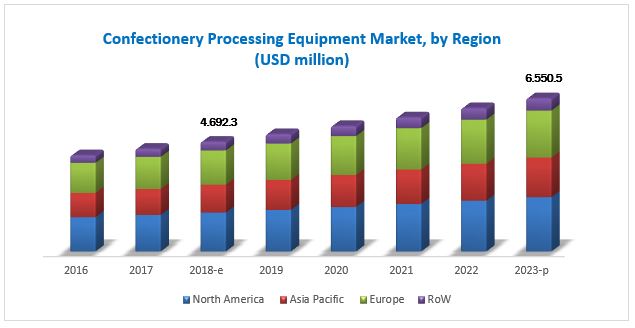

The report "Confectionery Processing Equipment Market by Type (Thermal, Mixers, Blenders, Cutters, Extrusion, Cooling, Coating), Product (Hard Candies, Chewing Gums, Gummies & Jellies, Soft Confectionery), Mode of Operation, and Region - Global Forecast to 2023", The confectionery processing equipment market is estimated to be valued at USD 4.69 Billion in 2018 and is projected to reach USD 6.55 Billion by 2023, at a CAGR of 6.90% from 2018. Factors such as growth of the retail industry and increase in demand for confectionery items such as candies, toffees, chocolates, chewing gums, and jellies have driven the growth of the confectionery processing equipment market.

The objectives of the study are:

- To define, segment, and forecast the size of the confectionery processing equipment market with respect to product, type, mode of operation, and region

- To analyze the market structure by identifying various sub segments of the confectionery processing equipment market

- To forecast the size of the market for confectionery processing equipment and its various submarkets with respect to four main regions, namely, North America, Asia Pacific, Europe, and the Rest of the World (RoW)

- To provide detailed information about crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as expansions & investments, acquisitions, and partnerships in the market for confectionery processing equipment.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=26974693

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=26974693

The confectionery processing equipment market, by product, is segmented into hard candies, chewing gums, gummies & jellies, soft confectionery, and others. The soft confectionery segment is estimated to dominate the market with the largest share in 2018 as the demand for a variety of chocolates, such as sugar-free and dark, is increasing, globally. This is followed by the hard candies segment.

The confectionery processing equipment market, based on type, is segmented into thermal, extrusion, mixers, blender, and cutters, coating, cooling, and others. The extrusion segment is projected to grow at the highest CAGR among all confectionery processing equipment types from 2018 to 2023. Extrusion equipment is used to make confectionery products of different shapes and sizes. The need to provide innovative products is one of the factors expected to augment the demand for extrusion products.

Based on mode of operation, the confectionery processing equipment market is segmented into automatic and semi-automatic. The automatic segment is anticipated to be relatively larger as against the semi-automatic segment. Automatic operation helps to reduce labor costs as well as time and ensures high-quality products.

Rise in the middle-class population in the region and the increase in disposable incomes drive the demand for nutritious chocolate bars & candies with new & enhanced flavors, which increases the need for confectionery processing equipment. This provides an opportunity for the major players in the field of confectionery processing to expand their geographical reach in the region.

This report includes a study of business strategies, along with the product portfolios of leading companies. More than nine developments were tracked for the 13 companies in the confectionery processing equipment market. It includes the profiles of leading companies such as Robert Bosch GmbH (Germany), Bühler AG (Switzerland), GEA Group (Germany), Alfa Laval (Sweden), John Bean Technologies Corporation (JBT) (US), Aasted ApS (Denmark), BCH Ltd (England), Tanis Confectionery (Netherlands), Baker Perkins Limited (UK), Sollich KG (Germany), Heat and Control, Inc. (US), and Rieckermann GmbH (Germany).

Target Audience:

- R&D institutes

- Technology providers

- Confectionery processing equipment providers

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- End users