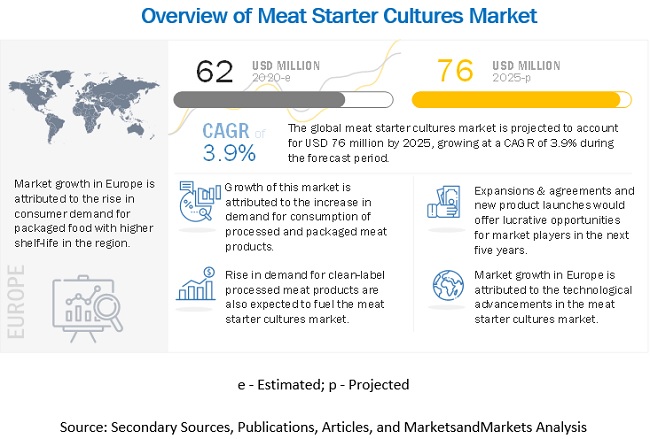

According to MarketsandMarkets, the global meat starter cultures market size is estimated to be valued at USD 62 million in 2020 and is projected to reach USD 76 million by 2025, recording a CAGR of 3.9% in terms of value. The growth of the meat starter cultures market can be attributed to the increase in demand for processed meat products with higher shelf-life. Along with that, demand for organic and clean-label meat products have been increasing in the developed regions, which are also expected to fuel the meat starter cultures market in the forecasted period. European region dominated the global meat starter cultures market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=43153327

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=43153327

Starter cultures are bacterial or fungal strains that are used to initiate the fermentation process. The meat starter culture can be defined as microbial cultures used to promote and conduct the fermentation process in meat products. They help in increasing the safety of fermented meat products and also enhance the characteristics of the end-product. The meat starter cultures market is witnessing growth due to the increasing demand for packaged meat products and technical advancement in the processed meat industry. In recent times, consumers have been more aware of health and wellness and have been selective in their daily consumptions. Consumers have been conscious about the proteins and nutrients intake from non-preservative food products for their overall physical and mental growth and development. This resulted in a shift in consumer preferences toward clean-label food products. Since ages, meat has been a prominent source of high-quality proteins for humans, and in recent times, meat has been consumed either in the fresh or processed form. According to the Food and Agriculture Organization (FAO), the global average meat consumption was 41.3 kg/capita in 2015, and is estimated to be 46.3 kg/capita in 2030. Also, a study published by the North American Meat Institute (NAMI) in 2018 had stated, more than 90% of US citizens include meat and poultry products in their diet.

The processed meat undergoes modification in order to improvise its taste and shelf-life suitable for consumption at a later time. Additionally, processed meat involves products that contain either 100% meat or, at times, the minimum composition of meat. They include products such as chicken sausages, corned beef, canned meat or bacon, among others. The consumer preferences have been increasing toward processed meat due to their ease of cooking and can be consumed anytime, with minimal time required for cooking.

The synthetic or processed food products consist of nitrites and nitrates in larger quantities, and higher consumption of such food products have proven to be detrimental to the human body and may also lead to cancer in some cases. Therefore, the augmenting demand for safe and healthy food products is fueling the demand for organic animal husbandry. Additionally, organic processed meat products have negligible use of artificial chemicals, resulting in their usage for the manufacturing of clean-label meat products. Ingredient manufacturing companies such as DuPont (US) and Kerry Group (Ireland) have been emphasizing the development of meat starter cultures to mitigate the use of artificial preservatives for increasing the shelf-life of meat products. Therefore, the above factors are anticipated to drive the global meat starter cultures market during the forecast period.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=43153327

The meat starter cultures market in Europe is dominant due to the increasing demand for processed meat products with higher shelf-life because of a shift in lifestyle trends. People are looking for ready-to-cook meal options as they are leading a busy life. The consumption of sausage has been prominent in these countries, resulting in a rise in demand for meat starter cultures for their production. The leading companies dominating the meat starter cultures market include Chr. Hansen (Denmark), Kerry Group (Ireland), and DSM (Netherlands); have a robust presence in Europe due to higher demand for packaged meat in these regions.

North America is the fastest-growing market as the technological advancements involved in monitoring and using meat starter cultures are available in the region, and meat manufacturers have been adapting to the changing technologies. The demand for meat starter cultures is increasing as consumers have been inclined toward organic and clean-label meat products. Also, key players are increasingly investing in the North American meat starter culture market.