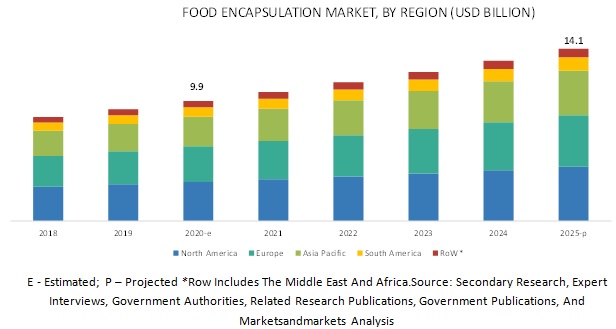

The global food encapsulation market is estimated to account for USD 9.9 billion in 2020 and is projected to reach USD 14.1 billion by 2025, recording a CAGR of 7.5% during the forecast period. The market is primarily driven by the increasing use of encapsulated flavors in the food and beverage industry and the rising adoption of microencapsulation for functional ingredients.

The polysaccharides segment accounted for the largest share in the North American food encapsulation market in 2019.

The polysaccharides segment accounted for the largest market for shell material in 2018 and is projected to follow the same trend through 2025. Owing to their enormous molecular structure and ability to entrap bioactives, polysaccharides are considered the most-suitable building blocks for delivery systems. On the other hand, the market for the emulsifiers is projected to be the fastest-growing, owing to its ability to provide improved solubility and bioavailability.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=68

The demand for encapsulated vitamins and minerals to remain high during the forecast period.

Vitamins are functional ingredients that are used in food, owing to their specific nutritional properties for varied human body parts. Thus, targeted and controlled release of vitamins often becomes important when added as a food ingredient. Thus, encapsulation is majorly adopted for vitamins for its targeted effect. Also, flavor manufacturers have been adopting this technology at a rapid speed, and hence, the vitamins segment was closely followed by flavors in terms of dominance in the global market.

The physical method of encapsulation is estimated to dominate the market globally for the food industry in 2020.

Food encapsulation demand is targeted by a few ingredient manufacturing companies. With the use of advanced technology, the price of the ingredient rises, and hence, manufacturers prefer low cost-efficient encapsulation methods. Thus, the physical methods are the most in-demand for the encapsulation of food ingredients.

The food encapsulation market in the Asia Pacific region is projected to grow at the highest CAGR from 2019 to 2026.

Factors driving the growth of the Asia Pacific market include the increasing adoption of encapsulated flavors and colors in the beverage and premium food industry. With the rising awareness about the benefits of functional food and dietary supplements among consumers and rising disposable income, consumers have been willing to pay a premium price for value-added products. Thus, manufacturers have been grabbing this opportunity in countries such as China and India to expand their business in the encapsulation market. Also, small enterprises have been delivering generic encapsulated products in the market at competitive prices, which has been further boosting awareness.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=68

Many domestic and global players provide food encapsulation of various ingredients across the world. Few players offer encapsulated ingredients, while few companies offer encapsulation as an extended service for their clients. Major players have their presence in the North American and European countries. Key players operating in this market include FrieslandCampina (Netherlands), DSM (Netherlands), Ingredion Incorporated (US), Kerry Group (Ireland), Cargill (US), Lycored Group (Israel), Balchem Corporation (US), Firmenich Incorporated (Switzerland), BASF SE (Germany), International Flavors and Fragrances Inc. (US), DuPont (US), Symrise AG (Germany), Sensient Technologies Corporation (US), Aveka Group (US), Advanced Bionutrition Corp (US), Encapsys (US), Tastetech Encapsulation Solutions (UK), Sphera Encapsulation (Italy), Clextral (France), and Vitasquare (Netherlands).

Recent Developments:

- In July 2019, DSM (Netherlands) entered into a joint venture with Evonik (Germany) to produce encapsulated omega-3 fatty acids, reducing the pressure on fish stocks, and supporting the aquaculture industry.

- In May 2017, Lycored (Israel) entered into a joint venture with a biotechnology company, Algatechnologies (Israel), to distribute Algatech's AstaPure in the form of beadlets, which will help in increasing the brand's commercial reach for this product range in the North American market.

- In January 2017, DSM (Netherlands) launched a new product, MEG-3, with new encapsulation technology.