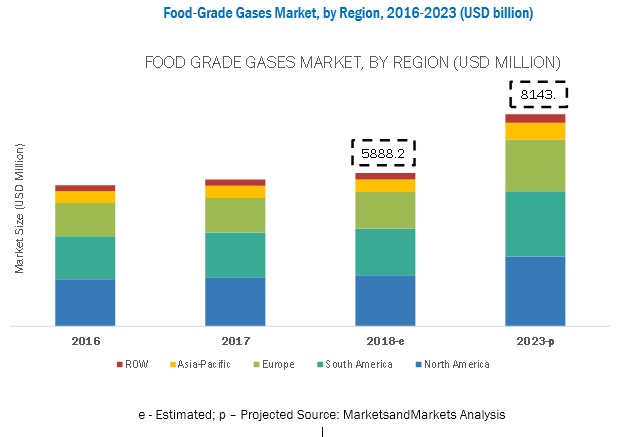

The global food-grade gases market is estimated to be valued at USD 5.9 billion in 2018 and is projected to reach USD 8.1 billion by 2023, at a CAGR of 6.7% from 2018 to 2023. The growing demand for convenience food products and carbonated beverages have significantly fueled the market for food-grade gases. Further, with the introduction of new products in the food industry and advancements in packaging technologies, there has been a growing need for food-grade gases for various end-uses.

Download PDF Brochure:

Increasing demand from developing economies such as India and China will provide growth opportunity.

Significant opportunities for the food-grade gases market are present in developing economies such as China, India, and Latin American countries. A major factor fueling the demand for food-grade gases is the increasing consumer demand for chilled and frozen foods, which are becoming popular with the younger generation in emerging economies. The rise in middle-class population, rapid urbanization, increased spending power, and the increase in the number of working women have also spurred the demand for chilled & frozen foods. Food & beverage manufacturers are tapping into these markets due to the growing demand for processed foods, propelled by changing lifestyles of consumers who prefer convenience foods, availability of abundant raw material, cheap labor, governmental support to set up processing units for SMEs, and lower tariff duty. This growth is also fueled by new legislation in the retail environment, which gives foreign investors and multinational retail chains access to these markets. These retail chains have organized distribution across these markets, which provides opportunities for setting up food & beverage industries here. The rising importance given to food safety and quality of processed foods by the governments in these countries has increased the need to prevent the deterioration of food with the use of proper packaging technology and investment in refrigerated storage facilities.

The beverages segment, by end-use, is estimated to witness the fastest growth in the food grade gases market in 2018

By end-use, the food-grade gases market is segmented into meat, poultry, and seafood products; dairy & frozen products; beverages; fruits & vegetables; convenience food products; bakery & confectionery products; and others. The beverages segment is estimated to grow at the highest CAGR due to the use of large volumes of food-grade gases, especially carbon dioxide and nitrogen, for carbonation and blanketing. As the demand for carbonated beverages increases, there is a simultaneous growth in the market for food-grade gases.

Make an Inquiry:

North America is estimated to dominate the food grade gases market, in terms of value, in 2018

The microbrewery culture is also on the rise in the North American market. There are multiple microbreweries present in the region. These microbreweries require carbon dioxide for beer dispensing. Also, the North American soft drinks market is one of the largest, with the presence of all the big brands such as Coca-Cola and PepsiCo. The soft drinks industry is one of the largest users of food-grade carbon dioxide for the carbonation of beverages.

The large beverage industry and rising trends of microbreweries create a huge demand for carbon dioxide in the North American region, with the US being the largest and fastest growing market. Also, because of the presence of highly organized retail chains and cold chain infrastructure, the North American market holds the largest market share in the food-grade gases market.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies. It includes the profiles of leading companies such as The Linde Group (Germany), Air Products & Chemicals (US), Air Liquide (France), The Messer Group (Germany), Taiyo Nippon Sanso (Japan), Wesfarmers Ltd. (Australia), SOL Group (Italy), Gulf Cryo (Kuwait), Air Water, Inc. (Japan), Massy Group (Caribbean), PT Aneka Industri (Indonesia), and The Tyczka Group (Germany)

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.