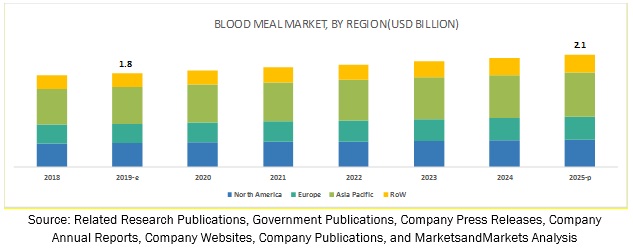

The blood meal market is estimated to account for a value of USD 1.8 billion in 2019 and is projected to grow at a CAGR of 3.0% from 2019, to reach a value of USD 2.1 billion by 2025. The rise in disposable incomes, urbanization, and increased demand for animal proteins in the Asia Pacific countries is projected to drive the blood meal market in the coming years. In addition, increasing consumption of livestock products such as meat, eggs, and milk in the US, is projected to drive the blood meal market in North America.

The poultry feed segment is projected to be the largest revenue contributor in the blood meal market during the forecast period.

Poultry blood is one of the most preferred raw materials that is used for the production of blood meal. By source, the poultry feed segment is the largest segment in the global blood meal market, in terms of volume. Consumption of poultry blood is increasing in the emerging countries of the Asia Pacific and South America. This is projected to increase the number of animal slaughter in these regions, thus increasing the blood meal production in these regions.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=84855008

The porcine feed segment is projected to record the fastest growth during the forecast period.

Blood meal is high in crude protein and is commonly used as a protein source in diets for porcine. In growing pigs, blood meal partially replaces soybean meal in maize- and soybean-based diets. Feeding growing pigs with fermented blood meal, in combination with molasses, allows the same feed intake, growth, and feed conversion efficiency as soybean meal. Dried blood meal is commonly used as a high-quality protein source in nursery pig diets. Thus, the porcine feed segment in the blood meal market is projected to record the fastest growth during the forecast period.

The expansion of the feed industry due to the rise in population is projected to drive the blood meal market in Asia Pacific

The Asia Pacific blood meal market is driven by the increase in disposable incomes, rise in urbanization, and expansion of the feed industry. The Asia Pacific region witnesses the presence of major revenue generating countries such as China and Vietnam. These countries witness high consumption of meat products such as pork and are ranked among the largest producers of feed at a global level. These factors are projected to drive the blood mal market in the coming years in the region.

Key players identified in this market include Darling Ingredients Inc (US), Terramar (Chile), Valley proteins Inc. (US), West Coast Reduction Ltd. (US), and Allana Group (India). These companies have a strong presence in North America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=84855008

Key questions addressed by the report:

The poultry feed segment is projected to be the largest revenue contributor in the blood meal market during the forecast period.

Poultry blood is one of the most preferred raw materials that is used for the production of blood meal. By source, the poultry feed segment is the largest segment in the global blood meal market, in terms of volume. Consumption of poultry blood is increasing in the emerging countries of the Asia Pacific and South America. This is projected to increase the number of animal slaughter in these regions, thus increasing the blood meal production in these regions.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=84855008

The porcine feed segment is projected to record the fastest growth during the forecast period.

Blood meal is high in crude protein and is commonly used as a protein source in diets for porcine. In growing pigs, blood meal partially replaces soybean meal in maize- and soybean-based diets. Feeding growing pigs with fermented blood meal, in combination with molasses, allows the same feed intake, growth, and feed conversion efficiency as soybean meal. Dried blood meal is commonly used as a high-quality protein source in nursery pig diets. Thus, the porcine feed segment in the blood meal market is projected to record the fastest growth during the forecast period.

The expansion of the feed industry due to the rise in population is projected to drive the blood meal market in Asia Pacific

The Asia Pacific blood meal market is driven by the increase in disposable incomes, rise in urbanization, and expansion of the feed industry. The Asia Pacific region witnesses the presence of major revenue generating countries such as China and Vietnam. These countries witness high consumption of meat products such as pork and are ranked among the largest producers of feed at a global level. These factors are projected to drive the blood mal market in the coming years in the region.

Key players identified in this market include Darling Ingredients Inc (US), Terramar (Chile), Valley proteins Inc. (US), West Coast Reduction Ltd. (US), and Allana Group (India). These companies have a strong presence in North America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=84855008

Key questions addressed by the report:

- What are the new application areas for blood meal that companies are exploring?

- Which are the key players in the blood meal market and how intense is the competition?

- What kind of competitors and stakeholders such as blood meal companies, would be interested in this market? What will be their go-to-market strategy for this market, and which emerging market will be of significant interest?

- How are the current R&D activities and M&A’s in the blood meal market projected to create a disrupting environment in the coming years?

- What will be the level of impact on the revenues of stakeholders due to the benefits of blood meal to different stakeholders‒‒from rising revenue, environmental regulatory compliance, to sustainable profits for the suppliers?