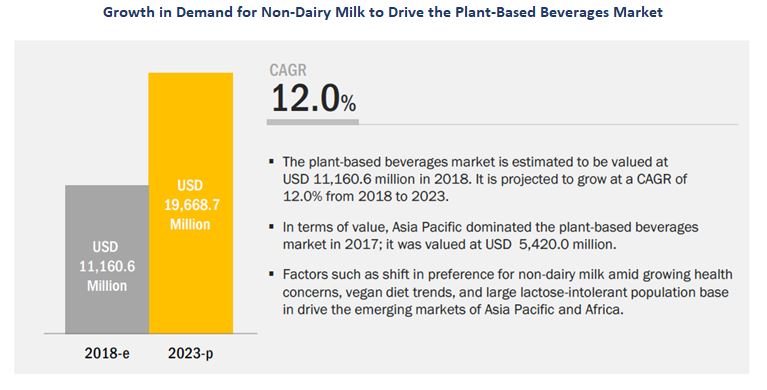

The global plant-based beverages market is estimated to be valued at USD 11.16 billion in 2018 and is projected to reach USD 19.67 billion by 2023, at a CAGR of 12.0% during the forecast period. The plant-based beverages market is driven by the growing popularity of vegan diets, especially in the developed countries such as the US, the UK, and Germany. Apart from this, the adoption of hectic lifestyles in the Asia Pacific and South American regions has urged consumers in these regions to opt for low-calorie options, thus, increasing the demand for plant-based beverages.

To know about the assumptions considered for the study download the pdf brochure

The WhiteWave Foods Company (US) is one of the leading players in the plant-based beverages market. The company offers almond milk, coconut milk, cashew milk, soy milk, rice milk, oat milk, and hazelnut milk under its plant-based beverages portfolio. In North America, the company distributes leading plant-based beverage brands such as Silk, So Delicious, and Vega. In Europe, WhiteWave’s popular plant-based beverage brands include Alpro and Provamel. In 2017, WhiteWave (US) was acquired by Danone (US). The company focuses on new product launches, as one of its key strategies, to expand its presence in the plant-based beverages market space. For instance, in 2018, the company launched 3 new almond milk products with cashew under its “So Delicious Dairy Free” brand. Apart from this, the company also adopted other strategies such as joint ventures, acquisitions, expansions, and partnerships.

Blue Diamond Growers (US) is one of the world’s largest almond processing companies. The company is engaged in the almond-based products business. It manufactures almond-based snacks, beverages, and ingredients. It operates in the plant-based beverages business through its brand, Almond Breeze, which represents almond milk made from California almonds and is marketed as an alternative to dairy and soymilk. The company sells its products in over 80 countries at a global level. It focuses on expansions, as one of its key strategies, to expand in the plant-based beverages market. For instance, in 2018, the company expanded its presence in the Brazilian plant-based beverages market with the launch of “Almond Breeze”.

Target Audience:

The report is targeted toward the existing players in the industry, which include:

- Manufacturers/suppliers

- Beverage manufacturers & processors

- Traders & retailers

- Regulatory bodies and associations, which include the following:

- The Plant Based Foods Association (PBFA)

- The Food and Drug Administration (FDA)

- The United States Department of Agriculture (USDA)

- The European Food Safety Authority (EFSA)

- The Soyfoods Association of North America (SANA)

- The Specialty Food Association (SFA)

- The British Dietetic Association (BDA)

- The National Recreation and Park Association (NRPA)

- Dietitians of Canada (DC)

- National Milk Producers Federation (NMPF)

- Dietitians Association of Australia (DAA)