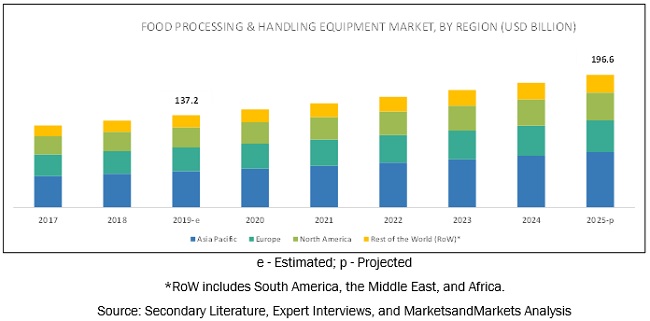

The report “Food Processing & Handling Equipment Market by Type (Food Processing Equipment, Food Packaging Equipment, and Food Service Equipment), Application, Form (Solid, Liquid, and Semi-Solid), and Region – Global Forecast to 2025″, The global food processing & handling equipment market is estimated to be valued at USD 137.2 billion in 2019 and is projected to reach USD 196.6 billion by 2025, growing at a CAGR of 6.2%. Advancements in the food processing & packaging equipment industry, innovation in processing technology, and continuous growth in the demand for processed food are some factors that are expected to support the growth of the food & beverage processing equipment market. With the growing preference for healthy food and functional foods, manufacturers are expected to adopt new equipment to fulfill the demand for healthy functional foods & beverages. The expansion of food manufacturing capacities and growth of the food processing industry in emerging economies are also expected to support the growth of the food processing & handling equipment market.

The food processing equipment segment is estimated to dominate the global market in 2019.

By equipment type, the market was dominated by the food processing equipment segment in 2018, in terms of value. Food companies are focusing on product innovations and providing efficient and advanced technologies to food producers who are demanding operationally advanced machinery to cater to the growing demand from the food industry. New technologies such as non-thermal processing are also being developed to support the manufacturing process by reducing production time, ingredient & food waste, and overall cost. The growing health awareness is driving the demand for healthy and convenience food products, which is also expected to drive the food processing & handling market in the food industry.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=145960225

The bakery & confectionery products segment is estimated to account for the largest share in the market in 2019.

By application, the bakery & confectionery products segment is estimated to account for the largest share in the food processing & handling equipment market in 2019. Processing equipment such as industrial ovens, molders, formers, mixers, blenders, and cutters form an integral part of bakery & confectionery products manufacturing, and their high demand is mainly due to the highly fragmented bakery & confectionery market and high prevalence and demand for these products in both developed and developing countries. The demand for ultra-processed bakery products is high in developed countries such as the UK, Germany, the US, Canada, and Spain. These countries represent an established bakery industry and are experiencing a rise in the popularity of premium and innovative bakery products such as pastries, glazed & chocolate coated donuts, sugar & chocolate coated cookies, and chocolate pies. Such countries are focused on the production of bakery items to meet the increasing demand. This demand for bakery products is facilitating the increasing use of bakery processing equipment.

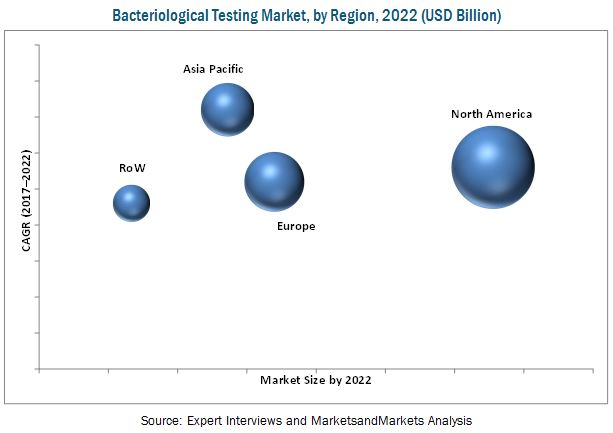

Asia Pacific is estimated to dominate the food processing & handling equipment market in 2019.

Asia Pacific is estimated to account for the largest market share in the food processing & handling equipment market in 2019. Key factors such as industrialization, growing middle-class population, rising disposable income, changing lifestyles, and the rising consumption of processing and packaged products are expected to drive the demand for food processing & handling equipment market during the forecast period. The increasing disposable incomes, growing population, busy lifestyles, and shift in the focus toward convenience foods and instantly processed foods are some of the key trends influencing the growth of the food processing & handling equipment market in Asia Pacific. As a result, the next few years is likely to see continued growth in the sector’s performance.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies in the food processing & handling equipment market. The key players in the food processing & handling equipment market include GEA (Germany), Buhler Ag (Switzerland), Alfa Laval (Sweden), JBT Corporation (US), SPX FLOW (US), Robert Bosch (Germany), IMA Group (Italy), Middleby Corporation (US), and Dover Corporation (US), Robert Bosch (Germany), IMA Group (Italy), Tetra Laval (Switzerland), Multivac (Germany), Middleby Corporation (US), Welbilt, Inc. (US), and Electrolux (Sweden).

Make an Inquiry:

Recent Developments:

- In May 2019, GEA launched a new SmartPacker CX400 packaging machine, which has induction sealing capabilities for meat and poultry manufacturers. In April 2019, GEA also launched CALLIFREEZE system for the GEA S-Tec spiral freezer in the Asian market. This product would help GEA’s customers to meet their Industry 4.0 strategy requirements.

- In May 2019, Bosch Packaging Technology, a subsidiary of Bosch, launched the Pack 403, a fully-automated, narrow horizontal flow wrapper in the European and Asian markets. The company has been continuously developing innovative products according to the customers’ demands.

- In April 2019, Tetra Pak launched a connected packaging platform; this would transform juice and milk cartons into interactive information channels, digital tools, and full-scale data carriers.