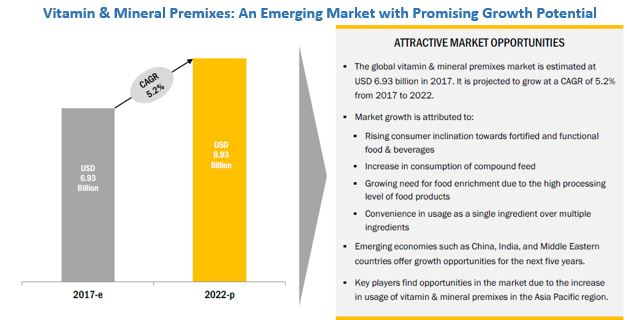

The report "Vitamin & Mineral Premixes Market by Type (Vitamins, Minerals, Vitamin & Mineral Combinations), Application (Food & Beverages, Feed, Healthcare, and Personal Care), Form (Powder and Liquid), and Region - Global Forecast to 2022", The market for vitamin & mineral premixes, in terms of value, is estimated at USD 6.93 Billion in 2017 and is projected to reach USD 8.93 Billion by 2022, at a CAGR of 5.2%.

Download PDF Brochure:

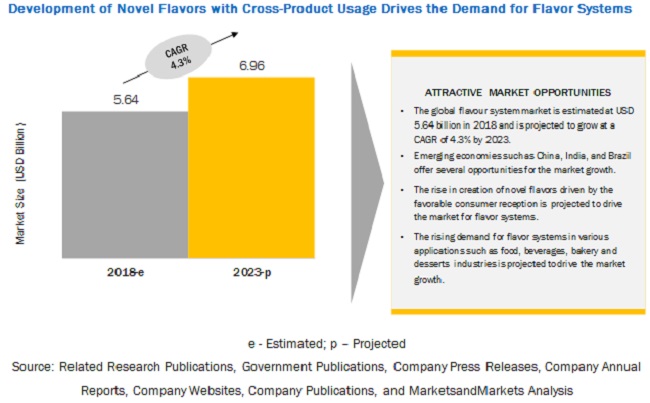

The increasing demand for fortified & functional food products, growing need for food enrichment due to high processing levels of food products, and growth in compound feed consumption have led to an increased demand for vitamin & mineral premixes. Also, with the growing level of consumer understanding of nutrition intake and health issues due to deficiencies, consumers are now focusing on comparing different brands by reading through product labels for information on the nutritional content. Such consumers’ inclination provides an opportunity for the growth of the vitamin & mineral premixes market.

The vitamin & mineral combinations segment accounted for the largest share during the forecast period.

In 2016, on the basis of type, the vitamin & mineral combinations segment accounted for the largest share, in terms of both value and volume. The large market share of vitamin & mineral combinations in various food & feed applications can be attributed to these products being a cost-effective solution to customers and supplying multiple nutrients to humans and animals. Also, one of the factors fueling the growth of this market is the occurrence/prevalence of vitamin & mineral deficiencies and anemia in developing countries. Leading manufacturers are tapping this opportunity and addressing the malnutrition concerns by introducing blends of vitamin and mineral premixes for a wide range of applications.

Healthcare: The fastest-growing application in the vitamin & mineral premixes market.

In 2016, the healthcare segment accounted for the largest share of the vitamin & mineral premixes market, in terms of value, and is projected to grow at the highest CAGR from 2017 to 2022. With the increased occurrence of health problems such as obesity, malnutrition, and weak immune systems and rise in geriatric population, the demand for dietary supplements and products which are high in nutrition has increased. Significant growth in the demand for infant formula products is one of the major factors driving the growth of the vitamin & mineral premixes in the healthcare segment.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=78349714

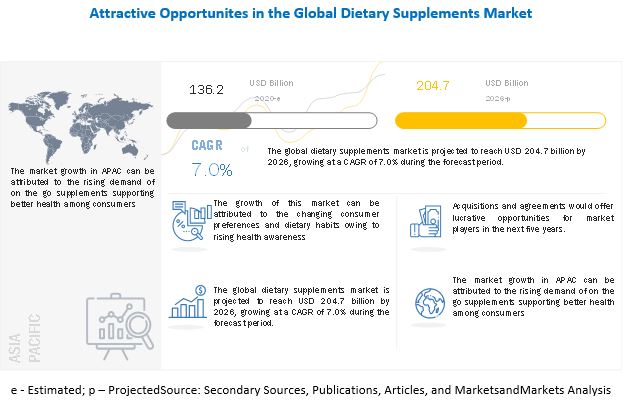

Asia Pacific is projected to be the fastest-growing market for vitamin & mineral premixes.

The demand for food and feed products with specific health benefits is experiencing growth in the Asia Pacific region owing to the changing lifestyles of customers. The major drivers for vitamin & mineral premixes in this region are the growing regional population; rise in disposable incomes; rapid urbanization, especially in China, India, and Japan; and continuous modernization in the food & feed industry. Rising population and changing consumer tastes & preferences for healthy and sustainable lifestyles drive the growth of the vitamin & mineral premixes market.

This report studies marketing and development strategies, along with the product portfolios of leading companies such as DSM (Netherlands), Corbion (Netherlands), Glanbia (Ireland), Vitablend Nederland (Netherlands), Watson (US), SternVitamin (Germany), The Wright Group (US), Zagro Asia (Singapore), Nutreco (Netherlands), Farbest-Tallman Foods Corporation (US), Burkmann Industries (US), and Bar-Magen (Israel).