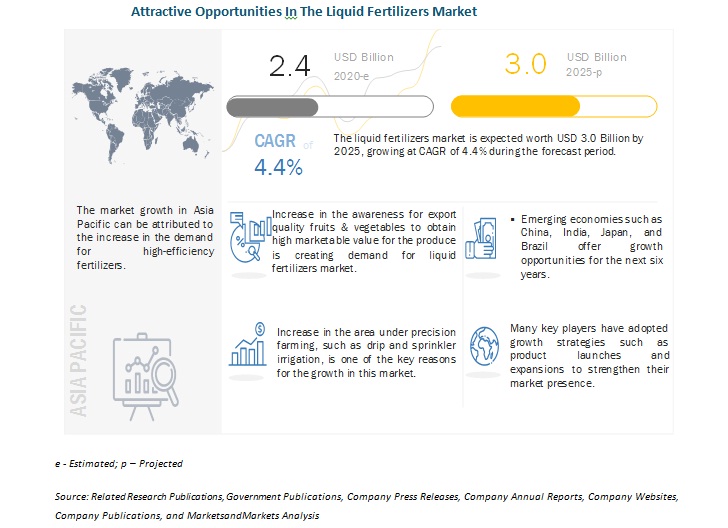

The report " Liquid

Fertilizers Market by Type (Nitrogen, Phosphorus,

Potassium, and Micronutrients), Mode of Application (Soil, Foliar, and

Fertigation), Major Compounds (CAN, UAN, MAP, DAP, and Potassium Nitrate), Crop

Type, and Region - Global Forecast To 2025", The global liquid fertilizers

market size is estimated to be valued at USD 2.4 billion in 2020 and is

projected to reach a value of USD 3.0 billion by 2025, growing at a CAGR of

4.4% during the forecast period. Factors such as the rise in demand for

high-efficiency fertilizers and an increase in crop varieties are projected to

drive the growth of the liquid fertilizers market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=225530281

Driver: Growth in demand for

enhanced high-efficiency fertilizers

Enhanced, efficient application

of liquid fertilizers ensures that crops and plants receive nutrients in an

amount that is required at the right time and at the right place, with minimum

wastage. Enhanced efficiency fertilizers (EEF) are growing substantially in the

agriculture industry in various fields such as cereals and industrial crops, as

a result of the emergence of new urease inhibitors and inexpensive polymer

coating technologies. Such application of enhanced efficiency fertilizers also

helps in reducing the negative impact of nutrients by way of leaching into

water reservoirs.

Restraint: High handling costs

One of the major restraints in

the growth of the liquid fertilizers market is the high storage cost of liquid

fertilizers, along with the high cost of installation. Liquid fertilizers are

water-soluble. The cost of mixing the nutrients in the water is high, and so is

the cost of transportation, as fertilizers in the liquid form require

distinctive handling and storage facilities. This is hindering the growth of

the market around the globe, especially in regions such as Africa and the

Middle East due to the lack of awareness about the application of liquid

fertilizers.

By major compounds, the calcium

ammonium nitrate (CAN) segment to be the fastest-growing segment in the market

during the forecast period.

Calcium ammonium nitrate (CAN)

is the most widely used nitrogen fertilizer due to its relatively high nutrient

content and physical properties, such as high solubility, which helps in

quickly dissolving into the soil. It contains calcium and magnesium, which help

in improving the efficiency of absorbing nitrogen by the roots and reduce

nitrogen losses, making the fertilization more profitable; this also protects

subsoil waters against pollution by nitrogen compounds. CAN is used more in the

case of acidic soils as it does not further acidify the soil. It is majorly

used for wheat, barley, fruits, and vegetables. Increasing adoption of drip and

sprinkler irrigation is projected to increase the demand for CAN fertilizers

during the forecast period.

By mode of application, the

fertigation segment is projected to be the fastest-growing segment in the

liquid fertilizers market during the forecast period.

Fertigation is an agricultural

technique, which includes water and fertilizer application through irrigation.

This process provides an opportunity to maximize the yield and minimize

environmental pollution. Moreover, through fertigation, a farmer can uniformly

apply nutrients throughout the field, whenever required. This market is

projected to grow due to the adoption of efficient irrigation systems globally.

The advantage of fertigation is

that it requires less labor, time, energy, and water. This mode of application

is gaining importance due to its reliability and efficacy. However, to get the

desired results using this method, proper knowledge of the system and efficient

management are required. Fertigation is used in fields of row crops,

horticultural crops, fruit crops, vegetable crops, and ornamental &

flowering crops. There has been a shift in farming practices toward holistic

approaches that include both fertilizer and water application techniques, which

is a key factor that is projected to drive the growth of this market in the

next five years, particularly in North America and Europe.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=225530281

South America is projected to

grow at the highest CAGR during the forecast period.

The market for liquid

fertilizers in the South America region is projected to grow at the highest

CAGR from 2020 to 2025. According to FAOSTAT, Brazil is the largest producer of

agricultural products due to the availability of abundant land and rural labor

force, followed by Argentina. The growth in South America is majorly attributed

to by the increase in the adoption of agrochemicals and advancements in farming

techniques in Brazil and Argentina with distribution channels established by

global agrochemical players. Due to these factors, the market in the South

America region is projected to record the highest growth from 2020 to 2025.

This report includes a study on

the marketing and development strategies, along with a study on the product

portfolios of the leading companies operating in the liquid fertilizers market.

It includes the profiles of leading companies such as Nutrien, Ltd. (Canada),

Yara International ASA (Norway), Israel Chemical Ltd. (Israel), K+S

Aktiengesellschaft (Germany), Sociedad Química y Minera de Chile (SQM) (Chile),

The Mosaic Company (US), EuroChem Group (Switzerland), CF Industries Holdings,

Inc.(US), OCP Group (Morocco), OCI Nitrogen (Netherlands), Wilbur-Ellis (US),

Compass Minerals (US), Kugler (US), Haifa Group (Israel), COMPO Expert GmbH

(Germany), AgroLiquid (US), Plant Food Company, Inc. (US), Foxfarm Soil and

Fertilizer Company (California), Agro Bio Chemicals (India), Agzon Agro

(India), BrandT (US), Nufarm (Australia), Plant Fuel Nutrients, LLC (US),

Nutri-tech solutions (Australia) and Valagro SPA (Italy).