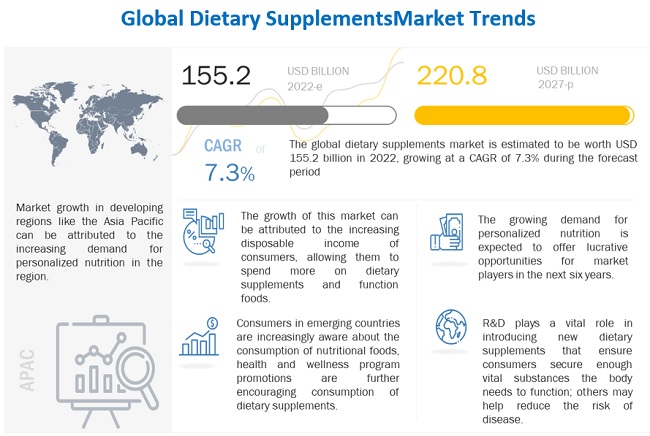

The global

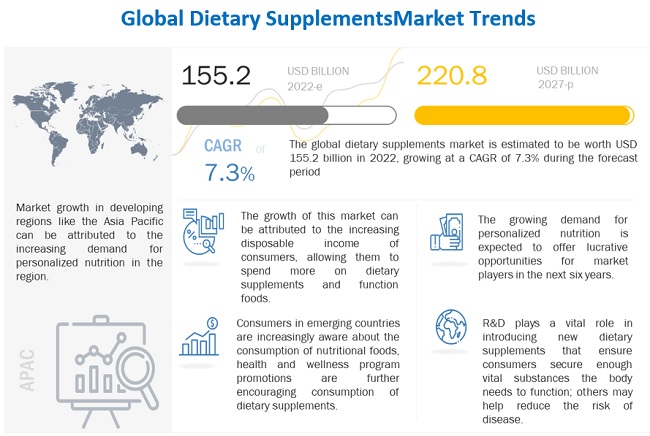

Dietary Supplements Market is estimated at USD 155.2 billion in 2022; it is projected to grow at a CAGR of 7.3% to reach USD 220.8 billion by 2027. Increasing awareness regarding nutrition and healthy lifestyles is driving the market for dietary supplements. It is widely known that having a healthy immune system can help reduce the risk or severity of diseases and infections. When combined with proper nutrition, dietary supplements can enhance the body’s natural defenses and immunity. As people become more conscious of holistic wellbeing, the demand for immunity-boosting products is expected to increase in the coming years.

The Dietary Supplements market consists of a few globally established players such as Amway Corp (US), Herbalife International of America, INC. (US), ADM (US), Pfizer INC (US), Abbott (US), Nestle (Switzerland), Otsuka Holding Co, LTD (Japan), H&H Group (China), Arkopharma (France), Bayer AG (Germany), Glanbia Plc (Ireland), Natures Sunshine Products Inc (US), Fancl Corporation (Japan), Danisco (Denmark), Bionova (India), American Health (US), Pure Encapsulations LLC (US), GlaxoSmithKline, PLC (UK). Strategic partnerships were the dominant strategy adopted by the key players, followed by expansions and new product launches. These strategies have helped them to increase their presence in different regions and industrial segments.

Herbalife Nutrition is a global nutrition firm that offers weight management, sports nutrition, and health & wellness products to people across the world. They distribute and advertise various nutrition products to and through a network of independent members, using a direct-selling business model. The company operates through five business segments, namely Weight Management, Targeted Nutrition, Energy, Sports and Fitness, Outer Nutrition and Literature, Promotional, and Others. It offers dietary supplements under the Weight Management and Targeted Nutrition product categories. Herbalife Nutrition offers a wide range of high-quality and science-backed products, including meal replacement protein shakes, teas, aloes, protein bars, nutritional supplements, sports hydration, and outer nutrition products. Till now, the company has marketed and sold approximately 120 types of products. The company’s manufacturing facilities, known as Herbalife Innovation and Manufacturing Facilities or HIMs, include HIM Lake Forest, HIM Winston-Salem, HIM Suzhou, and HIM Nanjing. Approximately 60% to 65% of their inner nourishment products distributed worldwide are made in the HIM manufacturing facilities.

The Archer-Daniels-Midland Company (ADM) harnesses the power of nature to offer nutrition to people all over the world. The corporation is a global leader in human and animal nutrition. It is also the world's largest agricultural origination and processing company. ADMs breadth, depth, insights, facilities, and logistical expertise give it unparalleled capabilities to address food, beverage, health & wellness, and other needs. ADM owns and manages a global grain elevator and transportation network for procuring, storing, cleaning, and transporting agricultural raw materials such as oilseeds, corn, wheat, milo, oats, barley, and products derived from those inputs. The company owns trademarks, brands, recipes, and other intellectual property, including patents, with a net book value of $903 million as of December 31, 2020. The company operates through four business segments: AG Services and Oilseeds, Carbohydrate Solutions, Nutrition, and Others. It offers dietary supplements under its Nutrition segment. The company’s Nutrition segment is involved in the manufacturing, sales, and distribution of a wide array of dietary supplements and nutrition products, including probiotics, prebiotics, enzymes, botanical extracts, and other specialty food & feed ingredients. The segment also comprises activities such as the manufacturing of contract and private label pet treats and foods, as well as the processing and distribution of formula feeds and animal health and nutrition products. The company operates through 46 innovation centers, 345 processing plants, 480 crop procurement facilities, and 200 bulk storage facilities in around 200 countries across the regions. ADM operates through numerous subsidiaries, such as Ab Mauri (UK), ABF Ingredients (UK), ABITEC Corporation (Us), Ohly (Germany), Golden Peanut Company LLC (US), ADM Milling (US), ADM Do Brasil Ltda. (Brazil), Wild Flavors, Inc. (US), and ADM Hamburg Ag (Germany).

Amway is one of the worlds largest direct selling companies. The company manufactures and distributes nutrition, beauty, personal care, and home products, which are sold solely through Amway’s Independent Business Owners (IBOs) in over 100 countries. The company operates through four business segments, namely Nutrition, Beauty, Personal Care, and Home and Others, which include Energy Drinks and Sports Nutrition products. It offers dietary supplements under its Nutrition segment. Dietary supplements and vitamins are offered under its Nutrilite brand. Amway is present in over 100 countries and territories and covers over 60 languages. More than 15,000 employees are involved in this organization, including around 500 scientists, engineers, and technical professionals. Amway has over 1,000 global patents and patents pending for its products, which is a natural result of its commitment to innovation and rigorous testing. Amway owns and operates about 6,000 acres (2,428 hectares) of certified organic farmland in Jalisco (Mexico), Trout Lake (Washington, US), and Ubajara (Brazil). Amway has about 750 locations and spaces worldwide, including experience centers, shops, plazas, and distribution centers. Amway operates six manufacturing facilities in strategic locations across the world that produce millions of high-quality products for its Amway Business Owners (ABOs) and customers.

Pfizer Inc. is a research-based, global biopharmaceutical company. Through the research, development, manufacturing, marketing, sale, and distribution of biopharmaceutical medicines around the world, the company employs science and its global resources to offer therapies to people that extend and significantly improve their lives. The company seeks to promote wellness, prevention, treatments, and cures for the world's most feared diseases in both developed and emerging markets. On June 2, 1942, the company was incorporated under the laws of the State of Delaware. Pfizer manufactures medicines, vaccines, and consumer healthcare products, among others. The company operates through two business segments, namely, Biopharma and Pfizer CentreOne. It offers consumer healthcare products, including multivitamins and calcium supplements, through brands Centrum and Caltrate, respectively, under the Consumer Healthcare segment. In 2019, Pfizer and GSK combined their respective consumer healthcare businesses into a JV that operates globally under the GSK Consumer Healthcare name. The company has its presence in North America, Europe, the Asia Pacific, and the Middle East. Some of the major subsidiaries of Pfizer are Pharmacia & Upjohn (Sweden), Pfizer Japan Inc. (Japan), Medivation (US), and Hospira (US).