Thursday, September 15, 2022

Sustainable Growth Opportunities in the Meal Replacement Market

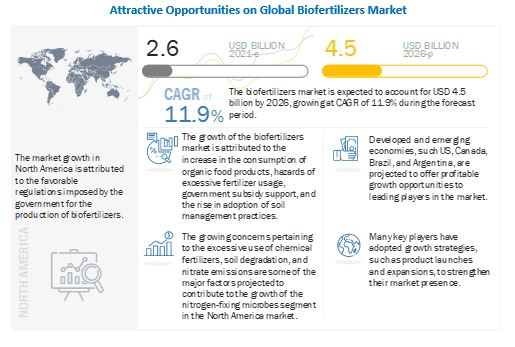

Biofertilizers Market to See Major Growth by 2026

Biofertilizers are substances that contain living microorganisms or latent cells. Biofertilizers are made from biological wastes and do not contain any chemicals. The National Center of Organic Farming (NCOF) defines biofertilizers as “products containing carrier-based (solid or liquid) living microorganisms, which are agriculturally useful in terms of nitrogen fixation, phosphorus solubilization, or nutrient mobilization, to increase the productivity of the soil and/or crop.

Tuesday, September 13, 2022

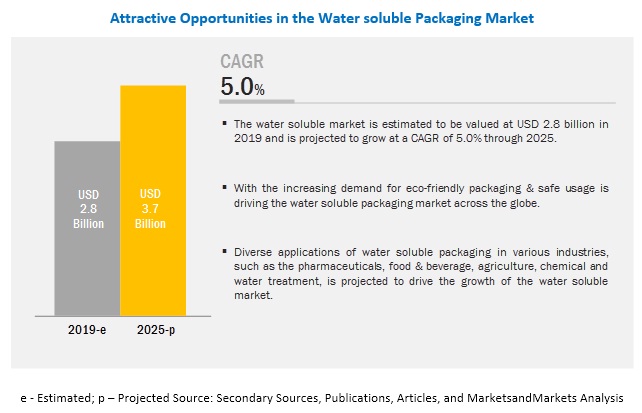

Upcoming Growth Trends in the Water Soluble Packaging Market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=243293980

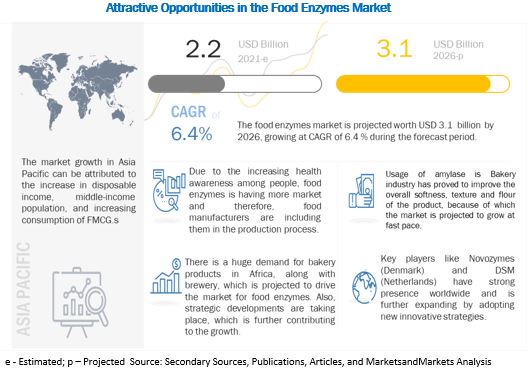

Sustainable Growth Opportunities in the Food Enzymes Market

The report "Food Enzymes Market by Type (Carbohydrases, Proteases, Lipases, Polymerases & Nucleases), Source, Application (Food & Beverages), Formulation, and Region(North America, Europe, Asia Pacific, and South America) – Global Forecast to 2026" The food enzymes market is estimated to be valued at USD 2.2 billion in 2021 and is projected to reach USD 3.1 billion by 2026, recording a CAGR of 6.4%, in terms of value. The growing demand for a diverse range of food products, clean label trends, and an increase in disposable income are the factors that are projected to drive the growth of the food enzymes market globally.

Monday, September 12, 2022

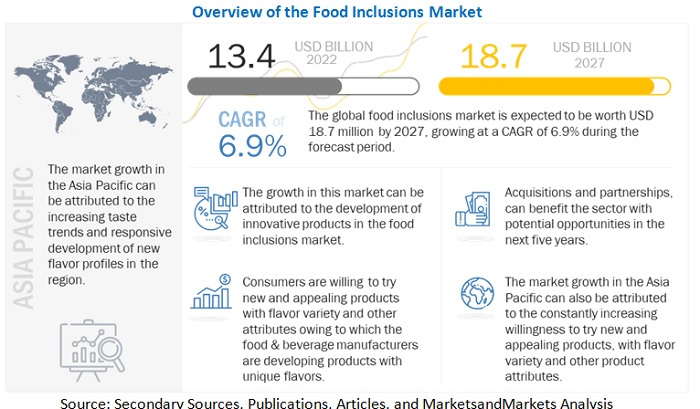

Food Inclusions Market to See Major Growth by 2027

Wednesday, August 17, 2022

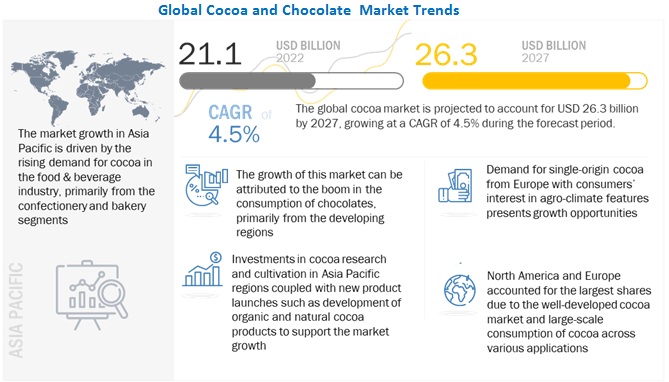

Sustainable Growth Opportunities in the Cocoa and Chocolate Market

According to a research report "Cocoa and Chocolate Market by Type (Dark Chocolate, Milk Chocolate, Filled Chocolate, White Chocolate), Application (Food & Beverage, Cosmetics, Pharmaceuticals), Nature (Conventional, Organic), Distribution and Region - Global Forecast to 2027" published by MarketsandMarkets, the global cocoa market is projected to reach USD 26.3 billion by 2027, growing at a CAGR of 4.5% from 2022 to 2027. The global chocolate market is projected to reach USD 160.9 billion by 2027, growing at a CAGR of 4.7% from 2022 to 2027.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=226179290

With the growing awareness about health, an increasing number of consumers are prioritizing their health and following specific diets with specific needs. This propels the demand for dark chocolate with high cocoa and less sugar. Cocoa is the major raw material required to manufacture chocolate. The slightest turbulence in the cocoa market would lead to price fluctuations. According to the International Cocoa Organization, the world’s largest supplier of cocoa is Africa, which accounts for 72% of the global production of cocoa. Ivory Coast and Ghana are the major countries producing cocoa, but these countries are also facing certain issues such as fair trade discrepancies, environmental issues, spells of government unrest, and reducing labor force as more population is leaving farming as an occupation and opting other professions Therefore, measures such as implementation of National Cocoa Development Plan (NCDP) in the member countries of ICCO are being undertaken to improve the production of cocoa. Initiatives like these gives a promising outlook towards fulfilling the rising demand for cocoa globally. The cocoa & chocolate market players are showing trends of pursuing both organic as well as inorganic strategies for their expansion, consolidation, and sustainability in the market. Developments and new product launches in chocolate and rise in the use of cocoa for cosmetics and pharmaceuticals are driving the market and is leading to an increased demand for cocoa.

Milk Chocolate segment is the fastest growing among the various types

of chocolate during the forecast period

The market for chocolate, based on type, is segmented as dark chocolate, milk chocolate, filled chocolate, and white chocolate. The milk chocolate segment is estimated to dominate the chocolate market in 2022 and is anticipated to witness similar trends throughout the forecast period. Milk chocolate has low level of cocoa solids and is lighter and sweeter than dark chocolate. Dark chocolate segment has witnessed an upwards trend over the years owing to various health benefits associated with it due to the presence of high fiber, high iron, magnesium, potassium, and phosphorous content.

In the cocoa and chocolate market, organic nature segment is

registering the highest growth during the forecast period

The cocoa market, based on the nature, is segmented into conventional and organic. In 2022, the conventional cocoa market segment is expected to dominate the market. The conventional cocoa products are easily available at low cost and is widely preferred. Due to the need for organic farming, high labour expenses, maintenance requirements, and other organic cocoa-related operating expenditures, organic cocoa ingredients and products are quite expensive. The organic cocoa segment, however, is estimated to witness a higher growth rate during the forecast period owing to its various health benefits and environment friendliness.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=226179290

Asia Pacific region is witnessing the highest growth rate in chocolate

market

The Asia Pacific region is witnessing the fastest growth rate of 5.72% during the forecast period. The Chinese cocoa market, in terms of volume, is estimated to grow at a CAGR of 6.39%. This is attributed to the strong demand for chocolate in the country. Across Europe, Germany consumed the highest quantity of chocolate in 2021 followed by UK, and Belgium. United States accounted for the largest market share primarily driven by the large consumption of confectionary and bakery items. According to the Observatory of Economic Complexity (OEC), the US was the seventh largest exporter of chocolate in 2020, with key export destinations being Canada, Mexico, South Korea, Australia, and the UK. Growth in this region is attributed to the growing population, rise in per capita income, growing urbanization, and therefore, an increase in demand for chocolate-based products. Additionally, the nutritional benefits of chocolate are promoting the growth of chocolate in the region.

The key players in cocoa and chocolate market include Mars, Inc.(US), Mondelez International (US), Nestle S.A. (Switzerland), Meiji Holding Co. Ltd.(Japan), Ferrero International(Italy), Olam Group (Singapore), Barry Callebaut(Switzerland), Cargill Incorporated (US), Cocoa Processing Company (GHANA), Archer Daniel Midland (ADM) Company (U.S.), Chocoladefabriken Lindt & Sprüngli AG (Switzerland) and Pladis Global(UK) among others.

Saturday, August 13, 2022

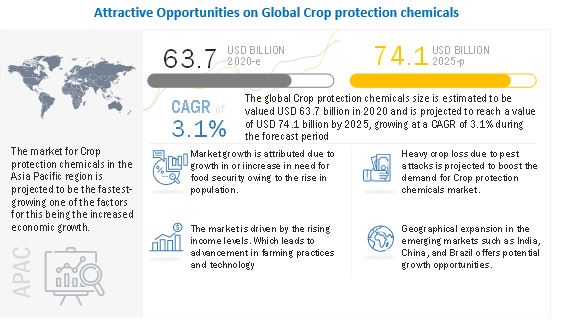

Upcoming Growth Trends in the Crop Protection Chemicals Market

The report "Crop Protection Chemicals Market by Type (Herbicides, Insecticides, Fungicides & Bactericides), Origin (Synthetic, Biopesticides), Form (Liquid, Solid), Mode of Application (Foliar, Seed Treatment, Soil Treatment), Crop Type and Region - Global Forecast to 2025" The global Crop protection chemicals size is estimated to be valued USD 63.7 billion in 2020 and is projected to reach a value of USD 74.1 billion by 2025, growing at a CAGR of 3.1% during the forecast period. The growth of this market is attributed to an increasing need for food security of the growing population.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=380

Herbicides, by type, are estimated to hold the largest market share

during the forecast period.

The market for crop protection chemicals, by type, has been segmented into feed grade and nutrition grade. Herbicides are widely used in weed control, which helps in enhancing crop productivity and quality of output. Herbicides help in reducing soil erosion and increase soil fertility and crop yield. They are used to control or kill unwanted plants and are often known as weed killers.

The liquid segment, by form, is estimated to hold the largest share in

the Crop protection chemicals during the forecast period

Liquid forms of crop protection chemical products are preferred more by suppliers as well as end-users. Liquid forms offer a longer shelf-life with easy handling, transportation, and application. Also, they are cost-effective, eco-friendly, and sustainable. Companies are investing in the technological development of crop protection chemicals in liquid forms. The liquid forms of crop protection chemicals can either be water-based, oil-based, polymer-based, or their combinations. Typical liquid formulating lines consist of storage tanks or containers to hold active ingredients, inert materials, and a mixing tank for formulating the crop protection chemical products. Water-based formulations require inert ingredients such as stabilizers, stickers, surfactants, coloring agents, anti-freeze compounds, and additional nutrients. Examples of liquid forms are suspension concentrate, suspo-emulsions, and capsule suspension.

Synthetic, by source, is estimated to account for the largest market

share during the forecast period

Synthetic crop protection chemicals are manufactured in laboratories and are mixtures of chemicals that intend to avert, kill, repel, or destroy any pests. Synthetic crop protection chemicals are perceived to be toxic and dangerous if proper chemicals are not used. However, since the past 60 years, various innovative synthetic crop protection chemicals have been developed which are less toxic and more effective on crops. Due to innovative product development by the leading crop protection chemical manufacturing companies such as BASF SE (Germany), various new and more pest-specific synthetic crop protection chemicals are being developed, which cause less damage to the environment.

Foliar spray, by mode of application, is estimated to account for the

largest market share during the forecast period

The foliar spray mode of application is the most widely used for crop protection chemicals. It can be used for herbicides, insecticides, as well as fungicides. However, it is majorly used for spraying herbicides and insecticides due to labor shortage for removing unwanted weeds manually and also for destroying insect attacks on crops.

Foliar spray or foliar feeding is a technique of feeding plants by applying liquid crop protection chemicals directly to their leaves. Foliar spray is suitable for destroying large number of unwanted grasses, herbs, and shrubs.

Cereals & grains, by crop type, is estimated to account for the

largest market share during the forecast period

The cereals & oilseeds segment accounted for the largest market share in terms of value; this is projected to grow at the highest CAGR during the forecast period. The demand for cereals & oilseeds is increasing significantly across the globe owing to the increasing demand for food.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=380

South America is estimated to hold the largest market share during the

forecast period

South America is an emerging agricultural powerhouse, growing at a rapid pace above the global growth average. Growth in this region is significantly contributed by the growth in Brazil and Argentina, which are the world’s most potent agricultural producers and are expected to grow well above the regional average. The economic growth in South America has been stimulated by democratization, economic reforms, and the foundation of the two trading blocs namely, Mercosur and the Andean Pact.

Regulatory framework in South America is quite weak as compared to North America and Europe. The South American Pesticide Action Network controls the regulatory issues in the region. The international trade system from the WTO for regional and bilateral trade deals also undermines national pesticide laws and threatens the ability of South American nations to prohibit dangerous chemicals from being used. This is especially observed in the case of WTOs demand for establishing certain common minimum standards for pesticides among countries. For instance, if a country wants to implement a stricter standard on pesticides as compared to the WTO, it could be recognized as a technical barrier to trade.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the Crop protection chemicals. It consists of the profiles of leading companies such BASF SE (Germany), The Dow Chemicals Company (US), Dupont (US), Sumitomo Chemical Co., Ltd (Japan), Syngenta AG (Switzerland), Bayer Cropscience AG (Germany), FMC Coropration (US), NufarmLimited (Australia), Adama Agricultural Solutions (Israel), Verdesian LIfescineces (US), Bioworks Inc. (US), Valent US (US), Arysta Lifescince Corporation (US), American Vanguard Corporation (US), Chr. Hansen (Denmark), Corteva Agrisciences (US), UPL Limited (India), Jiangsu Yangnong Chemical Group Co Ltd (China), Agrolac (Spain), Lianyungang Liben Crop Science Co. Ltd. (HongKong), Nanjing red sun co. ltd (China), Kumiai Chemicals (Japan), Wynca Chemicals (China), Lier Chemicals (China), Simpcam Oxon (Italy).