The report "Humectants Market by Type (Sugar Alcohol, Glycerol, Alpha Hydroxy Acid & Polysaccharides, Glycols), Application (Food & Beverages, Oral & Personal Care, Pharmaceuticals, Animal Feed), Source (Synthetic, Natural), and Region - Global Forecast to 2022", The humectants market is projected to reach USD 26.27 Billion by 2022, at a CAGR of 7.0% from 2017, in terms of value. In terms of volume, the market is projected to reach 14,741.6 KT by 2022, at a CAGR of 3.9% from 2017.

The global humectants market is poised to grow at a significant rate in terms of value, which is evident from the on-going innovations & developments of end-use products in the industry. Growing consumer preference for healthy food, rising concerns about animal health & nutrition, and a rise in demand for superior oral & personal care products are the factors majorly driving the humectants market, worldwide.

The food & beverage segment, by application, dominated the humectants market in 2016. Factors such as rise in health-conscious consumers, growth in aging population, increase in consumer awareness regarding nutritious diet, and rise in consumer health concerns related to the consumption of high-calorie foods are expected to drive the humectants market in food & beverage segment. The oral & personal care products segment is projected to grow at the second-highest CAGR during the forecast period, followed by the pharmaceuticals segment.

Download PDF Brochure:

The sugar alcohols segment dominated the market in 2016, by type, owing to its better nutritional profile as humectants and its dominant usage in major end-use applications such as bakery and confectionery products, fruits & vegetables, fruit & vegetable juices, oral & personal care products, pharmaceuticals, tobacco, plastics, and tanneries.

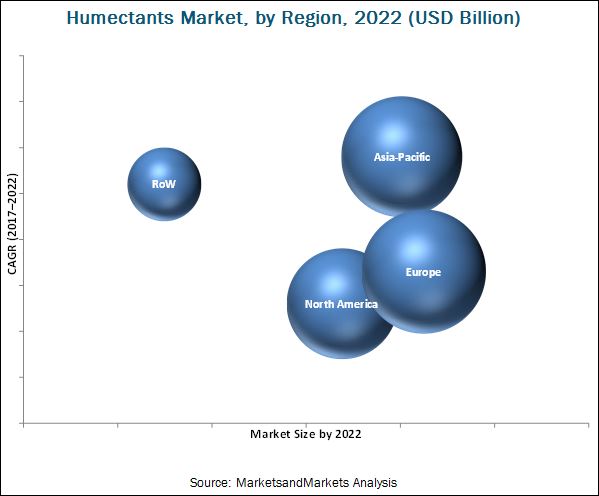

The Asia-Pacific region is projected to be the fastest-growing market for humectants, owing to its growing economy with a large population base ready to spend on functional & nutritional food and the rapidly growing consumer markets of China, India, and Japan.

The eco-friendly production process of bio-based propylene glycol has led to the growth in the usage of propylene glycol. The growing automotive industry in the Asia-Pacific region is also driving the market as propylene glycol is widely used in engine coolants and sheet molding compounds. Glycerine is one of the major humectants used in this region; this growth is due to the rapidly increasing consumption in countries such as China and India for personal care products.

Make an Inquiry:

This report studies marketing and development strategies, along with the product portfolios of leading companies such as Cargill (U.S.), The Dow Chemical Company (U.S.), Archer Daniels Midland Company (U.S.), E. I. du Pont de Nemours and Company (U.S.), and Roquette Frères (France). Other significant players include Ingredion Incorporated (U.S.), BASF SE (Germany), Brenntag AG (Germany), Barentz (Netherlands), Ashland Global Holdings Inc. (U.S.), Batory Foods (U.S.), and Corbion (Netherlands).

Target Audience:

- Humectant manufacturers

- Government bodies and research organizations

- Regulatory bodies

- Organizations such as the FDA, the EFSA, the USDA, and FSANZ

- Other local & regional government agencies

- Intermediary suppliers

- Traders

- Wholesalers

- Dealers

- Consumers