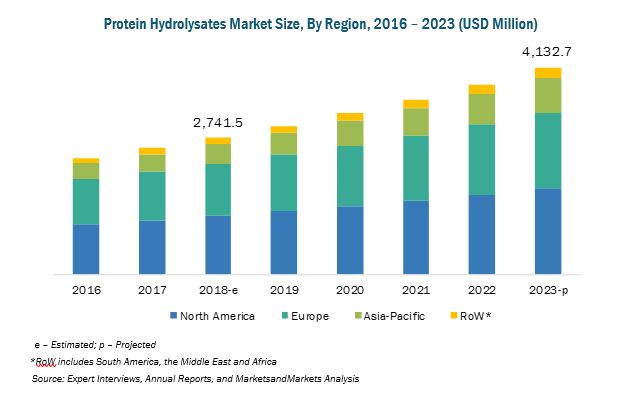

The report "Protein Hydrolysates Market by Type (Milk, Meat, Marine, Egg, Plant, and Yeast), Application (Infant Nutrition, Clinical Nutrition, Weight Management, and Feed), Process (Enzymatic, and Acid & Alkaline), Source, Form, and Region - Global Forecast to 2023", The global protein hydrolysates market is estimated to be valued at USD 2.74 billion in 2018 and is projected to have a CAGR of 8.56%, in terms of value, between 2018 and 2023. Protein hydrolysates are widely accepted ingredients in food & beverage applications owing to their functional properties. The multi-functionality of protein hydrolysates increases their adoption in end-use applications. Also, the growing demand for high protein, nutritious products has expanded the application areas of protein hydrolysates in the food & beverage industries. Protein hydrolysates are widely used by food processors to make their food products more nutritious and to enable them to endure the rigors of harsh processing.

Rising demand for protein hydrolysates for infant nutrition products to drive market growth

Infant nutrition is one of the major applications of protein hydrolysates owing to their various nutritional benefits. For instance, protein hydrolysates help manage the existing milk allergy and reduce the risk of its further development. Cow’s Milk Allergy (CMA) is one of the most common food allergies that generally affect children of under the age of 2–3 years; according to the World Allergy Organization (WAO), about 2%–5% of all children suffer from this condition. Moreover, extensive protein hydrolysates are more effective for infant nutrition, especially for children with CMA diseases, when compared with partial protein hydrolysates.

Download PDF Brochure:https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=39737295

High R&D costs to restrain market growth

Protein hydrolysates require high investment in innovations and product development, which increases their production cost. Hence, many small and medium-sized manufacturers are not able to enter this market. As a result, most developing countries such as India and Brazil import protein hydrolysates from developed countries. Moreover, high R&D costs lead to an increase in per unit production cost; price sensitive countries in Africa, South America, and South Asia mostly rely on other forms of protein such as protein concentrates and protein isolates.

Milk Protein Hydrolysates projected to be the largest segment

Milk protein hydrolysates is estimated to account for the largest share in the protein hydrolysates market in 2018, due to its wide range of applications in the food & beverage industry. The multi-functionality of milk protein hydrolysates results in their use in a broad spectrum of applications such as infant nutrition, clinical nutrition, weight management, and animal feed.

Infant Nutrition: The most widely preferred protein hydrolysates application

The infant nutrition segment is estimated to account for the largest share in the protein hydrolysates market, in terms of value, in 2018. Protein is one of the three major macronutrients that help build tissue structure. Protein deficiency is one of the significant reasons for malnutrition among consumers, especially among infants across the world. Protein hydrolysates are beneficial for all infant formula as they are easy to digest. Among other reasons, food allergies and the inability to breastfeed also contribute to the development of infant nutrition products, which increases the demand for protein hydrolysates.

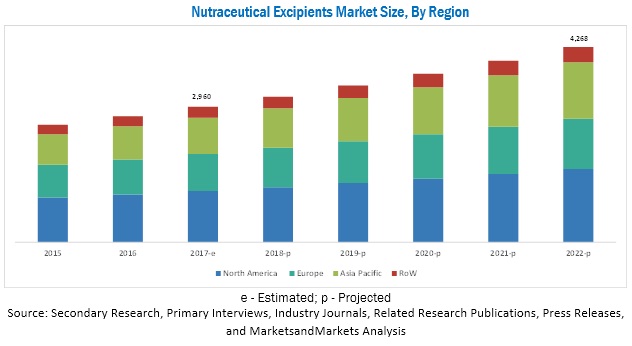

North America estimated to be the most lucrative market for protein hydrolysates

In 2018, the North America region is estimated to hold a significant share in the global protein hydrolysates market whereas Asia Pacific is projected to grow at the highest CAGR during the forecast period. The presence of large food & beverage and nutraceutical industries offers the North American protein hydrolysates market a prominent consumer base as well as growth prospects. The Asia Pacific market is driven by the economic growth of the region, coupled with the increasing demand for nutritious food & beverage products.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=39737295

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. It includes the profiles of leading companies such as Abbott Nutrition (US), Koninklijke DSM N.V. (Netherlands), Kerry Group (Ireland), FrieslandCampina (Netherlands), and Arla Foods (Denmark).

Key Questions Answered:

- What are the upcoming trends in the protein hydrolysates market?

- Major key players and their respective share in the market?

- Which is the largest and fastest growing segment by type both in terms of value and volume?

- Which region has the highest growth potential in the market?