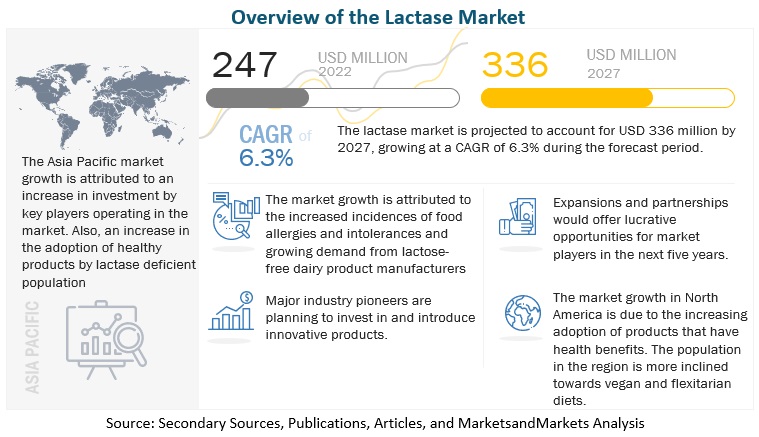

According to MarketsandMarkets "Lactase Market by Source (Yeast, Fungi, Bacteria), Form (Liquid, Dry), Application (Food & Beverage, Pharmaceutical Products & Dietary Supplements), Region (North America, Europe, APAC, South America, RoW) - Global Forecast to 2025", the global lactase market size is estimated to be valued at USD 217 million in 2020 and is projected to reach USD 298 million by 2025, recording a CAGR of 6.5%, in terms of value. The growing awareness among lactose intolerant population regarding self-diagnosis all across the globe offers potential growth for lactase enzyme, that helps in the production of lactose-free products.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=125332780

Drivers: Rising cases of lactose-intolerance and growing demand from lactose-free dairy product manufacturers

Lactase enzyme find its major applications in the food & beverage industry, majorly for dairy products, as it reduces the lactose content and makes the products lactose-free. The rise in lactose intolerant population globally is one of the major factors driving the growth of lactase market, which is used in the production of lactose-free dairy products.

The demand for lactose-free dairy food products is driven by the increase in incidences of food allergies and intolerances. According to the National Center for Biotechnology Information (NCBI), nearly 65% of the global population is prone to lactase deficiency. Thus, this has led to an increase in the production of lactose-free dairy products, which helps the lactose-intolerant population to avoid gastrointestinal problems. People with lactose intolerance are unable to digest lactose present in the milk due to the lack of an enzyme called lactase, which naturally occurs in the intestinal tract of children and adults. It causes bloating and diarrhoea after consuming any dairy product, especially milk. Lactase converts the milk sugar found in dairy products, such as milk, ice cream, and cheese, to readily digestible sugars, such as glucose and galactose. Without adequate lactase, the lactose in food ferments in the intestine produces undesirable side effects. In addition, the increase in health awareness and wellness concerns among consumers is a key factor that is projected to drive the growth and demand for lactose-free dairy products.

By source, the yeast segment is projected to account for the largest share in the lactase market during the forecast period

Yeast is a largely-used source for the extraction of lactase enzyme. Kluyveromyces lactis and Kluyveromyces fragilis (Sacchoramyces fragilis) are recognized as safe” (GRAS) by the Food & Drug Administration (FDA). Therefore, lactase enzyme sourced from yeast finds major applications in the food & beverage industry, especially in the dairy industry.

By form, liquid segment is projected to be the fastest growing segment in the lactase market during the forecast period

The liquid form of enzymes is generally less stable than the solid form, although it may have higher activity and better functionality than the powder form. It is directly used in the liquid form or sprayed and absorbed on a solid carrier. Among all applications, the liquid form of lactase enzyme is widely used in the food & beverage industry and pharmaceutical applications for products, such as syrups. Liquid lactase enzyme accelerates chemical, biological, and metabolic reactions by altering a reaction's efficiency and results in making the pharmaceutical product more efficient for human use.

The North America region dominated the lactase market with the largest share in 2019, whereas Asia-Pacific is expected to witness the highest growth rate.

The lactase market in North America is dominant due to the growing demand for different types of lactose-free products such as drinkable yogurt, ice-cream, and flavored milk. Increasing awareness about lactose intolerance among consumers and growing inclination towards health-promoting dietary supplements are the key factors that are projected to drive the growth of the market in the North American region.

The fastest growing market is Asia-Pacific for lactase. The increase in awareness and self-diagnosis among lactose intolerant population, also growing consumption of lactose-free products offers potential growth for the lactase manufactures in the region. The increase in health concerns and the growing trend of opting for reduced added sugar/no added sugar claims have created growth opportunities for lactase in the region. Major players such as Valio Ltd. (Finland), expanded its production facility in China to cater lactose-free products for lactose intolerant population.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as Chr. Hansen Holdings A/S (Denmark), Kerry Group (Ireland), Koninklijke DSM N.V (the Netherlands), Novozymes (Denmark), Merck KGaA (Germany), DuPont (US), Senson (Finland), Amano Enzyme (Japan), Advanced Enzyme Technologies (India), Enmex (Mexico), Antozyme Biotech Pvt. Ltd. (US), Nature Bioscience Pvt. Ltd. (India), Aumgene Biosciences (India), Creative Enzymes (US), Biolaxi Corporation (India), Novact Corporation (US), Enzyme Bioscience (India), Infinita Biotech Private Limited (India), Rajvi Enterprise (India), and Mitushi Biopharma (India).