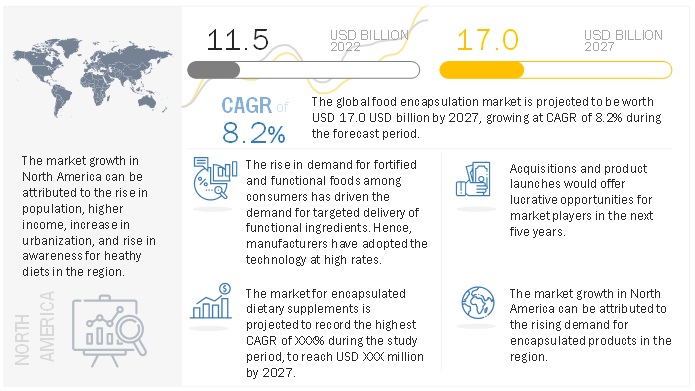

The food encapsulation market was valued at USD 11.5 billion in 2022; it is projected to grow at a CAGR of 8.2% to reach USD 17.0 billion by 2027. The market for encapsulation is growing globally at a significant pace due to its numerous applications and multiple advantages over other technologies. Some of the major advantages of encapsulation are that it helps provide enhanced stability and bioavailability to the bioactive ingredients and also helps increase the shelf life of food products and maintains the taste and flavor for a longer period. Encapsulation is increasingly used in various industrial areas such as nutraceuticals and food & beverages.

The high growth opportunities in emerging regions are attributed to the growing economies and technological advancements. North America accounts for the largest share of the food encapsulation market, with the US being the largest contributor. This is because of the presence of most of the major players in the market and the availability of advanced technologies. Asia Pacific is projected to grow at the highest rate due to the increase in industrial activities and health consciousness among consumers.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=68

Drivers: Innovative food encapsulation technologies enhance market penetration.

Food encapsulation technology has evolved from being a fundamental preservation technology to a complex food processing technology. This technology enables many properties such as color and taste-masking and controlled release of bioactive ingredients. The evolution of encapsulation technology has happened through many stages. They have been further classified into microencapsulation, microencapsulation, and nanoencapsulation. Food manufacturers are developing newer encapsulation technologies. The aim to maximize and preserve product taste without environmental degradation. The preservation of potency along with health benefits value addition to the product is pushing manufacturers towards adopting food encapsulation.

Robotic Technology in Food Encapsulation is One of the Major Trends

Robots enhance the process of packaging nutraceutical supplements by being time-efficient and accurate. They increase the shelf life of nutraceutical ingredient products and help them to comply with regulatory guidelines by reducing the risk of contamination. Furthermore, the recent increase in the demand for nutritional supplements requires large-scale production, increasing the demand for robots to optimize production facilities.

Analyzing machine performance, gathering data, and troubleshooting in advance are the key robotics trends in the nutraceutical ingredients market projected to increase technology adoption in the industry. COBOTs are primarily used in the nutraceutical industry for such applications. According to TransAutomation Technologies, the labor expenditures of three people each day can be offset by a single robot that can perform one function for 24 hours per day. This helped several pharmaceutical and nutritional supplement manufacturers increase productivity, reducing their need for human labor and the challenges and costs that go along with it. Collaborative robots enable humans and robots to work together effectively in open or uncaged environments. Through collaborative robots, a human operator and robot can be engaged together in the same process, or the operator can simultaneously manage other tasks that a person might better solve.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=68

North America dominated the food encapsulation market; it is projected to grow at a CAGR of 7.8% during the forecast period.

The food encapsulation market in North America is influenced by factors like health awareness, promotion of nutraceuticals and functional foods and growing expenditure on prevention of chronic non communicable diseases. Food encapsulation adds value to foods and effectively delivers potent bioactives in isolation as supplements or as value addition in functional foods. The US dominated the market in 2021 and is projected to be the fastest-growing market for food encapsulation in North America. The market in this region is driven by technological advancements in food encapsulation techniques such as liposome compression, inclusion complex and centrifugal extrusion and the growing demand for functional and fortified foods that use encapsulated nutrients and the growing consumption of convenience foods that use encapsulated flavors and colors. Most of the key market players have a presence in the region.