- In September 2019, Nutrien, Ltd. (Canada) acquired Ruralco Holdings Limited (Ruralco) in Australia. Through this acquisition, Nutrien would provide significant benefits to its stakeholders as well as enhance the delivery of its products and services to Australian farmers.

- In August 2019, Yara International ASA (Norway) and Nel Hydrogen Electrolyser, a division of Nel ASA (Norway), entered into a collaboration agreement for low-carbon-footprint fertilizer production at Yara’s existing plant in Porsgrunn, Norway. This project was supported by the Research Council of Norway, Innovation Norway, and Enova through the PILOT-E program.

- In March 2019, Yara International ASA (Norway) launched Yaralix, a tool for precision farming, allowing the farmers to measure crop nitrogen requirements using their smartphones. The system consisted of a free-to-download application that was designed to handle the smartphone camera to determine nitrogen requirements for different crops in the early growth stages.

Tuesday, September 29, 2020

Latest Regulatory Trends Impacting the Controlled-release Fertilizers Market

Monday, September 28, 2020

Food Authenticity Testing Market to Witness Unprecedented Growth in Coming Years

The food authenticity testing market, in terms of value, is projected to reach USD 7.50 billion by 2022, at a CAGR of 7.6% from 2016 to 2022. The growing international trade is one of the factors driving this market as compels the manufacturers to comply with the global mandates and regulations for food authenticity due to the growing economically motivated adulterations (EMAs). As international trade increases complexities in the supply chain and the chances of cross-contamination and fraud, the demand for food authentication services is projected to remain high.

- To define, segment, and project the size of the global food authenticity testing market on the basis of target testing, technology, and food tested

- To understand the structure of the food authenticity testing market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market trends

- To project the size of the market and its submarkets, in terms of value, with respect to four regions (along with their respective key countries)–North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

- Manufacturers, importers & exporters, traders, distributors, and suppliers of equipment, reagents, chemicals, and other related consumables

- Food authenticity testing solutions providers

- Food authenticity testing laboratories

- Food processors

- Food manufacturers

- Government and research organizations

- Trade associations and industry bodies

Growth Strategies Adopted by Major Players in the Antibacterial Market

The global antibacterial market in agriculture is projected to reach USD 11.89 Billion by 2022, at a CAGR of 4.6% during the forecast period. The market growth is driven by multiple factors such as the rise in the need for food security for the growing population, advancement in farming practices and technologies, and ease of application of antibacterial in agriculture. The antibacterial market is further driven by factors such as the increase in demand for fruits & vegetables, increase in acceptance for Integrated Pest Management (IPM) by farmers, and high opportunities in developing countries.

- To define, segment, and measure the antibacterial market based on type, crop type, mode of application, form, and region

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To analyze opportunities in the market for stakeholders and details of the competitive landscape for market leaders

- To analyze competitive developments such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and collaborations in the agricultural bactericides market

- Analyzing the demand-side factors based on the impact of macro and microeconomic factors on the market and shifts in demand patterns across different subsegments and regions

Sustainable Growth Opportunities in the Starter Feed Market

The report “Starter Feed Market by Type (Medicated and Non-medicated), Ingredient (Wheat, Corn, Soybean, Oats, and Barley), Livestock (Ruminants, Swine, Poultry, Aquatic, and Equine), Form (Pellets and Crumbles), and Region – Global Forecast Up to 2022″, The global market for starter feed was valued at USD 21.45 Billion in 2015; this is projected to grow at a CAGR of 4.57% from 2016, to reach USD 29.15 Billion by 2022. The market is driven by factors such as the need to increase livestock production to cater to the growing demand for animal sourced products, and adoption of precision nutrition techniques.

Upcoming Growth Trends in the Food grade Alcohol Market

The report "Food-grade Alcohol Market by Type (Ethanol, Polyols), Application (Food, Beverages, Healthcare & Pharmaceuticals), Source (Sugarcane & Molasses, Grains, Fruits), Functionality, and Region - Global Forecast to 2022", The food-grade alcohol market is projected to reach USD 12.86 Billion by 2022, at a CAGR of 3.9% from 2017 to 2022. The market is driven increasing global beer production and popularity of craft beer. Also, the increasing consumption of alcoholic beverages in the developing regions supported with the expansion of potential export markets due to demographic and economic reasons, have developed a growing platform for increased alcohol trade which is in turn driving the food-grade alcohol market.

Friday, September 25, 2020

Growth Opportunities in the Plant Breeding and CRISPR Plants Market

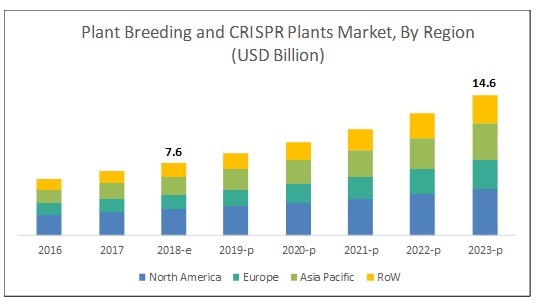

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

On the basis of application, the cereals & grains segment is projected to witness the fastest growth during the forecast period.

Corn, wheat, and rice are the major cereals bred with advanced technologies such as molecular breeding and genetic techniques. The availability of germplasm for these crops encourages the adoption of advanced techniques for crop breeding. The economic importance of corn due to its application in various sectors and increasing demand for high-quality wheat and rice in the food industry are other reasons for the adoption of hybrid breeding technologies among seed producers.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

On the basis of type, the biotechnological method is projected to witness the fastest growth in the plant breeding and CRISPR plants market during the forecast period

The increasing adoption of hybrid and molecular breeding techniques in developing countries and the growing cultivation of GM crops in the Americas are factors contributing to its high growth. The growing market for crop genetics in various countries of the Americas and the declining cost of genetic procedures in the past decade are factors driving the demand for genetic engineering and genome editing in the region. Unlike genetic techniques, no regulations are implied by the government for molecular breeding across the globe, which is projected to drive the growth of the biotechnological method at a higher rate during the forecast period. Advances in the field of CRISPR gene editing technology have brought about the third revolution in crop improvement and these tools can be used along with existing technologies. Growing innovation would facilitate the growth of CRISPR technology in agriculture, especially in countries such as the US, China, Japan, Brazil, and South Africa.

On the basis of trait, the herbicide tolerance segment is projected to witness the fastest growth in the plant breeding and CRISPR plants market

Increasing regulations on the use of chemical pesticides and rising instances of pest attacks during the early germination phase have increased the need for pesticide-tolerant seeds. Herbicide tolerance has been one of the major traits targeted by plant genetic companies for transgenic and non-transgenic crops. Non-transgenic Clearfield herbicide tolerance technology, developed by BASF and Syngenta, is recognized as one of the groundbreaking innovations in hybrid breeding technology, and more companies have exhibited their interest to enter this industry, which is projected to contribute to the growth in the next five years.

North America is estimated to dominate the market in 2018, while the Asia Pacific is projected to witness the fastest growth through 2023.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=256910775

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).

Key questions addressed by the report:

- Which market segments to focus on in the next two to five years for prioritizing efforts and investments?

- Which region will have the highest share in the plant breeding and CRISPR plants market?

- Which type of plant breeding techniques have high demand in each key country market?

- What are the trends and factors responsible for influencing the adoption rate of biotechnological methods in key emerging countries? What is the level of investment preferred by local seed manufacturers to adopt these technologies?

- Which are the key players in the market and how intense is the competition?

Factors Driving the Biofortification Market

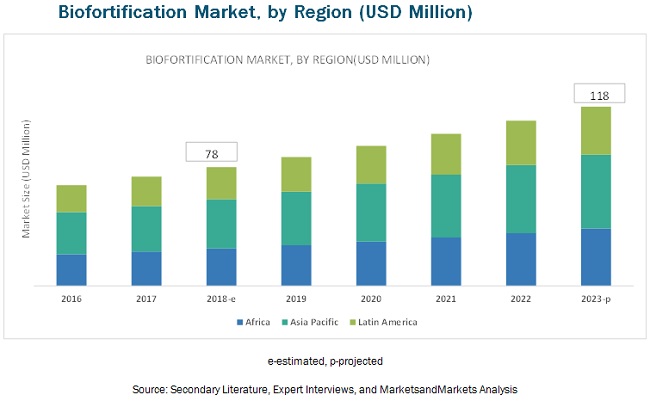

The report “Biofortification Market by Crop (Sweet Potato, Cassava, Rice, Corn, Wheat, Beans, and Pearl Millet), Target Nutrient (Zinc, Iron, and Vitamins), and Region (Latin America, Africa, and Asia Pacific) – Global Forecast to 2023 “, is estimated at USD 78 million in 2018, and it is projected to grow at a CAGR of 8.6% from 2018 to reach USD 118 million by 2023. Biofortified crops are usually sweet potato, cassava, rice, corn, wheat, beans, pearl millet, and other crops such as tomato, banana, sorghum, and barley. The growth of the biofortification market is driven by the rising demand for high nutritional content in food.

By crop, the biofortified sweet potato is projected to dominate the biofortification market during the forecast period.

The sweet potato segment is estimated to hold the largest share of the biofortified crop market in 2018. The demand for biofortified crops such as sweet potato and cassava has increased with the rising technological advancements to increase the nutrient content, particularly in orange-fleshed sweet potato (OFSP). Sweet potato has been an important source of energy in the human diet for centuries owing to its high carbohydrate content. However, its vitamin A content from carotene only became recognized over the past century. Using biofortification, sweet potato breeding in Africa is focused on higher yields, sweeter taste, and higher dry matter, which increase its carotene concentration.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38080924

By target nutrient, the vitamins segment is projected to be the fastest-growing segment in the biofortification market during the forecast period.

On the basis of target nutrient, the biofortification market is segmented into iron, zinc, vitamins, and others. The vitamins segment is the fastest-growing target nutrient in the biofortification market from 2018 to 2023. The demand for biofortified crops is increasing due to the increasing demand for high nutrient content in food. The rising demand for vitamins as feed additives or in premixes from the animal nutrition industry and the increasing demand for high-quality meat products have also been essential factors responsible for the increase in the demand for vitamins across the world.

Asia Pacific to be the dominant region in the biofortification market in 2018

The Asia Pacific is the dominant region in the biofortification market. Biofortification of crops has strong growth potential in agriculture, and it also improves the nutrition content in food. The biofortification market has grown considerably over the last five years, and this trend is expected to continue in the near future. The growing consumer demand for high nutritional content in food is projected to fuel the demand for biofortified crops, globally. Since the last decade, many countries in the Asia Pacific region have banned the usage of GM technology, and the researchers are opting to adopt biofortified crops as a key to unlock the region’s food production.

This report includes a study of marketing and development strategies along with the product portfolios of the leading companies in the biofortification market. It also includes the profiles of leading companies such as Bayer (Germany), Syngenta (Switzerland), Monsanto (US), and DowDuPont (US).

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=38080924

Key Questions Addressed by the Report:

- What are the new target nutrients areas, which the biofortification companies are exploring?

- Which are the key players in the market and how intense is the competition?

- What kind of competitors and stakeholders such as biofortification companies, would be interested in this market? What will be their go-to strategy for this market and which emerging market will be of significant interest?

- How are the current R&D activities and M&As for biofortified crop industry projected to create a disruptive environment in the coming years for the agricultural sector?

- What will be the level of impact on the revenues of stakeholders through the benefits of nanotechnology to different stakeholders‒‒from rising farmer revenue to environmental regulatory compliance to sustainable profits for the suppliers?