The report "Brewing Ingredients Market by Source (Malt

Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size

(Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global

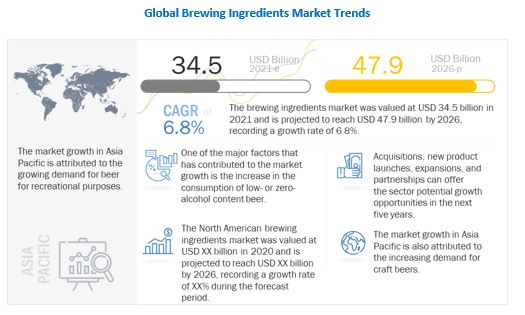

Forecast to 2026" The brewing ingredients market was

valued at USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%,

to reach USD 47.9 billion by 2026. The rise in global population and increasing

disposable income in developing economies are creating new avenues for

alcoholic beverages.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

The brewing ingredients market includes five major

sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives.

Malt extract is further bifurcated into standard malt and specialty malt.

Specialty malt is sub-segmented into crystal, roasted, dark, and others.

Different types of beers are obtained by using different sources of brewing

ingredients. For instance, roasted malt is used for producing the porter type

of beer. The malt extract segment dominated the global market for brewing

ingredients and accounted for a larger share in 2020. Beer additives accounted

for the second-largest market share in terms of revenue in 2020.

By source, the malt extract is expected to hold the largest

share in the market, during the forecast period

Types of malt extracts differ depending on the grains that

are used when making them. The production of malt extracts begins by grinding

malt, followed by mashing under controlled conditions to produce various

degrees of starch breakdown and resultant fermentability. This involves

carefully controlling the pH and using multiple temperature steps during mashing.

In the next step, the wort is separated from the spent grains in lauter tuns or

mash filters. Both these methods produce high-quality worts and can be set up

for high throughput, with as many as 10–14 brews per day. The further steps

include boiling, trub removal, vacuum evaporation, and spray drying.

The macro brewery as a brewery size is expected to hold one of

the largest shares in the brewing ingredients market, in terms of value, in

2021

On the basis of brewery size, the market is classified

into macro brewery and craft brewery. Macro or large breweries are defined as

breweries with annual beer production of ≥ 6 million barrels. The most popular

macro breweries include Anheuser-Busch InBev (Belgium), Heineken N.V.

(Netherlands), China Resources Snow Breweries Limited (China), and Carlsberg

Group (Denmark). These breweries generally operate on a global scale, shipping

their products to customers across the world. Anheuser-Busch owns the biggest

brewery in the world. Large breweries usually have a large staff as well. These

breweries employ staff to handle the brewing process, administrative staff,

logistics of distribution, teams for marketing and finance, and every role

imaginable required for a business to operate. Craft beers are perceived as

healthier beers as they may offer help in lowering the rate of cardiovascular

disease, improved bone density due to the presence of bone-developing elements

such as silicon, lower the risk of joint issues such as arthritis, and

increased high-density lipoprotein (HDL) levels which help lower cholesterol,

and lower the instances of diabetes.

By form, the dry form will drive the demand for brewing

ingredients, in terms of value, in 2021

Based on form, the market is categorized as dry and

liquid. Dry brewing ingredients such as dry malt extract (DME) are produced the

same way as liquid malt extract, except it goes through an additional

dehydration step, which reduces the water content down to about 2%. Because of

the lower water content, DME tends to have a better shelf life without the

darkening issues of light malt extract. It offers more fermentable extract by

weight. Thus, less of it is required to achieve the target gravity. Moreover,

as a powder, DME is easier to measure in precise increments. With a digital

scale, it can be measured out in fractions of an ounce. This makes DME a great

choice for priming, supplementing beer recipes, and for making gravity

adjustments.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=248523644

Asia Pacific is projected to dominate the majority market share,

in the global brewing ingredients market, in terms of value, in 2021

On the basis of the regional area, the market is segmented

into North America, Europe, Asia Pacific, South America, and Rest of World

(RoW). Due to the increase in population and rise in disposable income, Asia

Pacific is projected to account for the largest share during the review period.

The drinking preferences of the population in this region are gradually

shifting toward alcoholic culture. The large, increasing population and the

growing market mean that the demand for brewing ingredients is still promising.

Another factor is the densely populated areas that are not completely tapped by

beer manufacturing and brewing ingredient companies. Rapid industrialization

and urbanization, increase in environmental concerns, rise in disposable income

of growing middle class, and rising demand for craft beers are factors

consequently fueling the demand for brewing ingredients market in this sector.

This report includes a study on the marketing and development strategies, along with a survey of the product portfolios of the leading companies operating in the brewing ingredients market. It includes the profiles of leading companies, such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK). among others.

No comments:

Post a Comment