The report "Rodenticides Market by Type (Non-Anticoagulants, Anticoagulants (FGAR, SGAR)), End-Use Sector (Agricultural Fields, Warehouses, Urban Centers (Residential, Commercial)), Mode of Application (Pellets, Sprays, Powders), and Region - Global Forecast to 2025", is projected to reach USD 5.9 billion by 2025, from USD 4.7 billion in 2019, at a CAGR of 3.7% during the forecast period. The market is driven by factors such as urbanization and industrialization, along with public awareness about chemical-based rodenticides.

Opportunity: Development of non-toxic and third generation anticoagulants

Chemicals that have toxic effects are used to eliminate pests. However, these chemicals, when used in excess, can be toxic to other animals as well. Rodenticides can enter the food environment (right from agricultural farms to storage), and when consumed repeatedly, may accumulate to reach a toxic level in larger animals. Pets and wildlife can get poisoned directly by bait or indirectly through the consumption of poisoned rodents. Almost all rodenticides are synthetic, but there are also non-toxic, natural rodenticides that are cellulose-based. Presently, natural rodenticides are witnessing growth in the market due to the increasing safety concerns among consumers. For example, BIORAT is a natural rodenticide which is highly effective against rats and mice. In order to resolve the issue of the negative impact of toxic rodenticides, Biological Pharmaceutical Laboratories of Cuba developed BIORAT, which is based on a rat-specific pathogen. The product has successfully been marketed in 22 countries of Latin America, Africa, Asia, and Europe.

Download PDF Brochure:

By type, the anticoagulant segment is expected to hold the largest market share during the forecast period

The rodenticides market has been segmented on the basis of types into non-anticoagulant and anticoagulant. The market for anticoagulant rodenticides is projected to record the highest market share between 2019 and 2025. Anticoagulant rodenticides are of lethal doses that kill rodents in a single dose or multiple doses. These rodenticides block the activity of the vitamin K cycle, resulting in the inability to produce blood clotting factors—prothrombin and proconvertin; this leads to internal bleeding and death of the animal. Anticoagulants act relatively slowly, when compared to the most acute rodenticides.

By mode of application, the pellets segment is expected to hold the largest market share during the forecast period

The rodenticides market has been segmented on the basis of mode of application into pellets, sprays, and powder. Pellets are the particles usually prepared by the compression of original materials. In terms of rodenticides, pellets are used with the baits for attracting the rodents. Rodenticides under pellets are available in various forms such as grains and wax blocks which makes it very easier to coat with any of the baits.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=189089498

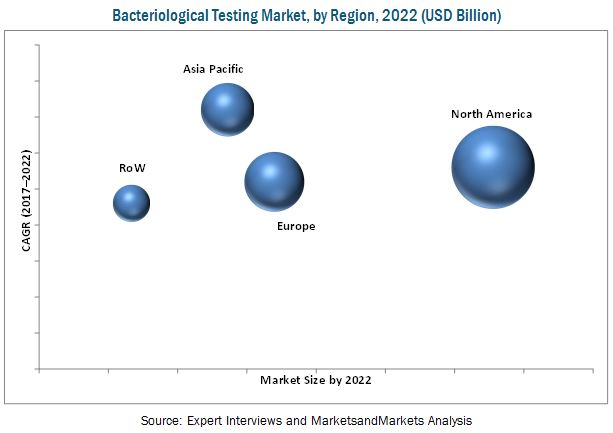

North America to account for the largest market size during the forecast period.

The North American rodenticides market is projected to be the largest between 2019 and 2025, while the Asia Pacific market is projected to grow at the highest CAGR. Strengthening of the housing industry and a steadily improving economy has been driving the overall pest control market, and thereby has been boosting the rodenticides market as well. Rodent is a major concern among all the pests in the US, and according to the Washington Post Company LLC (US), there were about 2 million New York City rats in 2014. According to the US Census Bureau and the US Department of Housing and Urban Development, nearly 667,000 new single-family houses were sold in February 2019, compared to 588,000 new single-family houses in December 2018. Thus, with the increasing number of new houses, the demand for rodent control products and services is also projected to increase during the forecast period.

BASF SE (Germany), Bayer (Germany), Syngenta (Switzerland), UPL (India), Liphatech Inc. (US), JT Eaton (US), Neogen Corporation (US), Pelgar International (UK), Senestech Inc. (US), Bell Laboratories (US), and Impex Europa (UK). Key service providers include Rentokil Initial Plc (UK), Terminix (US), Ecolab (US), Anticimex (Sweden), Rollins (US), Truly Nolen (US), and Abell Pest Control (Canada) are some of the key players operating in the rodenticides market.

Recent Development:

- In January 2019, Turner Pest Control, a Jacksonville-based Anticimex company acquired Brandon Pest Control (US). It is USD 8 million company that deals with pest control service provision. The acquisition is the part of company’s aggressive growth strategy.

- In April 2018, BASF (US) launched Selontra rodent bait, a soft bait formulation. This products is cholecalciferol based rodenticide which helps the professionals for rodent control.