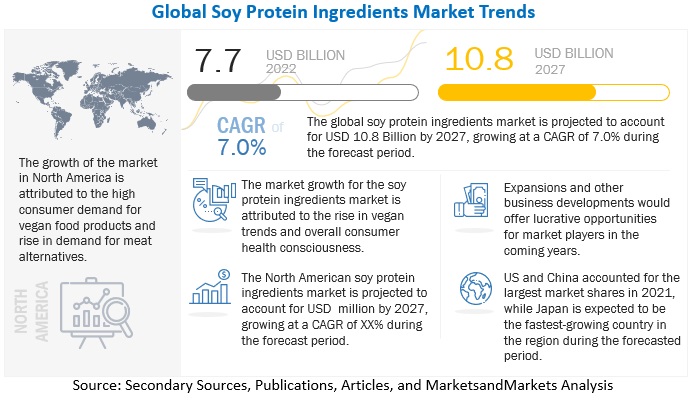

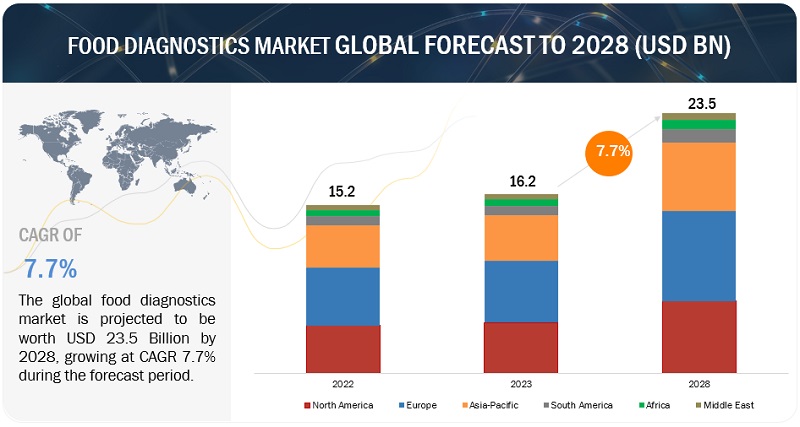

The food diagnostics market size is projected to grow from an estimated USD 16.2 billion in 2023 to USD 23.5 billion by 2028, reflecting a compound annual growth rate (CAGR) of 7.7% during this period. The demand for food diagnostic solutions has risen sharply as consumers and regulatory agencies prioritize food safety and quality. This market encompasses a diverse array of products, including systems, test kits, and consumables, all of which play a crucial role in its growth. The increasing need for rapid and precise detection of allergens, contaminants, pathogens, and adulterants in food products significantly drives this expansion.

A key factor propelling the food diagnostics market is the globalization of food trade. As the food supply chain becomes more interconnected internationally, the demand for effective diagnostic systems has surged. Food producers and exporters face the challenge of adhering to various food safety regulations and quality standards across different countries. Consequently, there has been a marked increase in the adoption of advanced diagnostic tools to ensure compliance with these diverse and often stringent requirements, thereby fostering market growth.

Food Diagnostics Market Drivers: Increasing cases of food recalls

The increasing frequency of food recalls has significantly impacted the food diagnostics industry, driven by growing concerns over food safety and public health. The introduction of contaminated or unsafe food products can result in serious consequences, including illnesses, hospitalizations, and even fatalities. This escalating awareness of food safety has led regulatory agencies and food manufacturers to invest in sophisticated diagnostic technologies. These innovations allow for the rapid and precise detection of contaminants, pathogens, allergens, and adulterants, thereby mitigating the risk of tainted food reaching consumers. Additionally, the financial and reputational damages associated with food recalls have motivated companies to implement advanced diagnostic solutions, reducing the likelihood of such incidents and contributing to the expansion of the food diagnostics market.

Food Diagnostics Market Opportunities: Increased budget allocation and expenditure on food safety

Governments, regulatory agencies, and stakeholders in the food industry worldwide have acknowledged the vital importance of maintaining safety and quality throughout the food supply chain. This acknowledgment has led to a significant increase in investments in food safety initiatives, fostering innovation and growth within the food diagnostics industry. The rise of advanced technologies, such as DNA-based testing and rapid pathogen detection, has gained considerable momentum, allowing for more accurate and efficient monitoring of food products from production to consumption. Furthermore, growing consumer awareness of foodborne illnesses and the demand for transparency in the food supply chain have intensified the need for effective food diagnostics solutions. This presents numerous opportunities for companies to create cutting-edge diagnostic tools and services. As the market evolves, the food diagnostics sector is well-positioned for substantial growth, promising enhanced food safety and quality.

The meat, poultry, and seafood segment is projected to hold the largest share of the food diagnostics market based on tested food types.

Foodborne illnesses and contamination outbreaks remain a significant global issue, often originating from protein-rich categories such as meat, poultry, and seafood. Ensuring the safety and quality of these products is essential to prevent serious health risks and uphold consumer confidence. Additionally, meat, poultry, and seafood are vital components of the food industry, significantly contributing to market revenues. As essential staples in diets worldwide, they represent a considerable share of consumer spending, making their quality and safety critically important. Therefore, monitoring these products for pathogens, allergens, chemical residues, and other contaminants is vital for consumer protection and the economic stability of the industry.

The globalization of the food supply chain has necessitated adherence to international regulations and standards. Compliance with rigorous regulations, including Hazard Analysis and Critical Control Points (HACCP), ISO standards, and national food safety guidelines, is essential for manufacturers and exporters. This demand has driven the adoption of advanced food diagnostics techniques in the meat, poultry, and seafood sectors.

Asia Pacific is projected to achieve the highest CAGR in the global food diagnostics market.

The Asia Pacific region is witnessing considerable population growth, urbanization, and a rise in disposable income. This rapid population increase, especially in countries such as China and India, has resulted in higher food consumption. Consequently, the demand for effective food safety and quality testing has become essential. As more individuals move to urban areas, the need for processed and packaged foods is escalating. This rising demand for food products requires stringent quality control and safety measures, which are fueling the expansion of the food diagnostics market.

Top Food Diagnostics Companies

Major key players operating in the food diagnostics market include Bio-Rad Laboratories Inc. (US), Thermo Fisher Scientific Inc. (US), Shimadzu Corporation (Japan), Neogen Corporation (US), BioMerieux (France), Agilent Technologies Inc. (US), Merck KGaA (Germany), QIAGEN (Germany), Bruker (US), and Danaher (US).