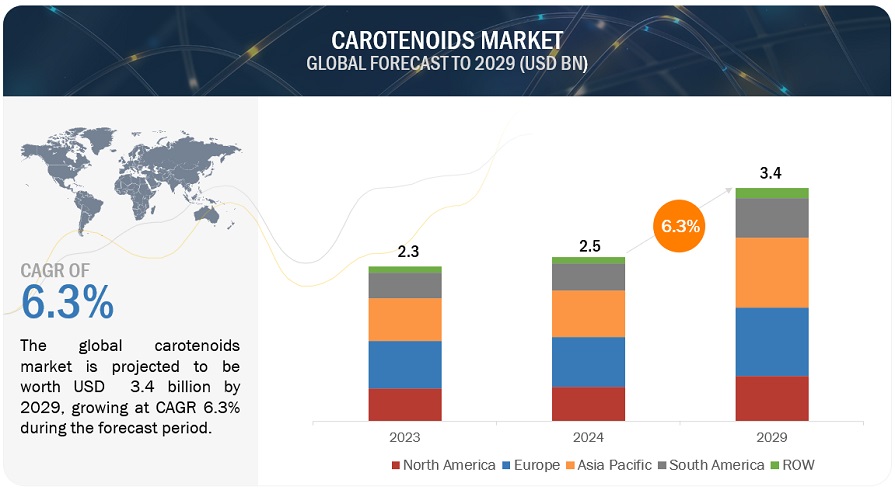

The global carotenoids market is estimated at USD 2.5 billion in 2024 and is projected to reach USD 3.4 billion by 2029, at a CAGR of 6.3% from 2024 to 2029. Carotenoids offer numerous health benefits, primarily due to their antioxidant properties. These compounds play a crucial role in preventing chronic diseases and promoting overall health. Consequently, there's a growing demand for carotenoids in supplements and pharmaceuticals, where they are utilized for their therapeutic potential. Moreover, the shift towards natural ingredients in the food and beverage industry has boosted the use of carotenoids as natural colorants. This trend aligns with consumer preferences for healthier and more natural products, further driving market growth. Furthermore, carotenoids find applications beyond the food and beverage sector. They are utilized in cosmetics for their skin-enhancing properties, in animal feed to improve animal health and product quality, and in pharmaceuticals for various purposes. This diverse range of applications broadens the market presence of carotenoids and contributes to their continued growth and importance in various industries.

Carotenoids Market Opportunities: Increased opportunity for expansion into high-growth potential markets, including developing countries in the Asia Pacific and South America regions

Currently, Europe is poised to lead the carotenoids market, yet the Asia Pacific region anticipates sustained demand growth due to expanding markets for dietary supplements and food and beverages. Increasing awareness of carotenoids' benefits is expected to fuel demand in Asia Pacific and South America. Additionally, the burgeoning animal feed segment in Asia Pacific is projected to drive market expansion. According to the 2024 Alltech report, Latin America has demonstrated consistent growth over the past decade, driven by robust monogastric exports and expanding aqua and pet markets. With China, India, and Japan among the top feed-producing countries, the region's accelerating use of carotenoids in animal feed is forecasted to propel overall market growth.

Carotenoids Market Challenge: Challenges in achieving the necessary quality standards.

The prevalence of adulteration poses a significant challenge to maintaining carotenoid quality, endangering animals, humans, and the environment. Adulterated carotenoids, increasingly found in North America, can be hazardous, even fatal, when consumed excessively. Synthetic astaxanthin, prevalent in the US market, is typically derived from petrochemicals or genetically modified yeast, posing health risks. To counter this, manufacturers are shifting towards natural sources for carotenoid production, yet the limited adoption of natural alternatives may impede overall market growth. Moreover, heightened competition, particularly in burgeoning Asian Pacific and South American markets, has led to an influx of smaller regional players, potentially compromising carotenoid quality.

In the application segment, food & beverage segment is expected to grow at highest CAGR during the forecast period.

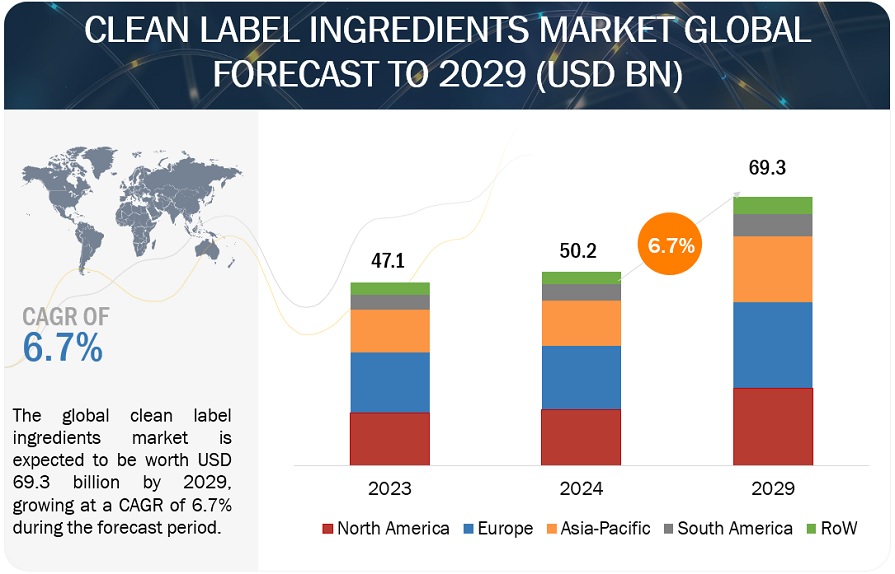

The food and beverage segment in the carotenoid market is witnessing the highest growth rate due to several key drivers. Firstly, increasing consumer demand for natural and healthy food additives drives the incorporation of carotenoids as natural colorants and functional ingredients. Secondly, growing awareness of the health benefits associated with carotenoids, such as antioxidant properties and potential disease prevention, fuels their utilization in a wide range of food and beverage products. Additionally, the rise in innovative product development and the introduction of clean-label products further stimulate market growth in this segment, catering to evolving consumer preferences for natural and nutritious food options.

Top Companies in the Carotenoids Market

Key players within this market consist of reputable and financially robust Carotenoids manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, cutting-edge technologies, and robust global sales and marketing networks. Prominent companies in this market are DSM (Netherlands), BASF SE (Germany), Cyanotech Corporation (US), Givaudan (Switzerland), ADM (US), NHU (China), Divi's Laboratories Limited (India), Allied Biotech Corporation (Taiwan), Lycored (US), Kemin Industries, Inc. (US), Fuji Chemical Industries Co., Ltd. (Japan), EW Nutrition (Germany), Döhler GmbH (Germany), ExcelVite (Malaysia) and Farbest Brands (US).

Carotenoids Market Recent Developments

In March, 2023, ADM (US) revealed the signing of a joint venture agreement with Marel (Netherlands), a leading provider of cutting-edge food processing solutions. This partnership aimed to establish an innovation center at the prestigious Wageningen Campus in the Netherlands, renowned as the epicenter of the nation's food valley. Tailored to foster collaboration among food manufacturers, food scientists, extrusion specialists, and culinary professionals, this strategic initiative is poised to bolster ADM's market expansion efforts and facilitate research and development in its carotenoid segments.