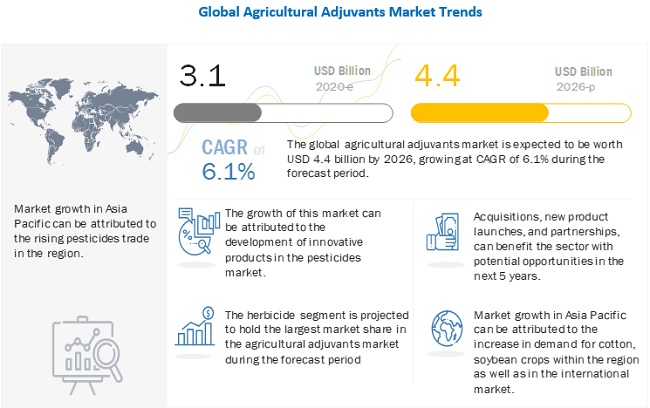

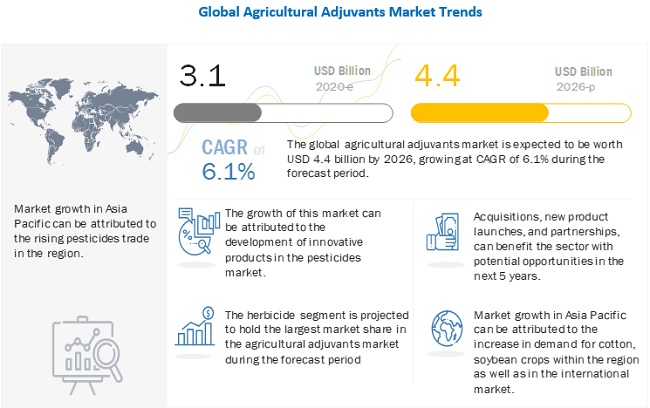

The global agricultural adjuvants market size is projected to reach USD 4.4 billion by 2026, growing at a CAGR of 6.1% from 2020. The growth of the agricultural adjuvants market is driven by factors such as the growing demand for agrochemicals and the adoption of protected agriculture technologies.

Key players in the agricultural adjuvants market include Solvay (Belgium), Evonik Industries (Germany), Nufarm (Australia), and Croda International (UK), Corteva Inc. (US), and BASF (Germany). Product innovation, expansions & investments, mergers & acquisitions, joint ventures, and agreements, collaborations, joint ventures, disinvestments, and partnerships were some of the core strengths of the leading players in the agricultural adjuvants market. These strategies were adopted by the key players to increase their market presence. It also helped them diversify their businesses geographically, strengthen their distribution networks, and enhance their product portfolios. Some of the other leading players in the agricultural adjuvants include Miller Chemical and Fertilizer, LLC (US), Precision Laboratories (US), CHS Inc (US), Winfield United (US), Kalo Inc. (US), Nouryon (Netherlands), Huntsman Corporation (US), Clariant (US), Helena Agri-Enterprises (US), Stepan Company (US), Wilbur-Ellis Company (US), Brandt (US), Plant Health Technologies (US), and Innvictis Crop Care (US).

Evonik Industries (Germany) is one of the leading specialty chemical companies. The company operates through business segments that include nutrition & care, performance materials, resource efficiency, services (technology and infrastructure), and corporate. The nutrition & care segment offers specialty chemicals that include amphoteric surfactants, ceramides, phytosphingosine, oleochemical quaternary derivatives, organically modified silicones, superabsorbents, amino acids and amino acid derivatives, synthesis products, pharmaceutical polymers, and DL-methionine. The company has a major presence in Europe, especially Germany, and other regions such as Asia Pacific, North America, and Central & South America.

Solvay (Belgium) is a chemical and advanced materials company and is involved in delivering innovative sustainable products and solutions. The company offers its products & services to diversified markets, which include agro, feed & food, automotive & aerospace, building & construction, consumer goods & healthcare, electrical & electronics, resources & environment, and industrial applications. It offers surfactants under its agro, feed, and food segment. The company has offices across 58 countries at 139 locations, along with 21 major research and innovation centers across North America, Europe, Asia Pacific, and Latin America; this enables it to have a significant global market presence.

Corteva Agriscience operates as a standalone agriculture company with industry expertise in seed technologies, crop protection, and digital agriculture. Globally, the company operates through eight segments—agriculture, performance materials & coatings, industrial intermediate & infrastructure, packaging & specialty plastics, electronics & imaging, nutrition & biosciences, transportation & advanced polymers, and safety & construction. The agriculture segment has a diverse network worldwide, which markets the brands of the company and distributes its products to customers globally. The company ranks fourth in terms of market revenues in the agricultural adjuvants market in 2018, as per the MarketsandMarkets analysis. Adjuvants, particularly surfactants, are offered by the company under its industrial intermediates and infrastructure business segment, in its crop defense chemicals line. Being one of the leaders in crop protection chemicals, the company has a large consumer base for agricultural adjuvant products, and is hence, one of the global market leaders.

Make an Inquiry:

Asia Pacific comprises of developing countries with vast agricultural lands; the per capita income of the region depends on agricultural activities. Agricultural technologies are widely accepted and practiced in this region. In Asia Pacific, the total area under agriculture is shrinking due to the high rate of industrialization and urbanization. As a result, farmers opt for practices such as the use of chemical pesticides, which help to increase the yield or productivity of crops.

Recent Developments:

- In April 2020, Corteva entered in a joint venture with the MercyOne Healthcare Organisation, to meet the urgent need for the processing of COVID-19 samples with an initial focus on Iowa area.

- In April 2020, Solvay entered into a partnership with Boeing, who is a face shield manufacturer, wherein the company would supply high-performance, medical-grade transparent film. The strategy was a response to the rising demands for personal protective equipment amongst healthcare professionals.

- In October 2019, Nufarm initiated a state of art crop protection segment facility in Greenville, Mississippi, which will help broaden the companies production in their facilities in Chicago to North American based platforms.