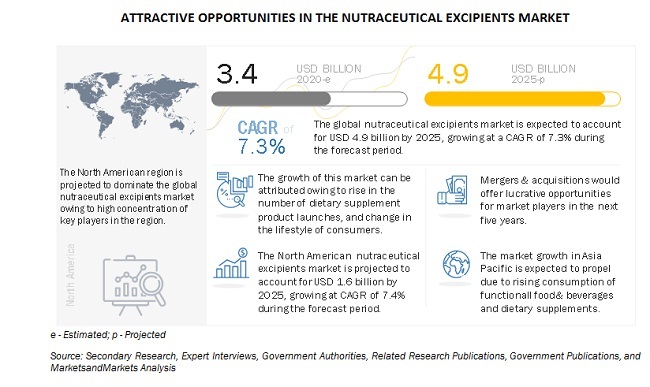

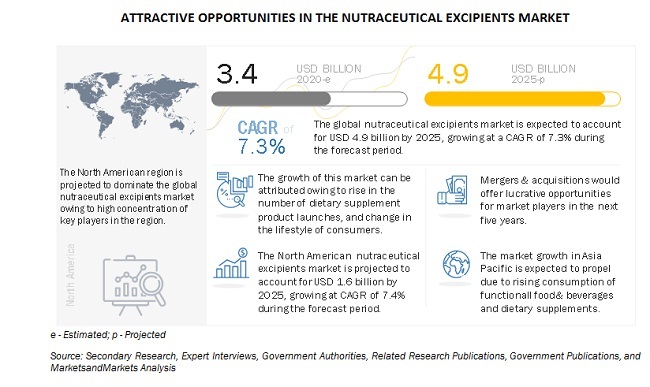

The global nutraceutical excipients market size is estimated to account for nearly USD 3.4 billion in 2020 and projected to grow at a CAGR of 7.3%, to reach nearly USD 4.9 billion by 2025. The market for nutraceutical excipients is been witnessing rise in demand, owing to the increase in consumption of nutraceutical in the global market. Consumers in the global market are increasingly preferring dietary supplements and fortified food & beverage products as a part of their daily dietary lifestyles. This gives immense opportunities for growth of nutraceutical excipients, which are largely used binding, coating, filling, coloring, flavoring, disintegrating, and lubricating agent. It is an inactive ingredient that is added along with the active nutraceutical ingredients in the product formulation. Furthermore, developed countries such as the US is already witnessing an upshift in the demand, however, the growth potential for nutraceutical excipients is growing at an exponentially high rate in the Asia Pacific and European countries.

Nutraceutical excipients are non-active nutraceutical ingredients that are included in the production of nutraceutical formulations. Excipients are also used to enhance the therapeutic effects of active ingredients in the final dose. Nutraceutical active ingredients are biologically functional molecules or components, which affect the nutritional uptake, balance, and health of a human body, and that mostly aims to supplement the nutritional profile provided by staple foods. Moreover, excipients are essential for the timely and precise delivery of nutraceutical components. In addition, maintaining optimum levels of active ingredients in the nutraceutical products, such as vitamins and minerals, is a key function of excipients.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=247060367

The key players in this market include DuPont (US), BASF SE (Germany), Kerry Group PLC (Ireland), Ingredion Plc (US), Sensient Technologies (US), Associated British Foods (UK), Roquette Freres (France), Meggle Group Wasser (Germany), Cargill Inc (US), Ashland Global Holdings Inc (US), Seppic (France), Shin-Etsu Chemical Co Ltd (Japan), Fuji Chemical Industries Co Ltd (Japan), Pharmatrans Sanaq AG (Switzerland), Pioma Chemicals (India), Gattefosse (India), W.R.Grace & Co (US), Omya (Switzerland), Grain Processing Corp (US), and Gangwal Chemicals Pvt Ltd (India). The key market players, along with the other players, adopted various business strategies such as new product launches, expansions, and joint ventures & agreements, in the last few years, to meet the growing demand for nutraceutical excipients.

The nutraceutical excipients market also consists of key start-up players, which include IMCD (Netherlands), Hilmar Ingredients (US), Innophos Holdings Inc (US), JRS Pharma (Germany), Biogrund GmbH (Germany), Pharma Line Intl Corp (South Korea), Jigs Chemical (India), Panchamrut Chemicals (India), Azelis Chemical Ltd (Europe), and Daicel Group (Japan).

Major players in the market are mainly focusing on undertaking expansions for developing research centers to meet the growing requirements of the end-industry manufacturers by formulating innovative products/solutions. The core strengths of the key players identified in this market are growth strategies such as expansions & investments and mergers & acquisitions. The undertaking of mergers & acquisitions as a key growth strategy has enabled the market players to enhance their presence in the nutraceutical excipient market. The key players, such as DuPont (US), Ingredion Plc (US), Roquette Freres (France), and few others have undertaken these strategies to improve their distribution network, gain a stronger foothold, and enhance market share. For example, DuPont inaugurated a new facility in Oegstgeest, the Netherlands. This development will benefit the company in expanding its research capabilities for its nutrition and bioscience segment along with specifically strengthening its position in Europe, the Middle East, and Africa regions.

Cargill Incorporated (US), is involved in the manufacturing and marketing of food ingredients, agricultural products, risk management & financial services, and industrial products around the globe. The company’s key business segments include animal nutrition, food & beverage, bio-industrial, food service, agriculture, risk management, meat & poultry, industrial, beauty, pharmaceutical, and transportation. It offers a wide range of excipient products under its pharmaceutical segment to several players in the pharmaceutical and nutraceutical industry.

Cargill Inc has a strong geographical presence in over 125 countries across regions, such as North America, Latin America, Asia Pacific, Europe, North Africa, the Middle East, and Africa. It operates its R&D centers in over 200 locations in the European and North American regions. Some of the company’s major research facilities are Minneapolis R&D and Innovation Centers, Asia Innovation Center, Biotechnology Development Center, Cargill ONE Innovation Center, and European Food Innovation Center. In addition, some of the subsidiaries of the company include Cargill Meat Solutions (US), Cargill Enterprises Inc. (Russia), Cargill Asia Pacific Holdings Pvt Limited (Singapore), Cargill RSA (Pty) Limited (South Africa), Cargill España SA (Spain), Cargill Nordic A/S (Sweden), Provimi (Netherlands), and NatureWorks (US). The key competitors of the company are Associated British Foods (ABF) Plc (UK), Ashland Inc. (US), DuPont (US), and Ingredion Incorporated (US).

Associated British Foods (ABF) Plc (UK), was formerly known as Food Investments Ltd until 1982. It is a leading manufacturer and processor of food & ingredients and is also involved in retail businesses of its food & ingredients. The company operates a majority of its business through five major segments, such as sugar, agriculture, retail, grocery, and ingredients. Associated British Foods (ABF) Plc owns a number of subsidiaries under its brand, some of which are mentioned as follows:

- AB Agri (UK)

- AB Mauri (UK)

- ABF Ingredients (UK)

- ABITEC Corporation (US)

- Ohly GmbH (Germany)

- AB Enzyme GmbH (Germany)

- ACH Food Companies Inc (US)

ABITEC, an ABF ingredients company, is the major provider of excipients products, which include lubricants, binders, coating agents, and flavoring agents to various players in the pharmaceutical and nutraceutical industries. In addition, ABF commercializes a range of other excipient products through its other brand, SPI Pharma (US), a manufacturer of pharmaceutical and nutraceutical products, which offers a line of functional excipient products, catering to the demand of key players in the pharmaceutical and nutraceutical industries. SPI Pharma operates under the Associated British Foods (ABF) Plc ingredients division, ABF Ingredients (UK). Of its subsidiaries, ABF Ingredients (UK) has a global presence in nine countries, which include the US, Brazil, Germany, France, the UK, Finland, India, Singapore, and China, and has nearly five companies operating under it.

Kerry Group Plc (Ireland), is a leading global manufacturer of food ingredient products and flavors and a supplier of value-added brands. At first, it operated as a dairy cooperative in Ireland, and in the later phase, as manufacturers of real and wholesome ingredients. It provides a broad range of excipients under its product line of pharmaceutical products through its taste & nutrition business segment.

The group operates through over 147 manufacturing sites in 32 countries across six regions. It has presence in more than 140 countries in Europe, the Middle East, and Africa (EMEA), North America, South America, and Asia Pacific. The company primarily focuses on investing in innovations and developing new products to cater to the global demand for innovative ingredients and alternatives. The company has over 577 patents registered globally. Its product solutions serve an array of industries, including bakery, dairy, poultry & seafood, snacks, beverages, pharma & biotechnology, and animal & pet.