The carotenoids market size is projected to grow from USD 1.5 billion in 2019 to USD 2.0 billion by 2026, recording a compound annual growth rate (CAGR) of 4.2%, in terms of value, during the forecast period. Carotenoids are a group of yellow to red pigments, including the carotenes and the xanthophylls, found particularly in plants, algae, and photosynthetic bacteria and certain animal tissues. The increase in the usage of carotenoids as food colorants and the advancements end-user technologies are the major factors that are projected to drive the growth of the carotenoids market.

Friday, May 21, 2021

Key Trends Shaping the Carotenoids Market

Thursday, May 20, 2021

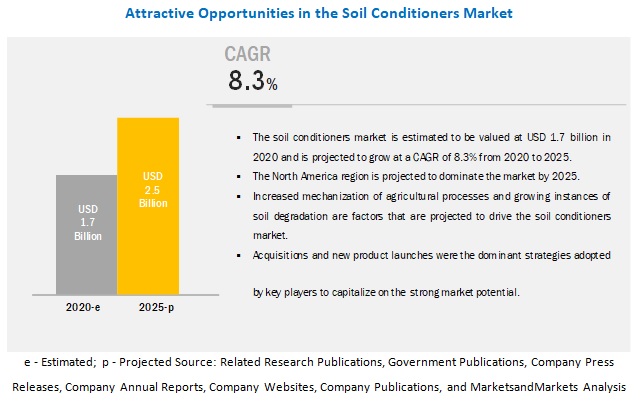

Soil Conditioners Market Projected to Reach $2.5 Billion by 2025, at a CAGR of 8.3%

The report "Soil Conditioners Market by Type (Surfactants, Gypsum, Super Absorbent Polymers, and Others), Application (Agriculture, Construction & Mining, and Others), Formulation (Liquid and Dry), Crop Type, Soil Type, and Region - Global Forecast to 2025", The global soil conditioners market is estimated to account for a value of USD 1.7 billion in 2020 and is projected to grow at a CAGR of 8.3% from 2020, to reach a value of USD 2.5 billion by 2025. Increased demand for agricultural crops such as rice, wheat, and soybean, especially from the developing countries and decrease in availability of agricultural land owing to urbanization is among the key factors expected to drive the soil conditioners market.

Feed Yeast Market to Record Steady Growth by 2025

The global feed yeast market size estimated at USD 1.8 billion in 2020 and is projected to grow at a CAGR of 5.1% to reach USD 2.3 billion by 2025. The market has a promising growth potential due to several factors, including the increasing awareness of yeast-based animal feed products and strict government regulations regarding animal health.

Key players in the feed yeast market include Associated British Foods Inc. (UK), Archers Midland Company (US), Alltech Inc. (US), Cargill (US), Angel Yeast Company (China), Chr. Hansen (Denmark), Lesaffre (France), Nutreco N.V. (Netherlands), Lallemand Inc. (Canada), Novus International (US), Zilor (Biorigin) (Brazil), Kerry Group (Ireland) and Kemin (US).Manufacturers are adopting strategies such as new product launches, expansion & investments, mergers & acquisitions, agreements, collaborations, joint ventures, and partnerships to strengthen their position in the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=108142106

Associated British Foods PLC (UK) is one of the market leaders in Europe and is trying to increase its global presence by offering various feed grades to fulfill customer needs and demands. The company has entered the retail sector, which has helped it grab opportunities in the market. The company operates with various subsidiaries at the global level but has a wider distributional reach in the European region. The major growth strategies of the company include organic approaches to collaborate and partner with other players such as Lallemand (Canada) for effective operations of the Hutchinson site. The company operates through numerous subsidiaries, such as AB Agri Ltd (UK), AB Mauri (UK), ABF Ingredients (UK), ABITEC Corporation (US), and Ohly (Germany). Of these, AB Mauri, ABF Ingredients, Ohly, and AB Vista produce yeast and yeast extracts. In January 2019, Ohly (UK) and Lallemand (Canada), entered into a strategic partnership for the divestment of Ohly’s Hutchinson Torula Yeast facility and associated Torula whole cell business in the US. The long-term supply partnership between these companies aims at benefitting Ohly by ensuring sustainable security of the Hutchinson site.

Alltech Inc. (US) is engaged in the production and sale of nutritional products and solutions for the feed industry. The company’s core capabilities lie in yeast fermentation, peptide technology, and solid-state fermentation. It has used these technologies to offer a range of natural solutions to the feed industry for improving animal performance and profitability. The company performs research and innovation in various areas such as bioscience centers, nutrigenomics centers, aquaculture centers, community biorefinery, and quality assurance. Alltech is one of the leading animal nutrition companies across the globe. The company has its presence in various countries with 31 manufacturing facilities. It has a great market coverage as the company serves customers in more than 120 countries. Use of inorganic approaches such as the acquisition of WestFeeds Inc. (US) helped the company to strengthen its distribution network and product portfolio in the animal nutrition segment. Owing to its strong financial capabilities and being a global innovator in feed formulations and technologies, the company holds opportunities by investing in R&D for the development of innovative yeast-based ingredients for feed solutions.

Cargill (US) manages its business operations through its business segments, such as agriculture; animal nutrition and protein; food; and financial and industrial. Through its animal nutrition and protein segment, the company offers various animal nutrition products including yeast for beef, dairy, pet, poultry, and pork segments. The company manufactures and supplies feed yeast throughout the world under various brands. Cargill has a very strong product portfolio as compared to its competitors. This would help in positioning the company’s overall position in absorbing investment risks to expand their production capacity as well as their market share. Cargill offers high-quality products to its customers with strong R&D capabilities, which provide it with a strategic advantage over its competitors. The company is focusing immensely on R&D to meet the demands of the feed industry. In terms of animal nutrition, the company has invested in acquiring Diamond V (US), which would help the company in gaining competitive advantage in the animal health and nutrition sector.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=108142106

As per the FAO figures of 2019, the consumption rate of meat products in East Asia had witnessed rapid growth. The consumption rate reached 50 kg per person in 2015 from nearly 9 kg per capita in the 1960s. However, the ban on the use of antibiotics as a growth promoter in the livestock sector across the European and North American countries has indirectly impacted the Asia Pacific countries. This has encouraged key companies of feed additives to develop natural growth promoters and health supplements. Since the ban, the livestock producers had identified innovative ways to promote animal production through products with similar benefits by replacing antibiotic growth promoters with microbial-based feed additives, which possess antibiotic properties. Many key players such as Lallemand Inc. (Canada) and Angel Yeast (China) are focusing on tapping the Asia Pacific market by setting up their feed additive manufacturing units.

Wednesday, May 19, 2021

Key Trends Shaping the Pesticide Inert Ingredients Market

The report "Pesticide Inert Ingredients Marketby Type (Emulsifiers, Solvents, and Carriers), Source (Synthetic and Bio-based), Form (Dry and Liquid), Pesticide Type (Herbicides, Insecticides, Fungicides, and Rodenticides), and Region - Global Forecast to 2023 " , The pesticide inert ingredients market is projected to reach USD 4.7 billion by 2023, from USD 3.5 billion in 2018, at a CAGR of 6.14% during the forecast period. The market is driven by factors such as the increasing demand for specific inert ingredients in pesticide formulation and capability of inert ingredients to improve the efficacy of pesticide application.

- Which market segments to focus on in the next two to five years for prioritizing efforts and investments?

- Which region will have the highest share in the pesticide inert ingredients market?

- Which type of pesticide inert ingredients witnesses high demand in each key country market?

- What are the trends and factors responsible for influencing the adoption rate of bio-based inert ingredients in key emerging countries?

- Which are the key players in the market and how intense is the competition?

Factors Driving the Plant Breeding and CRISPR Plants Market

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, at a CAGR of 13.95% during the forecast period. Strong funding by the private and public sectors toward plant biotechnology such as the development of high-throughput sequencing systems and application of MAS and genomic selection in field and vegetable crops are projected to drive the growth of the market over the next five years.

Corn, wheat, and rice are the major cereals bred with advanced technologies such as molecular breeding and genetic techniques. The availability of germplasm for these crops encourages the adoption of advanced techniques for crop breeding. The economic importance of corn due to its application in various sectors and increasing demand for high-quality wheat and rice in the food industry are other reasons for the adoption of hybrid breeding technologies among seed producers.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

On the basis of type, the biotechnological method is projected to witness the fastest growth in the plant breeding and CRISPR plants market during the forecast period

The increasing adoption of hybrid and molecular breeding techniques in developing countries and the growing cultivation of GM crops in the Americas are factors contributing to its high growth. The growing market for crop genetics in various countries of the Americas and the declining cost of genetic procedures in the past decade are factors driving the demand for genetic engineering and genome editing in the region. Unlike genetic techniques, no regulations are implied by the government for molecular breeding across the globe, which is projected to drive the growth of the biotechnological method at a higher rate during the forecast period. Advances in the field of CRISPR gene editing technology have brought about the third revolution in crop improvement and these tools can be used along with existing technologies. Growing innovation would facilitate the growth of CRISPR technology in agriculture, especially in countries such as the US, China, Japan, Brazil, and South Africa.

On the basis of trait, the herbicide tolerance segment is projected to witness the fastest growth in the plant breeding and CRISPR plants market

Increasing regulations on the use of chemical pesticides and rising instances of pest attacks during the early germination phase have increased the need for pesticide-tolerant seeds. Herbicide tolerance has been one of the major traits targeted by plant genetic companies for transgenic and non-transgenic crops. Non-transgenic Clearfield herbicide tolerance technology, developed by BASF and Syngenta, is recognized as one of the groundbreaking innovations in hybrid breeding technology, and more companies have exhibited their interest to enter this industry, which is projected to contribute to the growth in the next five years.

North America is estimated to dominate the market in 2018, while the Asia Pacific is projected to witness the fastest growth through 2023.

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=256910775

This report includes a study of development strategies of leading companies. The scope of this report includes a detailed study of major seed manufacturers that have in-house plant breeding facilities; these companies include players such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel).

Key questions addressed by the report:

- Which market segments to focus on in the next two to five years for prioritizing efforts and investments?

- Which region will have the highest share in the plant breeding and CRISPR plants market?

- Which type of plant breeding techniques have high demand in each key country market?

- What are the trends and factors responsible for influencing the adoption rate of biotechnological methods in key emerging countries? What is the level of investment preferred by local seed manufacturers to adopt these technologies?

- Which are the key players in the market and how intense is the competition?

Tuesday, May 18, 2021

Sustainable Growth Opportunities in the Agricultural Adjuvants Market

The global agricultural adjuvants market size is estimated to account for a value of USD 3.1 billion in 2020 and is projected to grow at a CAGR of 6.1% from 2020, to reach a value of USD 4.4 billion by 2026. The increasing need for green adjuvants, improving efficiency, and effectiveness of agrochemicals are some of the factors driving the growth of the market.

COVID-19 Impact on the Global Agricultural Adjuvants Market

The FAO has acknowledged that the spread of COVID- 19 pandemic is subsiding in a few countries and regions of the world. Still, it is also resurging or spreading quickly in some other countries such as Korea, Brazil, and India. This outbreak has affected significant elements of both food supply and demand. Border closures, quarantines, market supply chains, and trade disruptions have restricted people’s access to sufficient and nutritious sources of food, especially in countries hit hard by the virus. However, as the governments on a global level shut down borders and economies for restricting the spread of the coronavirus, the businesses observed major impacts on their international trades. Many markets are focusing on fulfilling their requirements for fertilizers, pesticides, and adjuvants by domestic companies.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

Opportunity: Manufacturing adjuvant products for cost-effectiveness

The cost of adjuvants fluctuates and depends mainly on the prices of petroleum and vegetable oil that are used for agricultural adjuvant production. As the application costs of different single-purpose adjuvants during pesticide application prove to be expensive for growers, applicators are looking for adjuvants that are simple to use and multifunctional. The increased downstream cost, high foam formation during production, and low productivity have resulted in many R&D activities. Many new developments have been the area of focus for researchers; these include reducing the raw material costs, increasing the production yield, and developing new techniques to lower the foam formation.

Challenge: Impact on the production cost of farmers

The adoption of adjuvants further adds to the costs of seed and pesticides used for crop cultivation. Even though the adoption of adjuvants reduces the application cycles of pesticides, the cost of adjuvants could considerably affect the farm production cost to an extent. The cost again would depend on the stage at which the adjuvants are utilized, either as in-formulation or tank-mix adjuvants. The farmers’ profit margins get reduced due to the additional cost of adjuvants. However, with the increasing need to undertake sustainable measures to control pesticide drift and avoid creating environmental risks, farmers would adopt these adjuvants, which would, in turn, turn out to be cost burden, especially in developing countries.

By application, the herbicide segment is projected to dominate the market during the forecast period.

The herbicide segment is projected to hold the largest market share in the agricultural adjuvants market during the forecast period as according to industry experts from prominent seed manufacturers, disease resistance and herbicide tolerance are traits that have been on demand, owing to the increasing instances of early germination pest attacks and regulations against cop protection chemicals. Cereals & grains accounted for the largest consumption of herbicides in North America and Asia Pacific, owing to the high cultivation of corn and wheat in countries such as the US and China.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=1240

Asia Pacific is projected to grow at the highest CAGR% during the forecast period

The market for agricultural adjuvants in the Asia Pacific region is projected to grow at the highest CAGR from 2020 to 2026, owing to the increasing investments by key players in countries such as China, India, and Thailand, and also the rising adoption of adjuvant technology by the crop growers for insecticide applications. Due to these factors, the market in the Asia Pacific region is projected to record the highest growth from 2020 to 2026.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the agricultural adjuvants market. It includes the profiles of leading companies such as this market include Miller Chemical and Fertilizer, LLC (US), Precision Laboratories (US), CHS Inc (US), WinField United (US), Kalo Inc. (US), Nouryon (Netherlands), Corteva (US), Evonik Industries (Germany), Nufarm (Australia), Croda International (UK), Solvay (Belgium), BASF (Germany), Huntsman Corporation (US), Clariant (US), Helena Agri-Enterprises (US), Stepan Company (US), Wilbur-Ellis Company (US), Brandt (US), Plant Health Technologies (US), Innvictis Crop Care (US), Interagro (UK), Lamberti S.P.A (US), Drexel Chemical Company (US), GarrCo Products Inc. (US), and Loveland Products Inc. (US).

Latest Regulatory Trends Impacting the Biofertilizers Market

The report "Biofertilizers Market by Form (Liquid, Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Crop Type, Type (Nitrogen-Fixing, Phosphate Solubilizing & Mobilizing, Potash Solubilizing & Mobilizing), Region - Global Forecast to 2025" The biofertilizers market is projected to reach USD 3.9 billion by 2025, from USD 2.3 billion in 2020, recording a CAGR of 11.6% during the forecast period. Rising awareness about the hazards of chemical fertilizers among consumers, soil degradation, nitrate emissions, along with government initiatives, is projected to witness significant growth during the forecast period.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

COVID-19 impact on Biofertilizers market

COVID-19 has impacted the businesses of biofertilizer companies up to some extent. Though this pandemic situation has impacted their businesses, there is no significant impact on the global operations and supply chain of their biofertilizers. Multiple manufacturing facilities of players are still in operation. The service providers are providing biofertizer products by following safety and sanitation measures.

Opportunity: New target markets: Asia Pacific & Africa

The Asia Pacific and African regions are the largest consumers of fertilizers. The increasing rate of population, especially in Asia, has resulted in the increasing demand for food, which would, in turn, lead to the increased consumption of fertilizers. However, the major concerns in this region are pollution and contamination of soil as well as their harmful effects on human beings. To combat the harmful effects of chemical fertilizers, governments in these regions are emphasizing on the use of environmental-friendly fertilizers, such as biofertilizers and organic manure.

Challenge: Lack of awareness & low adoption rate of biofertilizers

The lack of awareness in farmers about biofertilizers in underdeveloped and developing countries is creating a challenge for the biofertilizers market. They prefer using chemical fertilizers, as they are easy to handle. This can be attributed to a lack of training and information. Furthermore, the established nature of the chemical fertilizers market is also one of the reasons for the slow adoption of biofertilizers, as conventional fertilizer companies hold a wide range of product offerings and have a strong distribution network.

Higher consumption of biofertilizers for organic fruits & vegetables contributes to the growth of the biofertilizers market in this segment

Biofertilizers have proved to be useful in numerous ways, including improving the quality, shelf-life, and yield of fruits & vegetables. The increasing trend of consumer preferences for organic fruits & vegetables due to changing lifestyle and rising per capita income is the primary factor driving market growth. A rising trend in the cultivation of organic fruits & vegetables and those under IPM practices have also created a positive impact on the growth of the biofertilizers market.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=856

With the increasing demand for organic food products, North America is estimated to dominate the biofertilizers market in 2020

Changing lifestyle and increasing buying power among consumers has increased the demand for biofertilizers. High adoption of advanced irrigation systems such as drip & sprinkler irrigation and widespread acceptance of biofertilizers among the farmers is further propelling the market growth. The farmers in this region are highly skilled in terms of knowledge and machinery. Due to the rampant use of chemical fertilizers, the fertility of the soil is declining. To maintain soil fertility as well as the yield of crops, farmers are sustainably opting for biofertilizers.

This report includes a study of the development strategies of leading companies. The scope of this report consists of a detailed study of biofertilizer manufacturers such as Novozymes (Denmark), Kiwa-Biotech (China), Rizobacter Argentina S.A (Argentina), Lallemand Inc. (Canada) and Symborg (Spain).