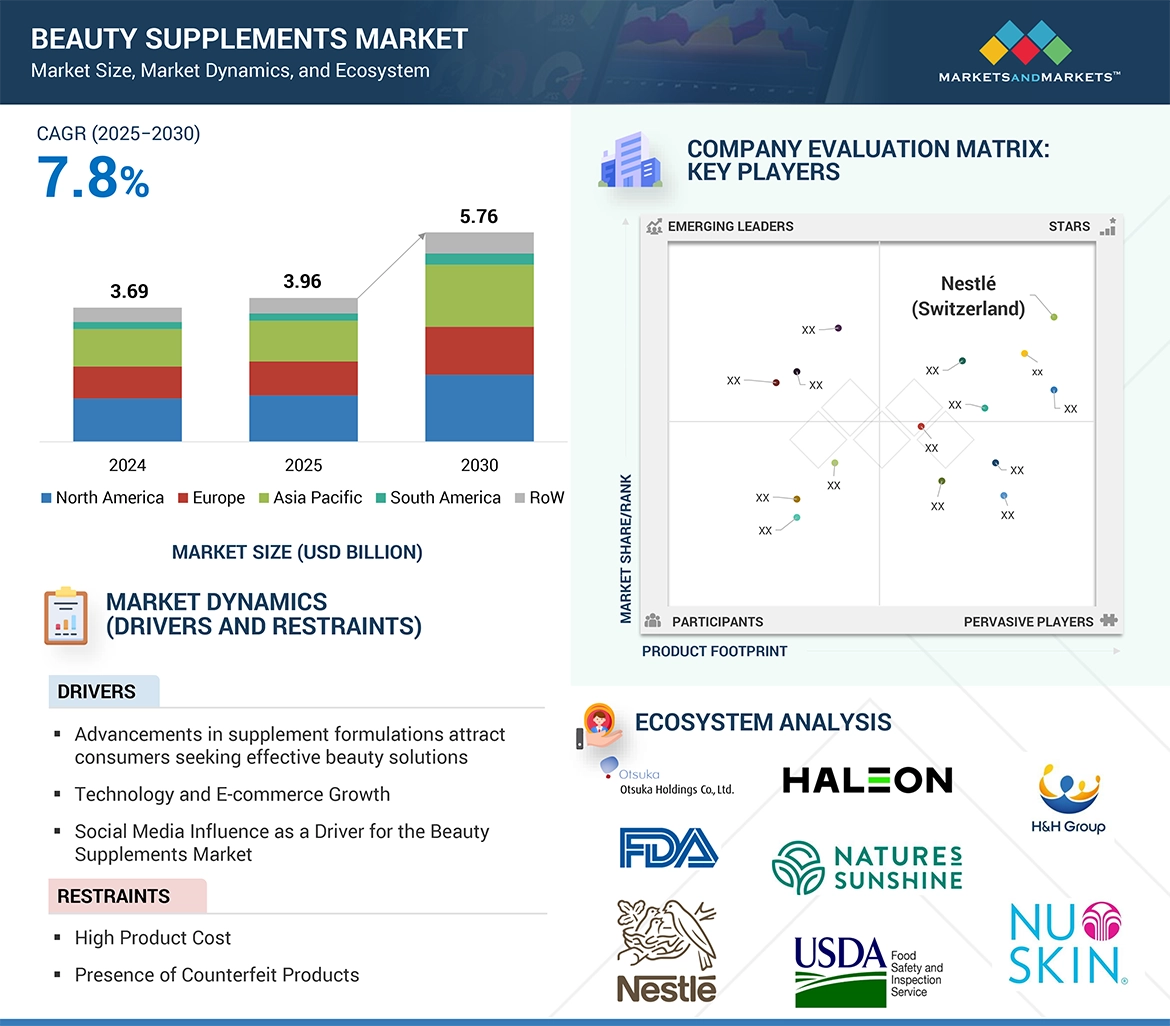

The global beauty supplements market is projected to grow from USD 3.96 billion in 2025 to USD 5.76 billion by 2030, registering a CAGR of 7.8% during this period. This growth is driven by increasing consumer awareness regarding skin, hair, and overall wellness. The rising preference for natural and plant-based products has fueled demand for supplements that support hydration, anti-aging, and hair health. Additionally, social media influence and the shift toward holistic beauty solutions have encouraged consumers to seek products rich in collagen alternatives, antioxidants, and essential vitamins. With sustainability and ethical sourcing becoming priorities, beauty supplements are evolving to meet clean-label and cruelty-free standards, making them an integral part of modern skincare and wellness routines.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=165507335

Powder Segment Dominates the Beauty Supplements Market

Powdered beauty supplements hold a significant market share due to their high bioavailability, customizable dosing, and ease of consumption. They dissolve quickly in liquids compared to tablets or capsules, leading to better absorption and effectiveness. This allows for higher concentrations of key ingredients like collagen, biotin, and antioxidants, which require substantial doses to deliver noticeable results. The flexibility of powdered supplements, which can be mixed with water, smoothies, or other beverages, makes them an appealing choice for consumers. Their adaptability is especially beneficial for macronutrient-based products requiring larger servings and rapid absorption, catering to individuals who struggle with swallowing pills. However, formulation considerations such as flavor, added sugars, and consumer preferences must be carefully addressed. Despite higher production costs, powdered supplements remain a preferred option for those seeking effective and convenient beauty solutions.

Omega-3 Fatty Acids Lead in the Ingredient Segment

Omega-3 fatty acids hold a significant share in the beauty supplements market, driven by growing health awareness, a shift toward plant-based diets, and advancements in food technology. The rising demand for omega-3-enriched beauty and health supplements has fueled the growth of the nutraceuticals sector. According to the Global Organization for EPA and DHA Omega-3s (GOED), Japan, India, and South Korea are leading innovators in omega-3 product development in Asia. Among 318 newly launched products, South Korea ranked highest, followed by India and Japan. Unlike Europe, where omega-3 supplements primarily target heart, brain, and eye health, Asian markets emphasize immune support, skin health, and weight management. Notably, Japan has experienced a surge in krill oil-based omega-3 products for skin health. Additionally, sustainability claims and transparency regarding EPA and DHA levels are becoming increasingly important in omega-3 product marketing.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=165507335

Europe Holds a Significant Share in the Beauty Supplements Market

The European beauty supplements market benefits from stringent regulatory frameworks that enhance consumer confidence and drive market expansion. The European Union (EU) enforces strict guidelines on the production, marketing, and sale of beauty supplements to ensure product safety, quality, and efficacy. Consumers, increasingly concerned about product ingredients and authenticity, rely on these regulations for assurance. For instance, the EU’s Health Claims Regulation mandates that all health and beauty-related claims be scientifically validated, ensuring that manufacturers provide substantiated evidence for their products. While such regulations prevent misleading claims, they also encourage innovation by compelling brands to develop scientifically backed formulations to remain competitive. This regulatory landscape guarantees that consumers have access to high-quality and reliable beauty supplements, fostering trust and driving adoption in the market.

Top Beauty Supplements Companies:

The report profiles key players such as Amway Corp (US), Nestlé (Switzerland), Nu Skin (US), Meiji Holdings Co., Ltd. (Japan), Herbalife International of America, Inc. (US), Unilever (UK), H&H Group (Hong Kong), Nature’s Sunshine Products Inc (US), Otsuka Holdings Co., Ltd (Japan), Haleon Group of Companies (UK), Vitaco (New Zealand), Vitabiotics Ltd (UK), Merz Consumer Care GmbH (Germany), Nordic Naturals (US), Kinohimitsu (Sinapore).