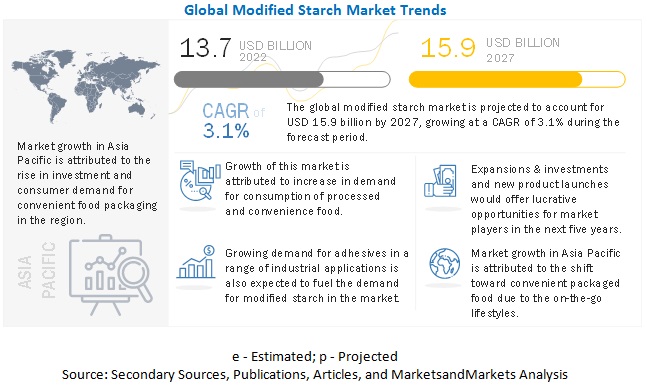

According to MarketsandMarkets "Modified Starch Market by Raw Material (Corn, Cassava, Potato, and Wheat), Application (Food & Beverages (Bakery & Confectionery, Processed Foods, Beverages, and Other Food Applications), Industrial, and Feed), Form, and Region - Global Forecast to 2025", the global modified starch market size is estimated to be valued at USD 13.1 billion in 2020 and projected to reach USD 14.9 billion by 2025, recording a CAGR of 2.7%, in terms of value. The functional properties of modified starch and their ease of incorporation in a wide range of applications are driving the global modified starch market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=511

Opportunities: Untapped application of modified starch

There are various application areas that are untapped and can be big opportunities for modified starch manufacturers. Expanding the commodity sources for extracting starch and combining modification processes add a wider range of probable applications to the list.

Modified starch can act as an excellent fermentation base for the bulk production of a wide variety of biotechnology products, such as organic acids, antibiotics, vitamins, and hormones. Starch-derived glucose can be fermented to produce lactic acid, which may be polymerized for biodegradable films or bioplastics. Similarly, potato starch wastes may also be used as feedstock in fermentation reactions. Several polymers can be prepared using a variety of starch-based feedstock.

By raw material, the corn is projected to account for the largest share in the modified starch market during the forecast period

Based on raw material, corn dominated the modified starch market. Corn is a staple food, and it is preferred across the globe due to its importance in the diets of several countries. It is used extensively as a thickening agent in soups and liquid-based foods such as sauces, gravies, and custards.

By application, food & beverages segment is projected to account for the largest share in the modified starch market during the forecast period

By application, the market is segmented into food & beverages, industrial, and feed. The food & beverage segment is further classified into bakery & confectionery products, processed food, beverages, and others, which includes snacks and soups. Modified starches have been developed for a significant period of time, and their applications in the food & beverage industry are increasingly gaining importance. Modified starches are considered as food additives that are prepared by treating starch or their granules with chemicals or enzymes, causing the starch to be partially degraded. They are used across various food applications owing to their functional properties.

Asia Pacific is projected to account for the largest market share during the forecast period

The market in Asia Pacific is dominant due to the increasing demand for processed food because of the shift in lifestyle trends. People are looking for ready-to-eat meal options as they are leading a busy life.

Asia Pacific is also the fastest-growing market as industrial applications and technologies involved in starch processing are changing rapidly in the region. The demand for modified starch is increasing as various industries are incorporating in their manufacturing processes and products. Also, key players are increasingly investing in the Asia Pacific modified starch market.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as Archer Daniels Midland Company (ADM) (US), Cargill (US), Ingredion (US), Tate & Lyle (UK), Roquette Frères (France), Avebe U.A (the Netherlands), Grain Processing Corporation (US), Emsland (Germany), AGRANA (Austria), SMS Corporation (Thailand), Global Bio-Chem Technology Group (Hong Kong), SPAC Starch (India), Qindao CBH Company (China), Tereos (France), and KMC (Denmark), Beneo (Germany), Angel Starch Food Pvt. Ltd. (India), Shubham Starch Chem Pvt Ltd. (India), Everest Starch India Pvt Ltd. (India), Sheekharr Starch Pvt Ltd. (India), Sanstar Bio-Polymers Ltd. (India), Universal Biopolymers (India), Sonish Starch Technology Ltd. (Thailand), Venus Starch Suppliers (India), and Gromotech Agrochem Pvt. Ltd. (India).