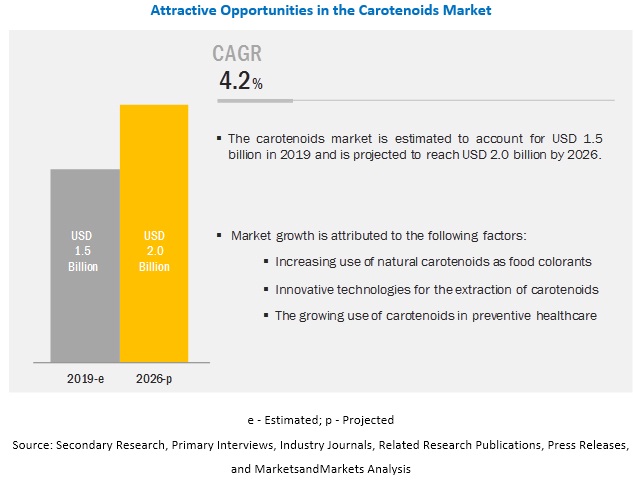

The global carotenoids market size is projected to grow from USD 1.5 billion in 2019 to USD 2.0 billion by 2026, recording a compound annual growth rate (CAGR) of 4.2%, in terms of value, during the forecast period. Carotenoids are a group of yellow to red pigments, including the carotenes and the xanthophylls, found particularly in plants, algae, and photosynthetic bacteria and certain animal tissues. The increase in the usage of carotenoids as food colorants and the advancements end-user technologies are the major factors that are projected to drive the growth of the carotenoids market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=158421566

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=158421566

Key carotenoids market players include Koninklijke DSM (Netherlands), BASF (Germany), Chr. Hansen (Denmark), Kemin Industries (US), Lycored Limited (Israel), Cyanotech Corporation (US), Fuji Chemical Industry Co Ltd. (Japan), Novus International (US), DDW The Color House (US), Dohler Group (Germany), Allied Biotech Corporation (Taiwan), E.I.D Parry (India), Farbest Brands (US), Excelvite Sdn. Bhd. (Malaysia), AlgaTechnologies Ltd. (Israel), Zhejiang NHU Co. Ltd (China), Dynadis SARL (France), Deinove SAS (France), Vidya Europe SAS (France), and Divi’s Laboratories (India). Product launches, expansions & investments, mergers & acquisitions, agreements, joint ventures, and partnerships were the dominant strategies adopted by major players. These strategies have helped them increase their presence in different regions.

KoninklijKE DSM (Netherlands), is a global science-based company engaged in health, nutrition, and materials businesses. The company operates through three segments, namely, nutrition, materials, and innovation center, and corporate activities. Carotenoids are offered under the nutrition segment and are used for a variety of applications in industries, such as food, feed, supplements, and pharmaceutical. The company is engaged in enhancing its market presence in the global carotenoids market through investments. For instance, in June 2018, Koninklijke DSM invested USD 3 billion to expand its nutrition business that includes carotenoids, vitamins, and enzymes.

BASF (Germany), is a leading chemical company, which manages its businesses through five segments, namely, chemicals, performance products, functional materials and solutions, agricultural solutions, and others. The performance products segment consists of four divisions, namely, nutrition &health, performance chemicals, dispersion & pigments, and care chemicals. Carotenoids are offered under the nutrition and health segment and have been categorized as animal nutrition (feed products) and human nutrition (food and beverage and supplements). It focuses on developing products to meet the EU regulatory requirements of feed. For instance, in September 2018, it launched new product lines, namely, Lucantin red 10% (Canthaxanthin), Lucantin Yellow 10% NXT ( C30 Ester), and Lucantin CX 10% NXT (Cintraxanthin) to meet the EU regulatory requirements for feed, which does not use antioxidant ethoxyquin.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=158421566

The Europe region is forecasted to dominate the carotenoids market in terms of market share during the forecast period. This is due to the presence of consumers who are demanding natural and clean-label food products. The players in food and feed industry in Europe are widely using natural ingredients as a colorant in their products and easy availability of carotenoids makes it a preferrable option for these manufacturers. Furthermore, growing ageing population has led to increase in demand for carotenoids as it may benefit in curing cataract and other eye disorders.