The chelated feed trace minerals market is estimated at USD 431.2 Million in 2017 and is projected to reach USD 570.8 Million by 2022, at a CAGR of 5.8 % from 2017. In terms of volume, the market is projected to reach 128.0 KT by 2022. Chelated trace minerals play an important role in the growth and performance of the animals. Chelated trace minerals are required in small quantities but have a significant impact on the performance of the livestock. This increasing awareness about the benefits of chelated trace minerals among growers increases their usage in animal nutrition, particularly in the developed countries. The shift in dietary preferences towards a protein-rich diet, owing to health awareness and a rise in income levels among the population, drive the consumption of meat and other animal-based products. This has resulted in an increased demand for animal-based products, subsequently driving the production of livestock, which in turn, is fed using novel methods and products, ensuring an optimum nutrition level and feed conversion ratio. These factors are expected to boost the demand for chelated feed trace minerals.Increasing awareness about the precision nutrition techniques and the growth of the organized livestock sector in developing countries are other factors driving the growth of this market.

Objectives of the Report:

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the competitive environment of the chelated feed trace minerals market

- To provide the analysis of the research & development spending and funding activities in the chelated feed trace minerals market

- To project the size of the market, in terms of value (USD million) in the key regions, namely, North America, Europe, Asia Pacific, South America, and the Rest of the World (RoW)

- To strategically profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments mergers, acquisitions, agreements/joint ventures, expansions, and new product launches in the chelated feed trace minerals market

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=196308436

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=196308436

The zinc segment is projected to grow at the highest rate during the forecast period.

In 2016, on the basis of type, the zinc segment accounted for the largest share of the chelated feed trace minerals market in terms of value and volume. Zinc is widely used because of its high applicability for different feed products. Zinc, when added to feed, increases growth in early nursery phase, improves the poor health status of the animals, and it also helps alleviate stress challenges which help in the overall growth of animals.

Poultry: The fastest growing livestock in the trace minerals (chelated) in feed market

In 2016, the poultry segment accounted for the largest share of the chelated feed trace minerals market in terms of value and is projected to grow at the highest CAGR from 2017 to 2022. Chelated trace minerals provide optimum mineral nutrition to poultry birds while including fewer minerals in the formulation. These minerals help reduce the overall cost of feed as they offer maximum benefits to the birds, in lower amounts compared to the other mineral sources.

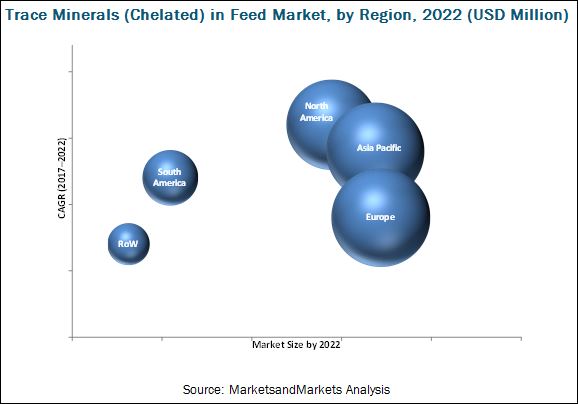

North America is projected to be the fastest-growing regional market for trace minerals (chelated) in feed

North America is one of the largest producers of livestock and animal-based products in the world, with the US being a major producer. Growing productions, as well as consumption of livestock and livestock-based products in this region, have enabled livestock producers to utilize feed with chelated trace minerals, as they are highly effective in promoting the healthier growth of animals and in improving the fertility rate. The US was the largest market for chelated feed trace minerals in North America in 2016. Furthermore, the presence of leading chelated trace minerals companies such as Cargill, ADM, DSM, BASF, and Nutreco in North America, and their continuous efforts for promoting their business in the chelated trace minerals segment through various strategies such as acquisitions and expansions are expected to drive the market for chelated feed trace minerals in this region.

Request for Customization:

This report studies marketing and development strategies, along with the product portfolios of leading companies such as Cargill (US), ADM (US), BASF (Germany), DSM (Netherlands), Nutreco (Netherlands), DLG Group (Denmark), InVivo (France), Bluestar Adisseo (China), Alltech (US), Phibro (US), Kemin (US), Zinpro (US), and Novus (US).

Target Audience:

- Associations and industry bodies

- Commercial research & development (R&D) institutions

- Chelated feed trace minerals manufacturers and suppliers

- Raw material suppliers and distributors

- Traders, distributors, and retailers

- Agricultural institutes, associations, and government agencies

- Commercial growers

- Animal nutrition industry players

- Researchers

- Industry experts