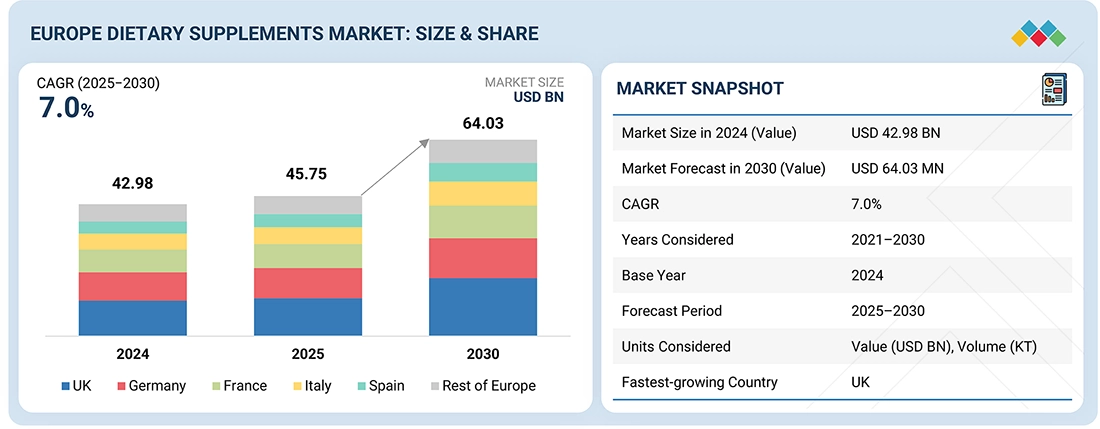

According to MarketsandMarkets™, The Europe dietary supplements market is estimated to be valued at USD 45.75 billion in 2025 and is projected to reach USD 64.03 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.0% during the forecast period. The market is witnessing consistent expansion, supported by a strong preventive healthcare culture and increasing consumer focus on long-term wellness across the region.

According to the European Consumer Organization, nearly 20% of consumers in several European countries use at least one food supplement, reflecting widespread acceptance of supplementation as part of daily health routines. Rising prevalence of micronutrient deficiencies—particularly vitamin D—along with growing interest in natural, science-backed nutrition solutions are key factors driving market growth. In addition, advances in formulation technologies, clean-label and plant-based innovations, and Europe’s emphasis on sustainability and traceable ingredient sourcing are creating significant growth opportunities. These trends support a broad range of health benefits, including improved digestion, enhanced nutrient absorption, stress management, stronger immune resilience, and overall well-being.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=246220087

United Kingdom to Lead the Europe Dietary Supplements Market

The UK is expected to lead the Europe dietary supplements market in terms of both market share and growth rate during the forecast period. This leadership is driven by a highly developed wellness culture, strong consumer awareness of preventive health, and rapid adoption of clean-label, plant-based, and evidence-based nutritional products. A high prevalence of vitamin D, omega-3, and magnesium deficiencies, coupled with growing demand for immunity support, mental well-being, digestive health, and healthy aging solutions, continues to fuel supplement consumption.

The UK also stands out for its advanced e-commerce ecosystem, subscription-based wellness models, and personalized nutrition platforms, which enhance product accessibility and consumer engagement. Furthermore, the presence of major industry players and influential brands fosters continuous innovation, positioning the UK as the fastest-growing dietary supplements market in Europe.

Liquid Supplements to Register the Fastest Growth by Mode of Application

By mode of application, the liquid segment is projected to witness the highest growth rate in the European dietary supplements market. Liquid supplements align well with consumer demand for convenient, easy-to-consume, and highly bioavailable formats. Their rapid absorption, appealing taste profiles, and suitability for populations such as older adults and children are driving adoption.

Growing demand for botanical tonics, vitamin shots, and probiotic drinks reflects Europe’s shift toward wellness-oriented beverage consumption. Liquid formats also support clean-label and plant-based formulations more effectively than traditional tablets, meeting Europe’s preference for minimal additives and sustainable ingredients. Increased availability through pharmacies and retail channels, along with innovation in flavoring and nutrient delivery, is accelerating uptake of liquid supplements across the region.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=246220087

Gut Health Segment to Record the Highest CAGR by Function

By function, gut health is expected to register the highest CAGR in the Europe dietary supplements market during the forecast period. Consumers increasingly recognize the connection between digestive health and overall well-being, including energy levels, skin health, and emotional balance. Shifts toward more processed, high-sugar, and low-fiber diets have intensified demand for supplements that support digestive balance and regularity.

An aging population and rising preference for natural wellness solutions further contribute to the rapid growth of gut health supplements, making this segment one of the most dynamic categories within Europe’s dietary supplements landscape.

Leading Europe Dietary Supplements Companies:

The report profiles several leading companies operating in the Europe dietary supplements market, including Bayer AG (Germany), Nestlé Health Science (Switzerland), Glanbia plc (Ireland), and Haleon Group of Companies (UK), all of which continue to invest in innovation, research, and sustainable product development to strengthen their market presence.