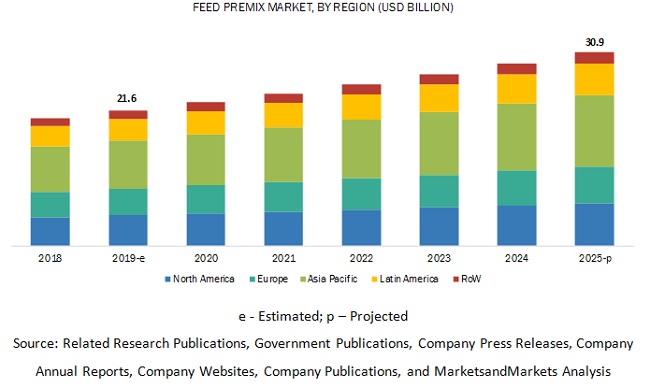

The report "Feed Premix Market by Ingredient Type (Vitamins, Minerals, Amino Acids, Antibiotics, Antioxidants, and Others), Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Equine, and Pets), Form (Dry and Liquid), and Region - Global Forecast to 2025", is estimated to be valued at USD 21.6 billion in 2019 and is expected to reach a value of USD 30.9 billion by 2025, growing at a CAGR of 6.2% during the forecast period. Feed premixes consist of necessary growth factors that are added as supplements with concentrate feed to provide a wholesome nutritional diet for animals. Owing to the recent disease outbreaks, ingredients in feed premixes have come under focus to strengthen the immunity of livestock. With advancements in technology and awareness among farmers, the emerging markets are obtaining more localized premix products and services.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=170749996

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=170749996

By livestock, the poultry segment is projected to dominate the feed premix industry during the forecast period.

The poultry segment is projected to hold the largest feed premix market share during the forecast period. Feed premixes such as vitamins, minerals, and amino acids are some of the significant premixes used in poultry feed for better quality and quantity production. On a global level, the total poultry production has been increasing, and with such growth in poultry production and consumption, it has become essential for meat producers to focus more on the quality of meat. This gives a boost to the feed premix industry, to provide a complete nutritional feed for poultry.

By form, the dry segment is projected to dominate the feed premix market during the forecast period.

The market for crops with other traits is growing significantly in the market due to its convenience in usage, packaging, and several other benefits, such as smooth handling and storage, which is posing challenges with liquid ingredients. Feed premixes in the dry form are easier to mix with animal feed and provide a longer shelf life than in the liquid form, due to which makes them they first witness high preference among feed manufacturers.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=170749996

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=170749996

Asia Pacific is projected to grow at the highest CAGR during the forecast period

With rapid economic growth in the region, high demand is expected for feed products, especially in China, India, South Korea, and Japan. The contribution of the Asia-Pacific region accounted for the largest share of the global meat production in 2018 according to the FAO, and is projected to grow due to increase in consumption of meat. The main reason for the high consumption of feed premixes in the region is the increased focus to enhance poultry and other livestock meat production.

This report includes a study on the marketing and development strategies, along with a survey of the product portfolios of the leading companies operating in the feed premix market. It includes the profiles of leading companies such as Nutreco N.V. (The Netherlands), Koninklijke DSM (The Netherlands), Cargill (US), ADM (US), and DLG Group (Denmark).