The global Dietary Supplements Market size is projected to grow at a CAGR of 7.3% to reach USD 220.8 billion by 2027. It is estimated at USD 155.2 billion in 2022. The growth of the global market is estimated to be driven by the increasing health awareness among consumers. Dietary supplements are a growing application of nutraceutical products. The food and nutrition industries have evolved to give consumers a more personalized experience to compensate for dietary loss through supplemental nutrition.

The Botanical segment by type is projected to achieve the Highest CAGR growth in the Dietary Supplements market.

The demand for the botanicals ingredients included in the dietary supplements solutions had driven because of their consumer-perceived benefits, such as functional benefits and being "closer-to-nature," as well as their ability to impart pleasant flavours. Furthermore, attractive flavours and colors produced from natural sources are a vital part in dietary supplements solutions. Some of the advantages of botanical dietary supplements are, Low cost compared to prescription drug, It can be obtained without a prescription, Has the potential to be effective, despite the lack of evidence, and Contribute to a sense of self-sufficiency

Driver: Shift in consumer preference due to increase in focus on health and prevention

‘Self-care’ has now become an essential part of the modern consumer’s lifestyle. The growing emphasis on holistic health and immunity has resulted in some significant dietary changes among consumers. The use of vitamins, minerals, immunity-boosting foods, organic products, supplements, and other nutritional supplements has increased significantly. Though the ongoing pandemic has increased the focus on immunity, it is widely known that having a healthy immune system can help reduce the risk or severity of diseases and infections. It is also a key factor that, when combined with proper nutrition, can enhance the body's natural defenses. As people become more conscious of holistic wellbeing, the demand for immunity-boosting products has increased significantly. People are increasingly shifting to herbal supplements and other dietary supplements to address their health concerns. The increasing consumer health awareness and rising disposable income across regions are factors that have encouraged people to shift to nutraceuticals such as dietary supplements. Lifestyle changes, along with a better understanding of fitness and health, have encouraged people to take multivitamins and minerals in the form of capsules and tablets.

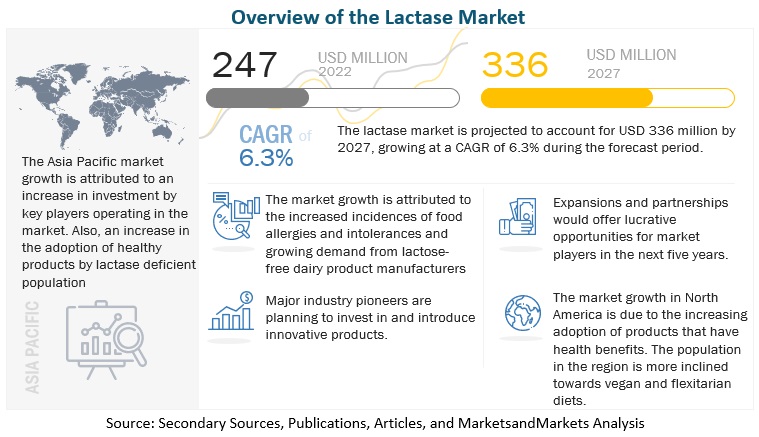

Asia Pacific is projected to achieve the highest CAGR growth in the Dietary Supplements market.

The rising influence of westernization, the growing millennial population, and increasing awareness are the key drivers of market growth. According to the UN, in 2019, 60% of the 1.8 billion global population of millennials reside in Asia. This population is active, enthusiastic about fitness, and continuously seeking innovative products. As a result, millennials are prominent consumers of dietary supplements in the region. Veganism has also become popular in the region, alongside rising demand for plant-based food products, especially in India, China, Australia, and Indonesia. This key factor would eventually pave the way for herbal supplements to grow significantly in value sales during the forecast period in the Asia Pacific.

What factors are driving the growth of the dietary supplements market?

Key Market Players:

The key players in dietary supplements market includes Amway Corp (US), Herbalife International of America, INC. (US), ADM (US), Pfizer INC (US), Abbott (US), Nestle (Switzerland), Otsuka Holding Co, LTD (Japan), H&H Group (China), Arkopharma (France), Bayer AG (Germany), Glanbia Plc (Ireland), Nature's Sunshine Products Inc (US), Fancl Corporation (Japan), Danisco (Denmark), Bionova (India), American Health (US), Pure Encapsulations LLC (US), GlaxoSmithKline, PLC (UK). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.