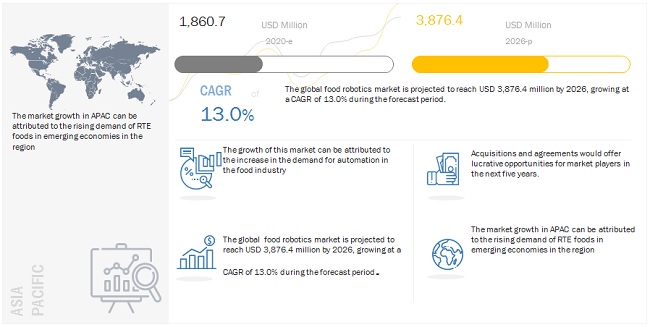

The report "Food Robotics Market by Type (Articulated, Cartesian, SCARA, Parallel, Collaborative, Cylindrical), Payload (Heavy, Medium, Low), Function (Palletizing, Packaging, Repackaging, Picking, Processing), Application and Region - Trends & Forecast to 2026" According to MarketsandMarkets, the global food robotics market size is estimated to be valued at USD 1.9 billion in 2020 and projected to reach USD 4.0 billion by 2026, recording a CAGR of 13.1% forecast period. The demand for food robotics is increasing significantly owing to surging demand for food with increasing population and increasing demand for enhanced productivity in food processing. Additionally, increasing automation in the food industry is projected to provide growth opportunities for the food robotics market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=205881873

Drivers: Growing demand for packaged food

In the last few years, there has been a growing need to package food products in order to increase their shelf life and cater to the demand for ready-to-cook and ready-to-eat products. Mass production of packaged food products especially in countries such as the U.S., Japan, France, and Italy has driven the market for food robotics. In most large-scale food manufacturing plants, processes are being automated in order to ensure quality and consistency in the Stock Keeping Units (SKUs). Food robotics is being increasingly implemented in the production of processed, frozen, dried, and chilled packaged food products. The growth in the packaged dairy products and baked goods industries is also driving the food robotics market as these products are manufactured on a large scale across regions.

Restraints: Scarcity of skilled workforce in emerging economies

The adoption and implementation of food robotics requires skilled workforce. There is a scarcity of people specializing in disciplines such as electrical, embedded, software, and mechanical, which are required for the installation and maintenance of robots. Also, there is a deficit of highly qualified employees with specific skills needed to develop high value-added robots integrated with advanced technologies.

In countries where the food & beverage industry has high potential for growth, such as China, India, and Brazil, there is a skill shortage in this domain. This is because knowledge of four to five engineering disciplines is required to become an expert in this field, and there is a scarcity of qualified faculty to teach the subjects. Moreover, there are limited branches of engineering that focus on robotics. This is a direct restraining factor for the food robotics market as the development of adequate skilled manpower is likely to be achieved only in the long run.

The beverage application segment is projected to witness significant growth during the forecast period.

The growing demand for robots for packaging and repackaging function in the beverage sector is projected to drive the demand for food robotics in the beverage industry. The growth in packaged beverages is further projected to contribute to food robotics systems in the beverage sector.

The European region dominates the food robotics market with the largest share in 2020.

The European food robotics market is driven by high investment in research & development with regard to technology, along with the rise in demand for packed, ready-to-cook, and high-quality food products. The European Robotics Association started monitoring in European Union activities, policies, and funding in the new robot technology to strengthen the international market for food & beverage manufacturing, which is likely to impact the adoption of food robotics positively.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, including ABB Group (Switzerland), KUKA AG (Germany), Fanuc Corporation (Japan), Kawasaki Heavy Industries Ltd. (Japan), Rockwell Automation Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Yasakawa Electric Corporation (Japan), Denso Corporation (Japan), Nachi-Fujikoshi Corporation (Japan), OMRON Corporation (Japan), Universal Robots A/S (Denmark), Staubli International AG (Switzerland), Bastian Solutions LLC (U.S.), Schunk GmbH (Germany), Asic Robotics AG (Switzerland), Mayekawa Mfg. Co. Ltd. (Japan), Apex Automation & Robotics (Australia), Aurotek Corporation (Taiwan), Ellison Technologies Inc. (U.S.), Fuji Robotics (Japan), and Moley Robotics (U.K.).

No comments:

Post a Comment