Wednesday, October 14, 2020

Factors Driving the Nutraceutical Excipients Market

Tuesday, October 13, 2020

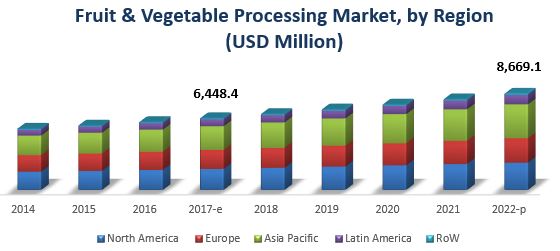

Fruit & Vegetable Processing Enzymes Market: Growth Opportunities and Recent Developments

The global fruit & vegetable processing enzymes market has grown steadily in the last few years. The market size is projected to reach USD 41.39 Billion by 2022, at a CAGR of around 6.7% from 2016 to 2022. The high specificity of enzymes in biochemical reactions is the major driving factor of this market.

- Suppliers

- R&D institutes

- Technology providers

- Enzymes manufacturers/suppliers

- Intermediary suppliers

- Wholesalers

- Dealers

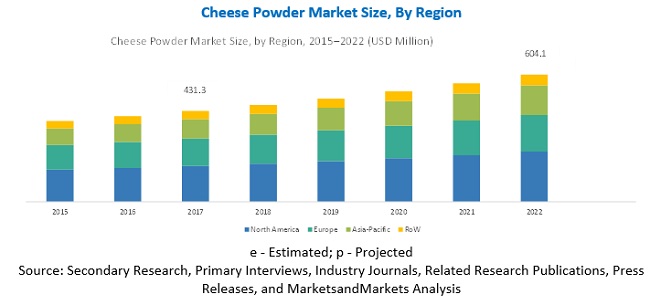

Cheese Powder Market to Showcase Continued Growth in the Coming Years

The report "Cheese Powder Market by Type (Cheddar, Mozzarella, Parmesan, American, and Blue), Application (Bakery & Confectionery, Sweet & Savory Snacks, Sauces, Dressings, Dips & Condiments, and Ready Meals), and Region – Global Forecast to 2022", The cheese powder market is projected to grow at a CAGR of 6.82% from 2016 to 2022, to reach USD 604.1 Million by 2022.

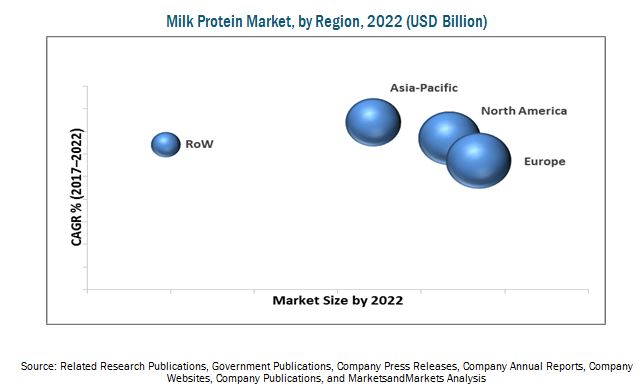

Upcoming Growth Trends in the Milk Protein Market

The milk protein market is projected to grow at a CAGR of 6.5%, in terms of value, from 2017 to reach a projected value of USD 13.38 Billion by 2022. The multifunctional nature of milk protein, ease of incorporation in a wide range of applications, increase in demand for high protein food, and increase in consumption of premium products are the factors driving the global market. Increase in awareness with regard to the importance of high nutritional food and its rising applications among the global population, fuels the demand for milk protein.

- Milk protein importers and exporters

- Dairy manufacturers and processors

- Secondary sources, which include the following:

- The Food and Agriculture Organization (FAO) and the International Dairy Food Association(IDFA)

- The European Food Safety Authority (EFSA) and the Food and Drug Administration (FDA)

- Food safety agencies

- End applications, which include the following:

- Bakery products, confectionery products, and convenience foods

- Dairy products

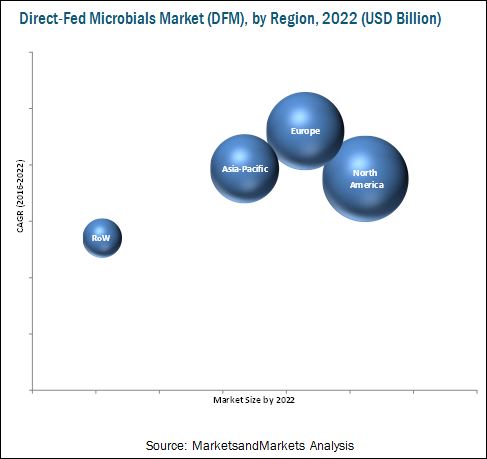

Direct-fed Microbials Market Projected to Garner Significant Revenues by 2022

The direct-fed microbials market is projected to grow at a CAGR of 6.96% to reach USD 1,399.6 Million by 2022. The market is driven by factors such as increase in awareness about feed quality and safety, rising demand for manufactured animal feed, growth in demand for animal protein, changes in farming practices and technology, and replacing antibiotic growth promoters (AGPs) with direct-fed microbials. The continuous rise in the population has also resulted in an increase in the demand for food and the necessity for direct-fed microbials, to increase meat and milk production in a sustainable manner.

- Direct-fed microbial manufacturers

- Feed manufacturers

- Animal pharmaceutical companies

- Direct-fed microbial raw material suppliers

- Direct-fed microbial product exporters & importers

- Educational institutions

- Regulatory authorities

- Consulting firms

Monday, October 12, 2020

Upcoming Growth Trends in the Pesticide Inert Ingredients Market

The report "Pesticide Inert Ingredients Market by Type (Emulsifiers, Solvents, and Carriers), Source (Synthetic and Bio-based), Form (Dry and Liquid), Pesticide Type (Herbicides, Insecticides, Fungicides, and Rodenticides), and Region - Global Forecast to 2023 " , The pesticide inert ingredients market is projected to reach USD 4.7 billion by 2023, from USD 3.5 billion in 2018, at a CAGR of 6.14% during the forecast period. The market is driven by factors such as the increasing demand for specific inert ingredients in pesticide formulation and capability of inert ingredients to improve the efficacy of pesticide application.

On the basis of type, the emulsifiers segment is projected to witness the fastest growth during the forecast period.Emulsifiers help in stabilizing the mixture of two liquids and avoid the formation of immiscible liquid phases. Major emulsifiers that are used as inert ingredients are polymers, nonylphenol and alcohol ethoxylates, and alcohol alkoxylates. The demand for emulsifier-based products remains high in the North American region due to the increasing industrialization and decreasing land area for agriculture, which in turn, creates demand for the use of pesticides for ensuring food security and production.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=176580687

With the increasing demand for organic fruits and vegetables, the bio-based segment is projected to witness the fastest growth, on the basis of source.

It has been witnessed that some of the inert ingredients used in pesticide formulation are more toxic than the active ingredients. Increasing health hazards associated with the usage of synthetic-based inert ingredients in pesticides creates an opportunity for the market players to develop bio-based inert ingredients from sources such as microbes for the formulation of bio-based pesticides. Governmental bodies and regulatory authorities have introduced regulations for the use of toxic pesticides, which affects the growth of bio-based inert ingredients in the market.

This report includes a study of development strategies for leading companies. The scope of this report includes a detailed study of major companies such as BASF (Germany), Clariant (Switzerland), DowDuPont (US), Stepan Company (US), and Croda International Plc. (UK). Other players in the market include Eastman Chemicals (US), Solvay SA (Belgium), Evonik (Germany), Huntsman Corporation (US), AkzoNobel (The Netherlands), Royal Dutch Shell (The Netherlands), and LyondellBasell Industries (Netherlands).

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=176580687

- Which market segments to focus on in the next two to five years for prioritizing efforts and investments?

- Which region will have the highest share in the pesticide inert ingredients market?

- Which type of pesticide inert ingredients witnesses high demand in each key country market?

- What are the trends and factors responsible for influencing the adoption rate of bio-based inert ingredients in key emerging countries?

- Which are the key players in the market and how intense is the competition?

Growth Opportunities in the Plant Breeding and CRISPR Plants Market

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

On the basis of application, the cereals & grains segment is projected to witness the fastest growth during the forecast period.Corn, wheat, and rice are the major cereals bred with advanced technologies such as molecular breeding and genetic techniques. The availability of germplasm for these crops encourages the adoption of advanced techniques for crop breeding. The economic importance of corn due to its application in various sectors and increasing demand for high-quality wheat and rice in the food industry are other reasons for the adoption of hybrid breeding technologies among seed producers.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

On the basis of type, the biotechnological method is projected to witness the fastest growth in the plant breeding and CRISPR plants market during the forecast period

The increasing adoption of hybrid and molecular breeding techniques in developing countries and the growing cultivation of GM crops in the Americas are factors contributing to its high growth. The growing market for crop genetics in various countries of the Americas and the declining cost of genetic procedures in the past decade are factors driving the demand for genetic engineering and genome editing in the region. Unlike genetic techniques, no regulations are implied by the government for molecular breeding across the globe, which is projected to drive the growth of the biotechnological method at a higher rate during the forecast period. Advances in the field of CRISPR gene editing technology have brought about the third revolution in crop improvement and these tools can be used along with existing technologies. Growing innovation would facilitate the growth of CRISPR technology in agriculture, especially in countries such as the US, China, Japan, Brazil, and South Africa.

On the basis of trait, the herbicide tolerance segment is projected to witness the fastest growth in the plant breeding and CRISPR plants market

Increasing regulations on the use of chemical pesticides and rising instances of pest attacks during the early germination phase have increased the need for pesticide-tolerant seeds. Herbicide tolerance has been one of the major traits targeted by plant genetic companies for transgenic and non-transgenic crops. Non-transgenic Clearfield herbicide tolerance technology, developed by BASF and Syngenta, is recognized as one of the groundbreaking innovations in hybrid breeding technology, and more companies have exhibited their interest to enter this industry, which is projected to contribute to the growth in the next five years.

North America is estimated to dominate the market in 2018, while the Asia Pacific is projected to witness the fastest growth through 2023.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=256910775

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).

Key questions addressed by the report:

- Which market segments to focus on in the next two to five years for prioritizing efforts and investments?

- Which region will have the highest share in the plant breeding and CRISPR plants market?

- Which type of plant breeding techniques have high demand in each key country market?

- What are the trends and factors responsible for influencing the adoption rate of biotechnological methods in key emerging countries? What is the level of investment preferred by local seed manufacturers to adopt these technologies?

- Which are the key players in the market and how intense is the competition?