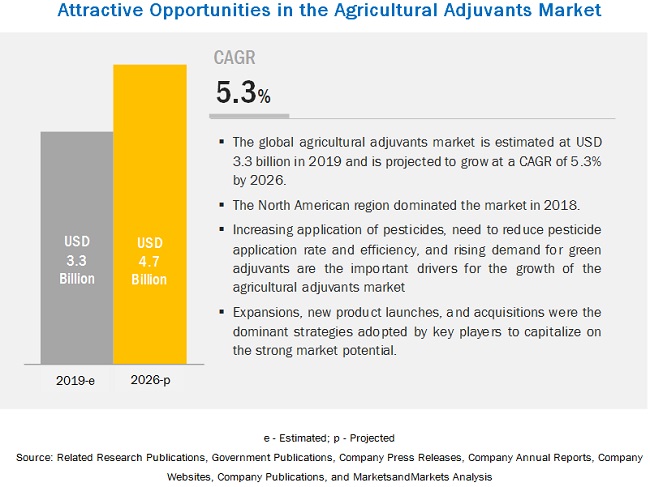

The report "Agricultural Adjuvants Market by Function (Activator and Utility), Application (Herbicides, Insecticides, and Fungicides), Formulation (Suspension Concentrates and Emulsifiable Concentrates), Adoption Stage, Crop Type, and Region - Global Forecast 2026", is estimated to be valued at USD 3.3 billion in 2019 and is expected to reach a value of USD 4.7 billion by 2026, growing at a CAGR of 5.3% during the forecast period. Factors such as the rising demand for improved crop varieties is driving the growth of the agricultural adjuvants market.

Adjuvants for biological products

Adjuvants for biological products

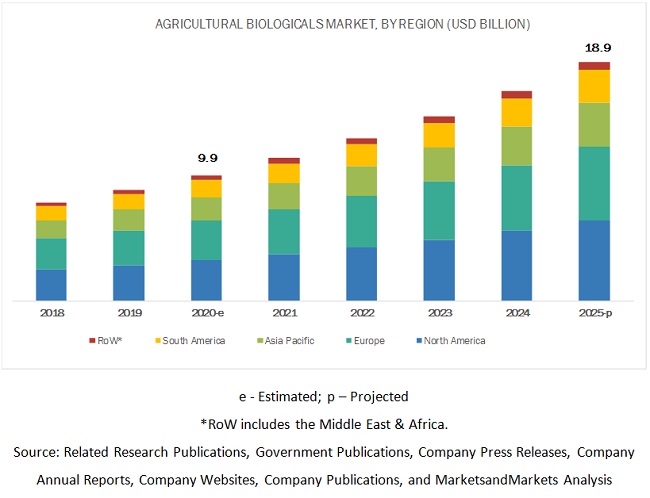

Adjuvants are mostly added to synthetic pesticides to improve their performance. However, these adjuvants undergo strict regulations and require high investment for production. Hence, there is a need to develop adjuvants that can be used in biological products such as biopesticides and biostimulants.

Adjuvant manufacturing companies are constantly adapting to the changing demands by developing novel products and technologies. With the increasing awareness of eco-friendly and sustainable products, the necessity to develop adjuvants that can be compatible with biological products has been increasingly realized. Sustainable and non-oil adjuvants are required to maintain the viability and pesticidal efficiency of agricultural biologicals such as biostimulants and biofertilizers.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

The cereals & grains segment, by crop type, is estimated to account for the largest market share, by value, in 2019

Cereals & grains accounted for the largest consumption of herbicides in North America and Asia Pacific, owing to the high cultivation of corn and wheat in countries such as the US and China. Adjuvants are added to the commercial formulae of herbicides to improve their efficacy by increasing the adhesion properties of herbicides to the leaf surface, as well as aiding transport across the waxy cuticle membrane and into the plant. Adjuvants used in herbicide treatment solutions for cereals & grains aim to improve spray droplet retention and penetration of active ingredients into the plant foliage. Thus, cereals and grains are estimated to be the most popular crop type in the agricultural adjuvants market.

Asia Pacific is projected to grow at the highest CAGR during the forecast period

The market for agricultural adjuvants in the Asia Pacific region is expected to grow at the highest CAGR from 2019 to 2026, owing to the increasing investments by key players in countries such as China, India, and Thailand, and also the rising adoption of adjuvant technology by the crop growers for insecticide applications. Due to these factors, the market in the Asia Pacific region is projected to record the highest growth from 2019 to 2026.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the agricultural adjuvants market. It includes the profiles of leading companies such as Miller Chemical and Fertilizer, LLC (US), Precision Laboratories (US), CHS Inc (US), Winfield United (US), Kalo Inc. (US), Nouryon (Netherlands), Corteva Inc. (US), Evonik Industries (Germany), Nufarm (Australia), Croda International (UK), Solvay (Belgium), BASF (Germany), Huntsman Corporation (US), Clariant (US), Helena Agri-Enterprises (US), Stepan Company (US), Wilbur-Ellis Company (US), Brandt (US), Plant Health Technologies (US), and Innvictis Crop Care (US).

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=1240

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=1240

Key questions addressed by the report:

- What are the new application areas for the agricultural adjuvants market that companies are exploring?

- Who are some of the key players operating in the agricultural adjuvants market and how intense is the competition?

- What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&A’s in the agricultural adjuvants market projected to create a disrupting environment in the coming years?

- What will be the level of impact of new product launches on the revenues of stakeholders, due to the benefits offered by agricultural adjuvants market, such as increasing revenue, environmental regulatory compliance, and sustainable profits for the suppliers?