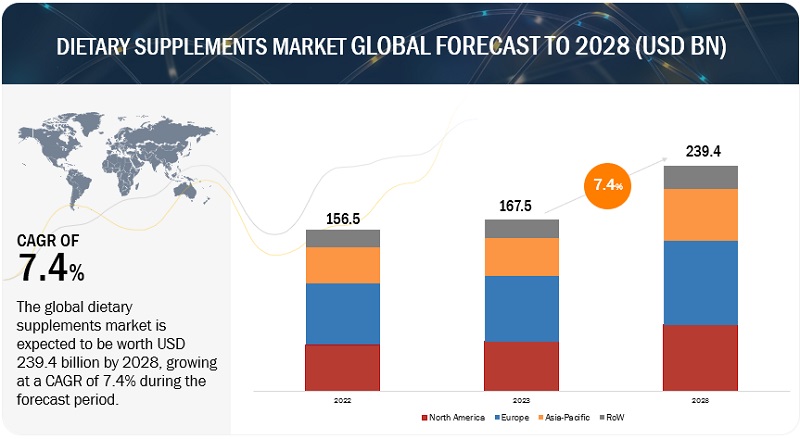

The dietary supplements industry is projected to reach USD 239.4 billion by 2028 from USD 167.5 billion by 2023, at a CAGR of 7.4% during the forecast period in terms of value. The demand for dietary supplements is driven by increasing consumer awareness of health and wellness, preventive healthcare, the aging population, and rising chronic diseases. The convenience of online purchasing and product availability further fuel market growth. For instance, in the United States, dietary supplement consumption is high due to a health-conscious population, a proactive approach to wellness, and a robust regulatory framework ensuring safety and quality standards.

Emerging trends in the global Dietary Supplements Market are:

- Plant-Based Supplements

- Personalized Nutrition

- Clean Label and Transparency

- Immune Health

- Beauty Supplements

- Digital Marketing and E-Commerce

- CBD and Hemp-Based Supplements

- Sports Nutrition and Performance

- Regulatory Compliance and Quality Assurance

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=973

The sports nutrition function segment is projected to grow at the highest rate during the forecast period.

Many sports nutrition supplements on the market today contain a variety of beneficial ingredients such as multivitamins, branched-chain amino acids (like leucine), omega-3 fatty acids, glucosamine, glutamine, beta-alanine, beetroot, and green tea extract. Each of these components offers distinct performance advantages. While everyone needs a sufficient intake of macro and micronutrients, athletes must pay particular attention to their diets due to the intense physical demands they face. Sports nutrition supplements help fulfill these nutritional requirements, contributing to the rapid growth of this segment in the dietary supplements market.

Based on Mode of Application, Soft gel segments is projected to grow at the fastest rate during the forecast period.

Soft gels are increasingly popular in the dietary supplements market due to their ease of consumption, particularly for individuals with swallowing difficulties. Their gel-like texture and smooth, easy-to-swallow nature make them a favored option. Additionally, soft gels enhance bioavailability through advanced formulations that improve nutrient absorption. They can be tailored to include a wide variety of ingredients, offering flexibility for specialized products. Their visually appealing, professional appearance, and ability to mask unpleasant tastes and odors further contribute to their popularity. Moreover, the gelatin-based shell of soft gels helps extend the shelf life of the enclosed ingredients. These factors collectively drive the growth of soft gels in the dietary supplements market.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=973

The elderly age group hold a significant share in the dietary supplements market by target consumer during the forecast period

As the population ages, there is a growing need to address the specific nutritional requirements of older adults. Aging individuals often need extra support to combat nutritional deficiencies and age-related health issues. Dietary supplements offer a convenient and targeted way to meet these needs, providing essential vitamins, minerals, and nutrients. The elderly population commonly seeks supplements to support joint health, cognitive function, cardiovascular health, bone strength, and immune system performance. In response, manufacturers are creating specialized formulations to meet the unique demands of older adults. Consequently, the dietary supplements market is projected to see substantial growth in this segment.

Top Companies in the Dietary Supplements Market

- Nestle (Switzerland)

- Abbott (US)

- Amway Corp (US)

- Pfizer Inc. (US)

- ADM (US)

- International Flavors & Fragrance (US)

- Otsuka Holdings Co., Ltd (Tokyo)

- Glanbia PLC (Ireland)

- GSK PLC (UK)