- What are the growth opportunities in the feed antioxidants market?

- What are the major and new product launches in the feed antioxidants market?

- What are the significant trends that are disrupting the feed antioxidants market?

- What are some of the major regulatory challenges and restraints that the industry faces?

- Which region is projected to emerge as a global leader by 2025?

Friday, March 4, 2022

Upcoming Growth Trends in the Feed Antioxidants Market

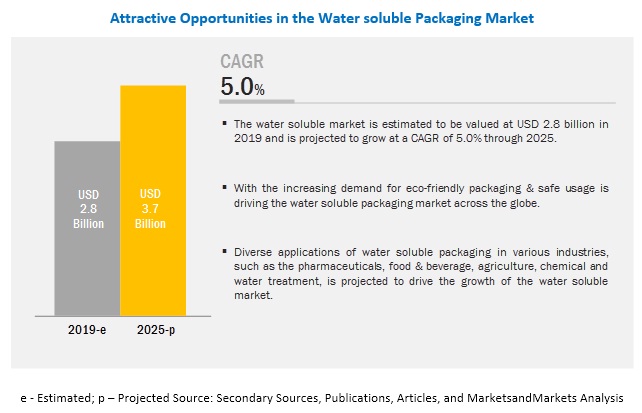

Latest Regulatory Trends Impacting the Water Soluble Packaging Market

The water-soluble packaging market is estimated to be valued at USD 2.8 billion in 2019 and is projected to reach USD 3.7 billion by 2025, recording a CAGR of 5.0% during the forecast period. The increasing demand for sustainable and green packaging drives the market growth for water-soluble packaging.

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=243293980

- What are the growth opportunities in the water soluble packaging market?

- What are the major raw materials used for manufacturing water soluble packaging?

- What are the key factors affecting market dynamics?

- What are some of the significant challenges and restraints that the industry faces?

Thursday, March 3, 2022

Enteric Disease Testing Market Growth by Emerging Trends, Analysis, & Forecast

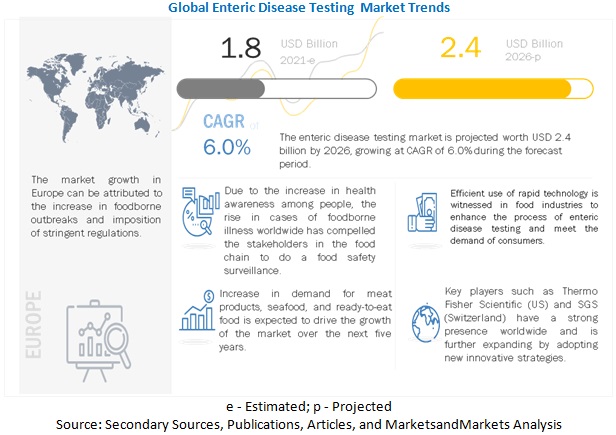

The report "Enteric Disease Testing Market by Technology (Traditional and Rapid), End Use (Food (Meat, Poultry, Seafood, Dairy, Processed Foods, and Fruits & Vegetables) and Water), Pathogen Tested, and Region - Global Forecast to 2026", The market for enteric disease testing is estimated at USD 1.8 billion in 2021; it is projected to grow at a CAGR of 6.0% to reach USD 2.4 billion by 2026. The increase in global food production impacts the food enteric disease testing market growth by increasing the number of food safety controls in each step from raw material procurement till the product reaches the consumers. Further, food manufacturers are willing to pay for testing and certification and have included this practice in their manufacturing cycles. With consumers becoming increasingly aware about the food and water-borne illnesses and stringent regulations to meet international standards, there is growing demand for enteric disease testing market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=139763313

Salmonella pathogen is estimated to account for the largest market share in the by pathogen for enteric disease testing market.

Increasing instances of food contamination and foodborne poisoning are the major reasons for the growth of the enteric disease testing market. Pathogens such as Salmonella are highly occurring contaminants in cereals & grains and are also known as enteric bacteria often caused by birds or rodents during harvesting. Salmonella also causes contamination in meat, poultry, fruits, and vegetables. A several number of cases are found for diarrhea and cholera, resulting in several deaths caused by Salmonella infected food. These factors are paving way for growth of testing for Salmonella within the enteric disease testing market.

By technology, the rapid testing technology sub-segment is estimated to account for the fastest growth in the enteric disease testing market.

The rapid technology market has been proved as a driver for the enteric disease testing market owing to the attributes such as low turnaround time, higher accuracy, sensitivity, and ability to test a wide range of contaminants in comparison to traditional technology. Increasing food trade across borders, rising food consumption, changing lifestyles of consumers, and demand for convenience & processed food have led to the growing demand for enteric disease testing in countries around the world, especially in the booming markets of Europe.

The meat, poultry and seafood sub-segment by end use is estimated to account for the largest market share of enteric disease testing market over the forecast period.

The meat, poultry, and seafood segment is estimated to dominate the enteric disease testing market in 2021. Due to easy susceptibility to microbial and other contaminations along with the growing number of tests for meat, poultry, seafood products has resulted in the growth of the market. Stringent government policies & regulations for meat, poultry, and seafood products and assurance of safe meat to consumers have led to consistent enteric disease testing with checkpoints at different stages to eliminate any incidences of meat contamination.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=139763313

Europe is projected to be the fastest-growing market for the forecast period.

The market in this region is primarily driven by growth in the German and UK markets. It is also driven by European food policies that have been extensively emphasized by the National Reference Laboratories (NRLs) and the European Reference Laboratories (EURLs) to maintain food standards and protect consumer health. Campylobacter has been the most commonly reported food outbreak, with an increase in confirmed human cases in the European Union (EU). The market is further fueled by the presence of major enteric disease testing companies such as SGS SA (Switzerland), Eurofins Scientific (Luxembourg), and Intertek Group plc (UK), which are continuously investing and collaborating for the development of better and faster testing technologies to aid conformity to various enteric disease regulations.

Key Market Players:

Key players in this market include SGS SA (Switzerland), Eurofins Scientific (Luxembourg), Intertek Group plc (UK), Bureau Veritas (France), ALS Limited (Australia), and TÜV SÜD (Germany). Key players in this market are focusing on increasing their presence through mergers & acquisitions and new product developments, specific to consumer tastes in these regions. These companies have a strong presence in Europe and North America. They also have manufacturing facilities along with strong distribution networks across these regions.

Wednesday, March 2, 2022

Crop Protection Chemicals Market: Growth Opportunities and Recent Developments

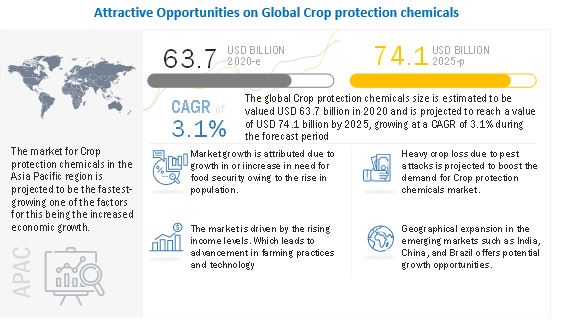

The report "Crop Protection Chemicals Market by Type (Herbicides, Insecticides, Fungicides & Bactericides), Origin (Synthetic, Biopesticides), Form (Liquid, Solid), Mode of Application (Foliar, Seed Treatment, Soil Treatment), Crop Type and Region - Global Forecast to 2025" The global Crop protection chemicals size is estimated to be valued USD 63.7 billion in 2020 and is projected to reach a value of USD 74.1 billion by 2025, growing at a CAGR of 3.1% during the forecast period. The growth of this market is attributed to an increasing need for food security of the growing population.

Upcoming Growth Trends in the Biofertilizers Market

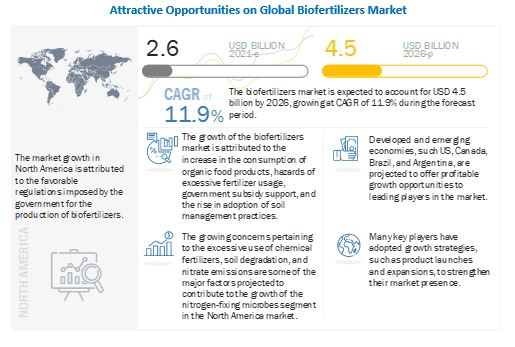

The report "Biofertilizers Market by Form (Liquid, Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Type (Nitrogen-fixing, Phosphate solubilizing & Mobilizing, Potash Solubilizing & Mobilizing), Crop Type, and Region - Global Forecast to 2026" The global biofertilizers market size is estimated to be valued at USD 2.6 billion in 2021 and is expected to reach a value of USD 4.5 billion by 2026, growing at a CAGR of 11.9% in terms of value during the forecast period. Factors such as growth in consumer preference for organic food products, adoption of soil fertility management practices, serious concerns regarding the control of nitrate emissions and eutrophication in the aquatic environment, and government promotions for the use of organic fertilizers are some of the factors driving the growth of the biofertilizers market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

COVID-19 Impact on the Biofertilizers Market:

The global market has witnessed a relatively stable market growth post-COVID-19 pandemic, with a similar trend of high demand in 2020. Biofertilizers can be developed easily, and therefore, are run by domestic manufacturers. As the produce can be manufactured by local companies, the supply chain has not been affected much due to the crisis. Therefore, local manufacturers are projected to dominate the market in most of the countries. There has been a significant increase in food crop production, such as soybean, in South America, fruits & vegetables in European countries, rice in Asian countries. In addition, there is repetitive cultivation due to the increased need in each country to step up domestic food production. Hence, biofertilizer is an effective tool, which helps in replenishing soil nutrition and has gained a high demand in the market. In addition, due to the ban on harmful chemical pesticides, the growth of the market for biofertilizers has not dropped significantly. With the relaxation of restrictions by the government, the market for biofertilizers is projected to grow significantly in the future.

Driver: Growth in the organic food industry

Consumers nowadays are becoming highly concerned about food safety issues, the rising residue levels in food, and environmental issues, due to the rising concerns about their health. This rise in awareness has induced them to prefer chemical-free food products. As a result, major supermarket chains such as Wal-Mart and Cosco are increasing their product offerings of organic foods. The restaurant industry in many developed countries is also offering organic food menus to serve health-conscious consumers. The growth in the organic food industry is triggering the demand for biofertilizers and organic manures, as these are pre-requisites of organic farming. With the outbreak of the COVID-19 pandemic, people have become more conscious about healthy organic food products, which has driven the market growth of biological inputs, such as biofertilizers. These factors have increased organic retail sales in many countries, such as the US, Germany, China, Switzerland, and Denmark.

Seed treatment by mode of application drives the market during the forecast period

By mode of application, the seed treatment segment is projected to have the highest CAGR during the forecast period. In seed treatment, biofertilizers such as Rhizobium, Azotobacter, and Azospirillum. are applied as coatings on seeds. This is the most common method of applying biofertilizers, as it is easy and generally effective under most conditions. This helps to encapsulate small amounts of functional microorganisms on it, which enables the plant to provide nitrogen for the roots, to uptake the nutrients. Seed treatment is extensively carried out for legume seeds for the purpose of nitrogen fixation.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=856

North America is the fastest-growing market during the forecast period in the global market

The North American market is projected to dominate the market due to the rising demand for organic products, increasing acceptance of biofertilizers among rural farmers, and high adoption of advanced irrigation systems such as drip & sprinkler irrigation for fertigation. A stringent regulatory environment in addition to a growing preference for the usage of biofertilizer products has led to the favorable growth of the market. Industrialization, mining, and urbanization have led to a decrease in arable land in North America.

Key Marker Players:

Key players in this market include Novozymes A/S (Denmark), Vegalab SA (Switzerland), UPL Limited (India), Chr. Hansen Holding A/S (Denmark), Kiwa Bio-Tech (China), Lallemand Inc. (US), Rizobacter Argentina S.A. (Argentina), T. Stanes & Company Limited (India), IPL Biologicals Limited (India), Nutramax Laboratories Inc. (US), Symborg (Spain), Kan Biosys (India), Mapleton Agri Biotech Pty Ltd (Australia), Seipasa (Spain), AgriLife (India), Manidharma Biotech Pvt Ltd (India), Biomax Naturals (India), Jaipur Bio Fertilizers (India), Valent BioSciences (US), Aumgene Biosciences (India), Agrinos (US), Criyagen (India), LKB BioFertilizer (Malaysia), Varsha Bioscience and Technology India Pvt Ltd. (India), and Valagro (Italy).

Tuesday, March 1, 2022

Animal Disinfectants Market to Showcase Continued Growth in the Coming Years

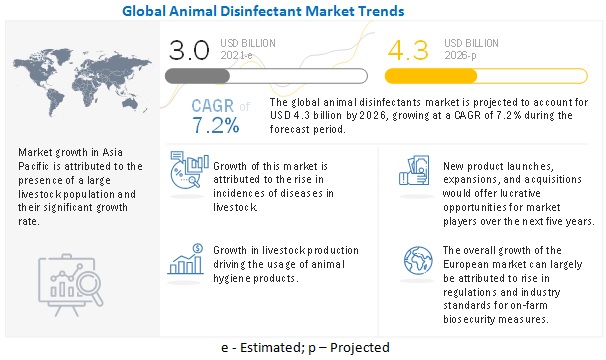

According to MarketsandMarkets "Animal Disinfectants Market by Application (Dairy Cleaning, Swine, Poultry, Equine, Dairy & Ruminants, and Aquaculture), Form (Liquid and Powder), Type (Iodine, Lactic Acid, Hydrogen Peroxide), and Region - Global Forecast to 2026", The global animal disinfectants market size is estimated to be valued at USD 3.0 billion in 2021. It is projected to reach USD 4.3 billion by 2026, recording a CAGR of 7.2% during the forecast period. The market has a promising growth potential due to several factors, including the rising awareness regarding hygiene and sanitation amidst this COVID-19 pandemic and increasing demand for meat and other animal products.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38718363

COVID-19 Impact on the Animal Disinfectant Market

The impact of COVID-19 lockdown was tremendous in scale across the globe and profound especially in the key consumption markets for animal disinfectants. The demand for disinfectant products channelized for the livestock sector has remained high, with manufacturing plants for both disinfectants and water treatment being utilized at almost full capacity for companies such as Lanxess. However, the supply-chain disruptions in the key emerging markets, especially Mexico and Central America, negatively impacted the sales, albeit for a temporary period. The last mile connectivity to small and medium-scale livestock farms suffered a setback due to weakness in the distribution channels. Prominent players in the market such as Neogen expect a surge in demand with markets opening up gradually, and thus, capacity-building remains among the major focus areas. Key giants have also embarked on inorganic growth strategies by acquiring regionally-prominent disinfectant manufacturers and thereby strengthening their geographical outreach. Livestock disinfectant companies are also intensifying their efforts to develop a plethora of anti-bacterial, anti-fungal, and anti-viral solutions in the wake of growing concerns for zoonotic diseases.

Restraint: High entry barriers for players

The high costs associated with the development and registration of animal disinfectant products can result in small to medium-scale companies losing out to larger players. Another barrier for smaller players entering the market is the dynamic nature of the market itself, which has recently witnessed prominent players intensively seeking to consolidate their position through inorganic growth attempts such as acquiring smaller market players. New companies showing disruptive potential become the key targets for acquisitions by larger players such as Neogen Corp. and CID Lines.

Prominent players in the market are intensively seeking to increase their market share with the combination of inorganic and organic growth trajectories with former holding precedence in the form of growing number of acquisitions witnessed in recent years. The regulatory framework in the developed markets of North America and Western Europe is very stringent, with growing focus on good hygiene practices (GHP) which are cost-intensive thereby hindering the entry of small to medium-scale enterprises.

On the basis of application, dairy cleaning segment is expected to retain its dominance in the foreseeable period

Dairy cleaning is a terminal biosecurity measure, which is carried out at regular intervals. Due to the cost factor for larger cattle herds, the use of dairy cleaning has a greater significance in the developed markets. Countries in regions such as Europe and North America maintain large-scale farms and dairy farms required to maintain proper dairy cleaning measures to ensure the efficacy of the livestock and the equipment.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=38718363

Asia Pacific is projected to be the fastest-growing region in the animal disinfectant market.

The animal disinfectant market in Asia Pacific is driven by growing inclination towards animal-based food products that have prompted stakeholders in supply-chain to ramp up their production and intensify rearing leading to greater demand for cleaning and hygiene products, including disinfectants. The region has also witnessed growing regulatory focus on the Good Hygiene Practices (GHP) that are embedded as part of various mandatory regulations to be followed at dairy, poultry, swine, equine and aquaculture sectors. Markets in South East Asia such as Singapore and Malaysia are providing vital cues to improve hygiene infrastructure in animal husbandry and this trend is largely adopted by other countries in the region such as Thailand, Vietnam, Indonesia where there is a strong need to implement robust disinfection protocols.

Key Market Players

Key global market players offer wide range of animal disinfectant products to improve animal health and performance. Prominent livestock disinfectant manufacturers have strong presence in the European and North America countries. The key companies in the animal disinfectant market are Neogen Corporation (US), GEA (Germany), Lanxess AG (Germany), Zoetis (US), Kersia Group (France), and CID Lines (Belgium). Various strategies, such as expansions, mergers & acquisitions, and new product launches, were adopted by the key companies to remain competitive in the animal disinfectant market.

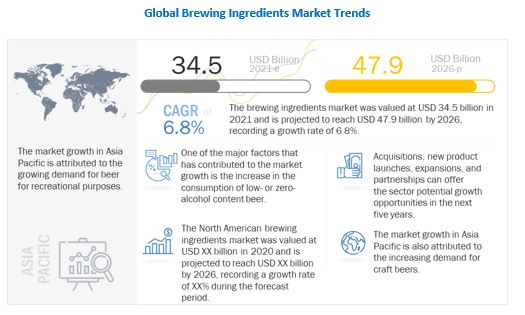

Brewing Ingredients Market Will Hit Big Revenues In Future

The report "Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global Forecast to 2026" The brewing ingredients market was valued at USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%, to reach USD 47.9 billion by 2026. The rise in the global population and increasing disposable income in developing economies are creating new avenues for alcoholic beverages.