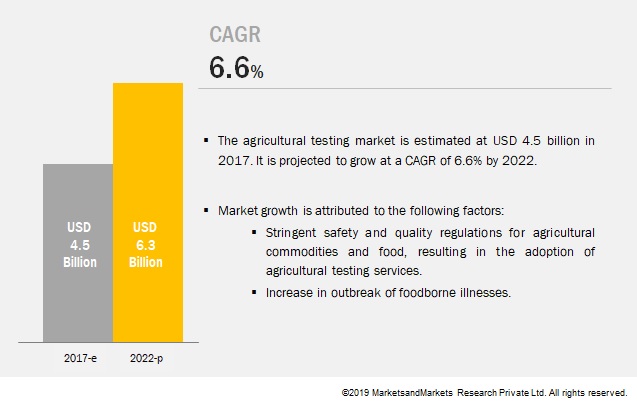

The agricultural testing market was valued at USD 4.30 Billion in 2016; this is projected to reach USD 6.29 Billion by 2022, at a CAGR of 6.64% during the forecast period. Stringent safety and quality regulations for agricultural commodities, increase in outbreaks of foodborne illnesses, and rapid industrialization leading to the disposal of untreated industrial waste into the environment are the factors driving this market.

Water and soil are the fast growing segments in agricultural testing during the forecast period

The global market, based on sample, has been segmented into soil, water, seed, compost, manure, biosolids, and plant tissue. The market for testing for soil is estimated to dominate in 2017, and is also projected to be the second fastest-growing segment during the forecast period. The growing contamination of soil, caused by wastewater and industrial effluents, has been propelling the importance of soil testing; this, in turn, is driving the market for agricultural testing.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=203945812

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=203945812

Spectrometry & chromatographic technologies contributed to the fastest growing rapid technology market in agriculture testing

The agricultural testing services market, by technology, has been segmented into conventional and rapid. The rapid technology segment is estimated to dominate the market in 2017, and is projected to grow at a higher CAGR by 2022. This can be attributed to low turnaround time, higher accuracy, sensitivity, and ability to test a wide range of bacteria in comparison to conventional technological methods.

The safety testing is projected to be the fastest growing market in application segment

The agricultural testing market, by application, has been segmented into safety testing and quality assurance. The global market, by application, was dominated by the quality assurance segment in 2016. The dominance of quality assurance in agricultural testing is attributable to the fact that it aids in proactively resolving major problems related to soil fertility, available water quality for irrigational facilities, and identifying required nutrients essential for a more robust growth and development of crops and other agricultural produce. The market for safety testing is projected to be the fastest-growing during the forecast period. Safety testing of agricultural samples is conducted to test samples for targets such as toxins, pathogens, heavy metals, pesticides, GMOs, and other organic contaminants. A growing importance given to safety laws for agricultural produce and food commodities is expected to boost the market for this segment during the forecast period.

Make an Inquiry:

Asia Pacific is projected to be the fastest-growing market during the forecast period

The Asia Pacific market is projected to grow at the highest CAGR from 2017 to 2022. Major growth drivers of the region include increased adoption of advanced biotechnological methods and organic farming resulting in the need for agricultural testing, and an increase in the number of exports from the region, necessitating agricultural testing for the produce.

This report includes a study of marketing and development strategies, along with the services & product portfolios of leading companies. It includes the profiles of leading service companies such as SGS (Switzerland), Intertek (UK), Eurofins (Luxembourg), Bureau Veritas (France), ALS Limited (Australia), and TÜV NORD GROUP (Germany). It also includes profiles other players that also have significant share in this market such as Mérieux (US), AsureQuality (New Zealand), RJ Hill Laboratories (New Zealand), SCS Global (US), Agrifood Technology (Australia), and Apal Agricultural Laboratory (Australia).

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Agricultural testing market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?