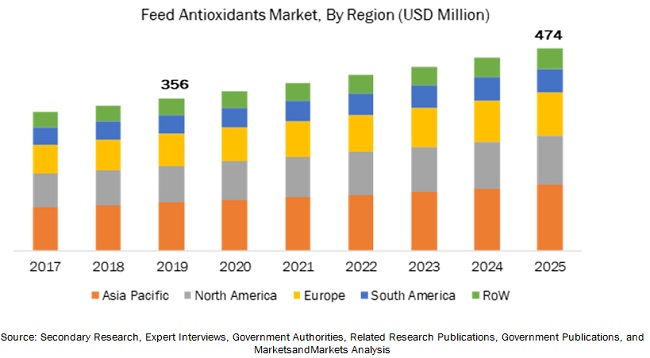

The report "Feed Antioxidants Market by Type Synthetic (BHT, BHA, Ethoxyquin, and Propyl Gallate) and Natural (Carotenoids, Tocopherols, Botanical Extracts, and Vitamins), Animal (Poultry, Swine, Aquaculture, Cattle, and Pets), Form, Region - Global Forecast to 2025", is estimated at USD 356 million in 2019 and is projected to grow at a CAGR of 4.9% from 2019 to 2025, to reach USD 474 million by 2025. Factors such as a rise in demand for quality feed, improved technology for feed production, and an increase in the standardization of meat products stimulate the growth of the feed antioxidants market across the globe.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=138013648

The poultry segment is projected to account for the largest feed antioxidants market share, by animal

In poultry production, one of the major factors for feed is the cost; hence, reducing feed costs per bird is a priority. Poultry production must be efficient as feed has to be converted into meat and eggs. Feed costs can be reduced by adding feed additives such as enzymes and antioxidants, which increase digestibility and prevent the loss of nutrients, with the result that the poultry gains more nutritional value from the same amount of feed, thus boosting the overall growth of the feed antioxidants market. Companies such as Cargill, Koninklijke DSM N.V., and Kemin provide feed antioxidants such as carotenoids, tocopherols, synthetic antioxidants, and citric acid, BHT, butylated hydroxyanisole (BHA), and tocopheryl acetate for the poultry industry.

The BHT segment is projected to account for the largest synthetic feed antioxidant market share

Synthetic antioxidants are generally produced as pure substances with consistent composition and are applied in well-defined mixtures with pure substances. Higher stability, easy availability, and low cost of production fuel the growth of the synthetic segment in the feed antioxidants market. Also, it protects fat-soluble vitamins and other nutrients against oxidative degradation, along with the loss of active ingredients in feed. Asia Pacific is projected to be the largest and fastest-growing BHT market. This is attributed to the growth of the feed industry in the region.

For the natural feed antioxidant market, the carotenoids segment is projected to account for the largest market share

The growing application of carotenoids in feed due to the modernization of livestock farming techniques in the swine, poultry, and aquaculture industries fuels the demand for feed antioxidants. Carotenoids help in meeting the rising demand for pork and poultry meat by enhancing the palatability of feed grades and in supplementing animals with the required nutrients for their growth.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=138013648

Asia Pacific is projected to witness significant growth during the forecast period

The market for feed antioxidants is increasing globally and is largely driven by the increase in meat consumption. The market for feed antioxidants is projected to increase steadily up to 2025. Asia Pacific is estimated as the largest developed market for feed antioxidants. This region is a growing market and provides great future potential for producers. The region’s dominance of share and growth rate is attributed to the growing economies in the Asian countries, which are bound to record an increase in disposable incomes and trigger the demand for protein-rich products such as meat and dairy. The globally increasing cost of feed is the main factor leading to an increased demand for the feed antioxidants to prevent feed spoilage and enhance its shelf-life. Also, the hot and humid climate in certain parts of the world makes the use of feed antioxidants necessary.

Key Market Players

Key participants in the market include Cargill (US), Archer Daniels Midland Company (US), Koninklijke DSM N.V. (Netherlands), BASF SE (Germany), Nutreco (Netherlands), Kemin (US), Adisseo (France), Perstorp (Sweden), Alltech (US), Caldic (Canada), Novus International (US), Chemical Fine Sciences (India), Oxiris Chemical (Spain), VDH Chemicals (India), Zhejiang Medicine Co. Ltd. (China), BTSA (Spain), Bertol Company (Czech Republic), FoodSafe Technologies (US), Videka (US), Lallemand Animal Nutrition (Canada), and Industrial Tecnica Pecuária (Spain).

No comments:

Post a Comment