2019.

The meat starter cultures

market in Europe is dominant due to the increasing demand for processed meat

products with higher shelf-life because of a shift in lifestyle trends. People

are looking for ready-to-cook meal options as they are leading a busy life. The

consumption of sausage has been prominent in these countries, resulting in a

rise in demand for meat starter cultures for their production. The leading

companies dominating the meat starter cultures market include Chr. Hansen

(Denmark), Kerry Group (Ireland), and DSM (Netherlands); have a robust presence

in Europe due to higher demand for packaged meat in these regions.

North America is the

fastest-growing market as the technological advancements involved in monitoring

and using meat starter cultures are available in the region, and meat

manufacturers have been adapting to the changing technologies. The demand for

meat starter cultures is increasing as consumers have been inclined toward

organic and clean-label meat products. Also, key players are increasingly investing

in the North American meat starter culture market.

This report includes a

study on the marketing and development strategies, along with the product

portfolios of leading companies. It consists of profiles of leading companies,

such as Chr. Hansen (Denmark), DSM (Netherlands), Kerry (Ireland), DuPont (US),

Frutarom (Israel), Galactic (Belgium), Lallemand (Canada), Proquiga (Spain),

Westcombe (UK), Biochem SRL (Italy), RAPS GmbH (Germany), DnR Sausages

Supplies. (Canada), Sacco System (Italy), Canada Compound (Canada), Biovitec

(France), Genesis Laboratories (Bulgaria), Meat Cracks (Germany), THT S.A.

(Belgium), Stuffers Supply Co. (Canada), MicroTec GmbH (Germany), and Codex-Ing

Biotech (US).

According to MarketsandMarkets, the "Meat Starter Cultures Market by Application (Sausages, Salami, Dry-cured meat, and Others), Microorganism (Bacteria, and Fungi), Composition (Multi-strain mix, Single strain, and Multi-strain), Form, and Region - Global Forecast to 2025" size is estimated to be valued at USD 62 million in 2020 and projected to reach USD 76 million by 2025, recording a CAGR of 3.9%, in terms of value. The functional properties of meat starter cultures and their benefits while incorporation in a wide range of applications are driving the global meat starter cultures market.

The food & beverage industry has witnessed emerging trends in recent years, and this is evident from the innovations and developments taking place in the packaged food segment. Packaged convenience food products have been increasingly becoming an integral part of the daily consumption around the world, especially in the North American and European regions. Busier lifestyles of consumers have been driving growth in convenience foods, and the food manufacturers have been dynamic in investing in the production of new products that could meet the rising consumer demand for packaged convenience food products.

Packaging offers protection and resistance against microbial (bacteria and fungi) growth, which results in food-borne illnesses otherwise. The shelf-life of food products also increases considerably. The packaged food products also ensure that food safety and quality are tested before it is consumed, according to the details provided on the package. These also provide the microbial safety of food products before they are kept for storage in inventories or handled during transportation. Moreover, packaged food augments the shelf-life of food products and mitigates food wastage. According to RTS, an innovative commercial waste management organization, around 40% of food is wasted in the US every year. However, developing countries such as China and India are also among the countries with major food wastage, globally.

The meat starter cultures market is highly consolidated in the emerging markets across Asia, Africa, and South America. The usage of meat starter cultures in small & medium enterprises has been a challenge due to lack of resources or the technology and facilities required to monitor high-quality meat starter cultures. Moreover, the selection of the right composition of starter culture is a key aspect that many companies have not figured out perfectly. This selection plays a crucial role in sustaining the flavor and texture of meat applications. The type of bacteria used (thermophilic or mesophilic) also plays a key role in the overall property of the meat products. The selection of the right composition of meat starter culture is a complex method that requires validation at a laboratory level and factory-scale. Lack of awareness among experts on the characteristics of the strain can lead to huge production losses, and hence, this factor has been posing as a major challenge for the meat starter culture market. Adequate training provided to the professionals in regard to the product functions and characteristics can help the manufacturers attain the desired quality end-product, with minimal production losses. Furthermore, the use of meat starter cultures requires advanced technology such as microbial count monitoring devices, pH measuring devices, and devices to determine bacterial community composition. Thus, the lack of these devices and huge initial set-up costs involved poses as a challenge for the use of meat starter cultures in developing countries.

The bacteria segment is projected to account for a major share in the meat starter cultures market during the forecast period

By microorganism, the meat starter cultures market is segmented into bacteria and fungi. Bacteria has been the most widely used microorganism as a starter culture, due to its large-scale application in meat products. Lactic acid bacteria (LAB) and coagulase-negative staphylococci (CNS) are the most commonly used bacteria-based starter cultures in the industry. These are the main microorganisms used in meat products in order to prohibit pathogens and spoilage microorganisms during the pre- and post-processing of meat products. Therefore, this segment is projected to grow at a higher CAGR of 4.0% during the forecast period.

Europe has been a major contributor to the growth of the processed meat industry, as a huge percentage of consumers have been inclined toward packaged meat applications such as sausages, salami, and dry-cured meat. The busier lifestyles of consumers in Western European countries such as Germany, the UK, France, and Italy have been propelling the demand for meat products with higher shelf-life. Therefore, augmenting the demand for meat starter cultures in this region. The European region consists of some of the major manufacturers from the meat starter culture market, such as Chr. Hansen (Denmark), DSM (Netherlands), Kerry Group (Ireland), Biochem SRL (Italy), and Sacco SRL (Italy). These key players have been bolstering the usage of meat starter cultures in this region by offering technologically advanced equipment for monitoring and usage of meat starter cultures.

Chr. Hansen (Denmark), DSM (Netherlands), Kerry (Ireland), DuPont (US), Frutarom (Israel), Galactic (Belgium), Lallemand (Canada), Proquiga (Spain), Westcombe (UK), Biochem SRL (Italy), RAPS GmbH (Germany), DnR Sausages Supplies. (Canada), Sacco System (Italy), Canada Compound (Canada), Biovitec (France), Genesis Laboratories (Bulgaria), Meat Cracks (Germany), THT S.A. (Belgium), Stuffers Supply Co. (Canada), MicroTec GmbH (Germany), and Codex-Ing Biotech (US).