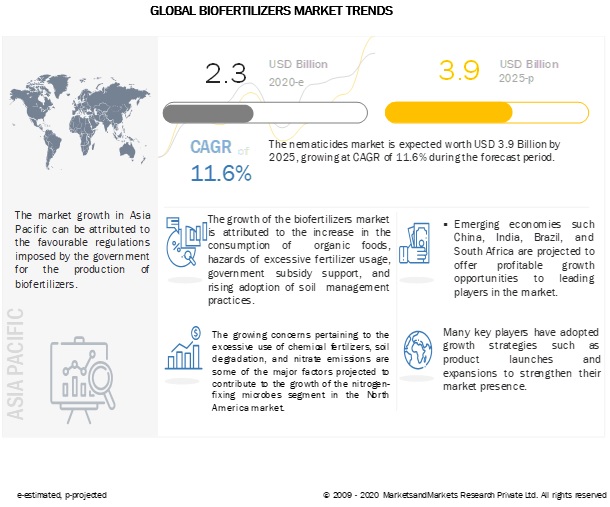

The report "Biofertilizers Market by Form (Liquid, Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Crop Type, Type (Nitrogen-Fixing, Phosphate Solubilizing & Mobilizing, Potash Solubilizing & Mobilizing), Region - Global Forecast to 2025" The biofertilizers market is projected to reach USD 3.9 billion by 2025, from USD 2.3 billion in 2020, recording a CAGR of 11.6% during the forecast period. Rising awareness about the hazards of chemical fertilizers among consumers, soil degradation, nitrate emissions, along with government initiatives, is projected to witness significant growth during the forecast period.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

COVID-19 impact on Biofertilizers market

COVID-19 has impacted the businesses of biofertilizer companies up to some extent. Though this pandemic situation has impacted their businesses, there is no significant impact on the global operations and supply chain of their biofertilizers. Multiple manufacturing facilities of players are still in operation. The service providers are providing biofertizer products by following safety and sanitation measures.

Opportunity: New target markets: Asia Pacific & Africa

The Asia Pacific and African regions are the largest consumers of fertilizers. The increasing rate of population, especially in Asia, has resulted in the increasing demand for food, which would, in turn, lead to the increased consumption of fertilizers. However, the major concerns in this region are pollution and contamination of soil as well as their harmful effects on human beings. To combat the harmful effects of chemical fertilizers, governments in these regions are emphasizing on the use of environmental-friendly fertilizers, such as biofertilizers and organic manure.

Challenge: Lack of awareness & low adoption rate of biofertilizers

The lack of awareness in farmers about biofertilizers in underdeveloped and developing countries is creating a challenge for the biofertilizers market. They prefer using chemical fertilizers, as they are easy to handle. This can be attributed to a lack of training and information. Furthermore, the established nature of the chemical fertilizers market is also one of the reasons for the slow adoption of biofertilizers, as conventional fertilizer companies hold a wide range of product offerings and have a strong distribution network.

Higher consumption of biofertilizers for organic fruits & vegetables contributes to the growth of the biofertilizers market in this segment

Biofertilizers have proved to be useful in numerous ways, including improving the quality, shelf-life, and yield of fruits & vegetables. The increasing trend of consumer preferences for organic fruits & vegetables due to changing lifestyle and rising per capita income is the primary factor driving market growth. A rising trend in the cultivation of organic fruits & vegetables and those under IPM practices have also created a positive impact on the growth of the biofertilizers market.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=856

With the increasing demand for organic food products, North America is estimated to dominate the biofertilizers market in 2020

Changing lifestyle and increasing buying power among consumers has increased the demand for biofertilizers. High adoption of advanced irrigation systems such as drip & sprinkler irrigation and widespread acceptance of biofertilizers among the farmers is further propelling the market growth. The farmers in this region are highly skilled in terms of knowledge and machinery. Due to the rampant use of chemical fertilizers, the fertility of the soil is declining. To maintain soil fertility as well as the yield of crops, farmers are sustainably opting for biofertilizers.

This report includes a study of the development strategies of leading companies. The scope of this report consists of a detailed study of biofertilizer manufacturers such as Novozymes (Denmark), Kiwa-Biotech (China), Rizobacter Argentina S.A (Argentina), Lallemand Inc. (Canada) and Symborg (Spain).