Tuesday, August 17, 2021

Probiotic Ingredients Market: Growth by Emerging Trends, Analysis, & Forecast to 2023

Wednesday, August 11, 2021

Growth Strategies Adopted by Major Players in the Nematicides Market

The report "Nematicides Market by Type (Fumigants, Carbamates, Organophosphates, Bionematicides), Mode of Application (Fumigation, Drenching, Soil Dressing, Seed Treatment), Nematode Type (Root Knot, Cyst), Crop Type, Form, and Region - Global Forecast to 2025", size is estimated to be valued at USD 1.3 billion in 2020 and is expected to reach a value of USD 1.6 billion by 2025, growing at a CAGR of 3.4% during the forecast period. Factors such as the growing demand for biological products and increasing number of product launches catering to the requirement of crop-specific nematodes drive the growth of the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=193252005

COVID-19 impact on Nematicides market

The nematicides market includes major Tier I and II suppliers like Syngenta AG, Bayer AG, BASF SE, UPL Ltd,FMC Corporation, Marrone Bio Innovations and Isagro S.p.A. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. COVID-19 has impacted their businesses upto some extent. Though this pandemic situation has impacted their businesses, there is no significant impact on the global operations and supply chain of their nematicides. Multiple manufacturing facilities of players are still in operation.

Driver: Strong demand for high-value crops

High-value agricultural products are generally defined as agricultural products with a high economic value per kilogram (or pound), per hectare, or per calorie, which includes fruits, vegetables, meat, eggs, milk, and fishes. The key factors driving the demand for high-value crops (fruits, vegetables, and plantation crops) are the rise in the income of consumers, rapid urbanization, and the increase in awareness about health benefits associated with fruits & vegetables. Besides, an increase in foreign direct investment (FDI) has led to a surge in the production of high-value crops. The demand for nematodes is mostly found in high-value crops, such as pome fruits, grapes, cotton, tomato, maize, cotton, and other vegetable and ornamental crops, as they improve the crop quality and yield.

Constraint: Pesticide residue problems

One key restraint in the crop protection chemicals market is the pesticide residue problem due to the non-judicious use of pesticides by the farmers. Pesticide residue problems are highly found in the crops grown in developing or under-developed countries. Countries such as Vietnam, Ghana, and the Philippines are known for such low-quality crop production, affected by pesticide residues. Though intensive farming is inevitable without the use of pesticides, farmers in developing countries tend to use excess pesticides, which then damage the crops. Thus, improper use and illegal import-export of pesticides, and lack of proper government regulations have resulted in pesticide residue issues and excessive application of toxic pesticides, thereby hindering the growth of the crop protection chemicals market.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=193252005

North America to be the largest market for nematicides during the forecast period.

The region is a host to some of the major players in the nematicides market such as BASF SE (Germany), Bayer AG (Germany), Syngenta (Switzerland), and Nufarm Ltd (Australia) who actively invest on new product launches that would cater to nematode attacks on field crops such as soybean, corn, and cotton which are majorly produced in countries such as the US and Mexico. The acreage which is being brought under field crops is growing due to increased international and domestic demand for these field crops. The adoption of genetically modified seeds has also increased the cases of nematode infestation on crops such as soybean and corn, thereby driving growth in the market.

Key Market Players:

Some of the major players operating in the market include Bayer AG (Germany), Syngenta Crop Protection AG (Switzerland), Corteva Agriscience (US), BASF SE (Germany), Adama Agricultural Solutions Ltd (Israel), FMC Corporation (US), Nufarm (Australia), UPL Limited (India), Isagro Group (Italy), Valent USA (US), Chr. Hansen (Denmark), Certis USA LLC (US), Marrone Bio Innovations (US), American Vanguard Corporation (US), Crop IQ Technology (UK), Real IPM Kenya (Kenya), Horizon Group (India), Agri Life (India), Crop IQ Technology Ltd (UK), and T. Stanes & Company Limited (India).

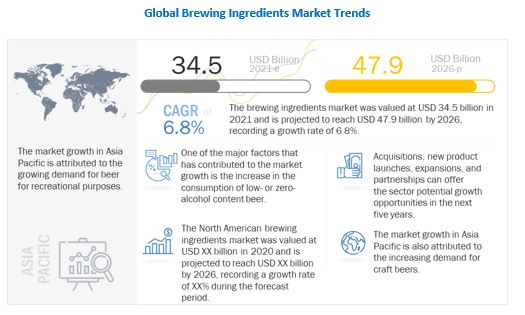

Brewing Ingredients Market Growth by Emerging Trends, Analysis, & Forecast to 2026

Tuesday, August 10, 2021

Feed Antioxidants Market to See Major Growth by 2025

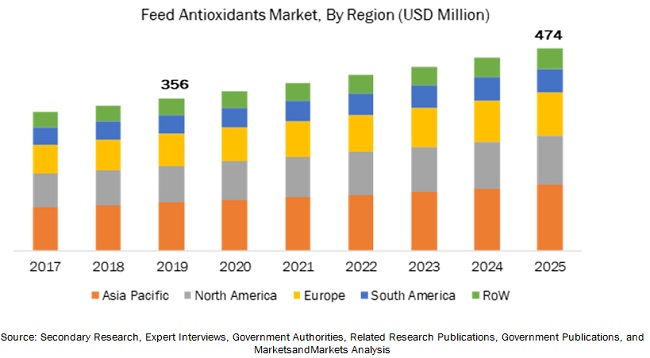

The report "Feed Antioxidants Market by Type Synthetic (BHT, BHA, Ethoxyquin, and Propyl Gallate) and Natural (Carotenoids, Tocopherols, Botanical Extracts, and Vitamins), Animal (Poultry, Swine, Aquaculture, Cattle, and Pets), Form, Region - Global Forecast to 2025", is estimated at USD 356 million in 2019 and is projected to grow at a CAGR of 4.9% from 2019 to 2025, to reach USD 474 million by 2025. Factors such as a rise in demand for quality feed, improved technology for feed production, and an increase in the standardization of meat products stimulate the growth of the feed antioxidants market across the globe.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=138013648

The natural segment is projected to be the faster-growing segment in the feed antioxidants market during the forecast period.

As the market demand shifts from synthetic to natural antioxidants, there is an increase in demand for natural feed antioxidants. The manufacturers are focusing on innovative products to develop cheaper natural antioxidants to capture the market and capitalize on this increasing demand, which is boosting the demand for natural feed antioxidants.

The liquid segment is projected to record the fastest growth during the forecast period.

The liquid form of feed antioxidants is projected to be the fastest-growing segment. Liquid feed antioxidants increase feed consumption and utilization by animals, reduce ration sorting, provide accurate dosage, and decrease feed wastage. Additionally, they help in the mixing of ingredients, resulting in the uniformity of the final product.

The aquaculture segment is projected to record the fastest growth during the forecast period.

An increase in demand for fish and fish-based products is fueling the demand for feed antioxidants in the aquaculture segment. Aquaculture has contributed to global food security, and with the demand for fish-based products increasing globally, the demand for fish feed antioxidants is also gradually increasing.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=138013648

The Asia Pacific region is projected to account for the largest market share during the forecast period.

Asia Pacific accounted for the largest share of the feed antioxidants market in 2018. Asia Pacific, being the largest continent with a relatively fast economic development, is witnessing a rising demand for meat. Consequently, to produce quality meat, feed antioxidants are gaining importance and being incorporated to prevent spoilage and increase shelf-life.

This report includes a study of marketing and development strategies along with the product portfolios of leading companies in the feed antioxidants market. It includes the profiles of leading companies such as Cargill (US), Archer Daniels Midland Company (US), Koninklijke DSM N.V. (Netherlands), BASF SE (Germany), Nutreco (Netherlands), Kemin (US), Adisseo (France), Perstorp (Sweden), Alltech (US), Caldic (Canada), Novus International (US), Chemical Fine Sciences (India), Oxiris Chemical (Spain), VDH ChemTech (India), Zhejiang Medicine (China), BTSA (Spain), Bertol Company (Czech Republic), FoodSafe Technologies (US), Videka Company (US), Lallemand Animal Nutrition (Canada), and Industrial Tecnica Pecuaria (Spain).

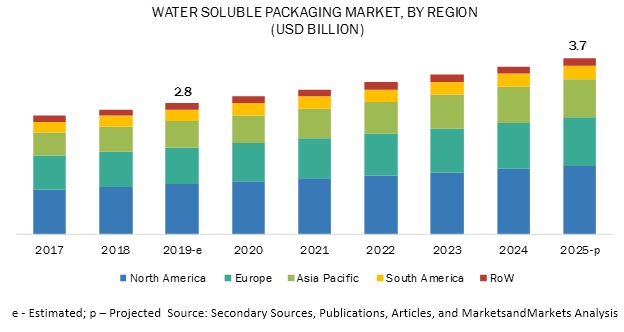

Sustainable Growth Opportunities in the Water Soluble Packaging Market

The report "Water Soluble Packaging Market by Raw Material (Polymer, Surfactant, and Fiber), End Use (Industrial, and Residential), Solubility Type (Cold Water Soluble and Hot Water Soluble), Packaging Type, and Region - Global Forecast to 2025", According to MarketsandMarkets, the water soluble packaging market is estimated to be valued at USD 2.8 billion in 2019 and is projected to reach USD 3.7 billion by 2025, recording a CAGR of 5.0%. The rapidly growing environmental and sustainability concerns across the globe and government initiatives to reduce the use of plastics are driving the market for water soluble packaging.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=243293980

The food & beverage and agriculture in industrial segment are projected to witness the significant growth during the forecast

Based on end use, the water soluble packaging market is segmented into industrial and residential, wherein industrial segment is sub-divided into pharmaceuticals, food & beverages, agriculture, chemicals, and water treatment. The food & beverages and agriculture segments are projected to witness significant growth during the forecast period due to the increasing concerns toward waste production due to high use of non-biodegradable plastics and their harmful effects on packaged food & beverages.

In the agriculture industry, chemical fertilizers wrapped with water soluble packets ease out the handling process. Also, dissolved packaging of the fertilizers cut down the packaging waste generation and leads to reduced cleaning costs.

The pouches segment is accounted to have the major share in the water soluble packaging market during the forecast period

By packaging type, the water soluble packaging market is segmented into pouches, bags, and pods & capsules. The pouches segment is estimated to account for the major share in the water soluble packaging market due to the high usage of water soluble packaging in the chemical industries. In the current scenario, most of the packaging is made of plastic for safe and secure handling and usage of detergent; water soluble packaging of detergent serves the purpose better. Detergent wastage can be minimized as water soluble packets or sachets can be made available to consumers for household and industrial cleaning. The water soluble packaging avoids direct contact with detergent as the product can be used without removing the package, which will ensure safe usage.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=243293980

The Asia Pacific region is projected to witness the fastest growth during the forecast period

The water soluble packaging market in Asia Pacific is projected to witness high growth due to the strong local and export demand. The rising population and growing number of manufacturing industries in Asia Pacific is the key factor driving the market for water soluble packaging. The manufactured product is used domestically as well as exported. China and Japan are the hubs for water soluble film production. In India, the population is increasing rapidly, and the country is striving for safe, better, clean, and healthy lifestyle. The water soluble packaging market will grow in these regions at a high rate.

This report includes a study on the marketing and development strategies, along with the product portfolios of the leading companies. It consists of the profiles of leading companies such as Lithey Inc. (India), Mondi Group (Austria), Sekisui Chemicals (Japan), Kuraray Co. Ltd. (Japan), Mitsubishi Chemical Holdings (Japan), Aicello Corporation (Japan), Aquapak Polymer Ltd (UK), Lactips (France), Cortec Corporation (US), Acedag Ltd. (UK), MSD Corporation (China), Prodotti Solutions (US), JRF Technology LLC (US), and Amtopak Inc. (US).

Monday, August 9, 2021

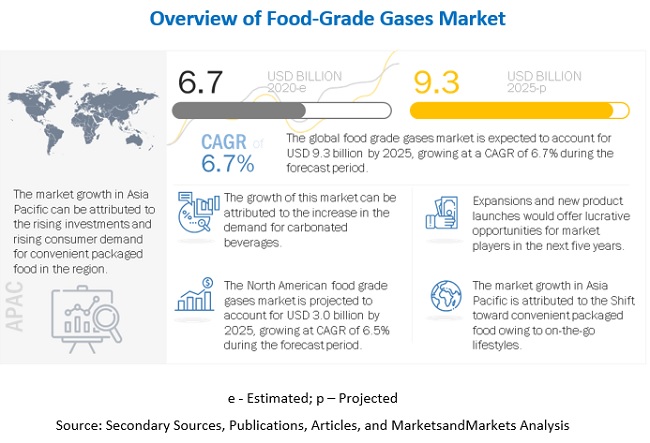

Food-Grade Gases Market: Growth Opportunities and Recent Developments

The report "Food-Grade Gases Market by Type (Carbon Dioxide, Nitrogen, Oxygen), Application (Freezing & Chilling, Packaging, Carbonation), End-Use (Dairy & Frozen Products, Beverages, Meat, Poultry & Seafood), and Region - Global Forecast to 2025", is estimated to be valued at USD 6.7 billion in 2020 and is projected to reach USD 9.3 billion by 2025, at a CAGR of 6.7% from 2020 to 2025. Shifting consumer preferences toward convenient food packaging owing to their on-the-go lifestyles and the growing number of microbreweries across all regions are some of the factors driving the growth of the food-grade gases market.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9473111

The carbon dioxide segment is estimated to account for the largest share, in terms of value, by type, in 2020.

Based on type, the food-grade gases market is segmented into carbon dioxide, nitrogen, oxygen, and others. The carbon dioxide segment is estimated to account for the largest market share in 2020 as carbon dioxide is used for almost all major applications like packaging, freezing & chilling, and carbonation.

Further, carbon dioxide is being used in the softening of water to avoid corrosion problems in long water distribution lines and also in producing potable drinking water. Due to the huge demand from the microbreweries and other carbonated beverage manufacturers, the carbon dioxide segment holds the largest market share.

Drivers: Growing Number of Microbreweries Across all Regions

Carbon dioxide is used for the carbonation of beers and renders a sparkle and tangy taste while also preventing spoilage. Large-scale breweries typically install CO2 reclamation equipment in their breweries that capture the carbon dioxide generated during fermentation process. According to The Brewers of Europe, the European beer production in 2017 reached its eight-year high. The growing number of independent and microbreweries wis contributing to the growth of market.

Restraints: Strict Government Regulations to Meet Quality Standards

Legislations have been sanctioned in most countries in North America and Europe to protect food products from spoilage and contamination due to inferior manufacturing and refrigerated storage processes. Therefore, each country has appointed agencies to inspect consumer health issues and also inspect the type of material used to make sure they are safe for food & beverage operations. Also, by law, all gas cylinders supplied for beverage manufacturers must have a product traceability label on the gas cylinder, valve, or valve guard. Food-grade gas manufacturers need to abide by these laws.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=9473111

North America is estimated to dominate the food-grade gases market, in terms of value, in 2020

The microbrewery culture is also on the rise in the North American market. There are multiple microbreweries present in the region. These microbreweries require carbon dioxide for beer dispensing. Also, the North American soft drinks market is one of the largest, with the presence of all the big brands such as Coca-Cola and PepsiCo. The soft drinks industry is one of the largest users of food-grade carbon dioxide for the carbonation of beverages.

The large beverage industry and rising trends of microbreweries create a huge demand for carbon dioxide in the North American region, with the US being the largest and fastest growing market. Also, because of the presence of highly organized retail chains and cold chain infrastructure, the North American market holds the largest market share in the food-grade gases market.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies. It includes the profiles of leading companies such as The Linde Group (Germany), Air Products & Chemicals (US), Air Liquide (France), The Messer Group (Germany), Taiyo Nippon Sanso (Japan), Wesfarmers Ltd. (Australia), SOL Group (Italy), Gulf Cryo (Kuwait), Air Water, Inc. (Japan), Massy Group (Caribbean), PT Aneka Industri (Indonesia), National Gases Limited (Pakistan), SIAD (Italy), Cryogenic Gases (US), Les Gaz Industriels Ltd. (East Africa), Aditya Air Products (India), Sidewinder Dry Ice & Gas (South Africa), Axcel Gases (India), Chengdu Taiyu Industrial Gases Co., Ltd (China), Yingde Gas Group Ltd (China), Siddhi Vinayak Industrial Gases Pvt Ltd (India), American Welding & Gas (US), Ijsbariek Strombeek N.V (Belgium), Air Source Industries (US), and Purity Cylinder Gases Inc. (US).

Latest Regulatory Trends Impacting the Protein Ingredients Market

According to MarketsandMarkets, the global protein ingredients market was estimated to be valued at USD 52.5 billion in 2020 and is projected to reach USD 70.7 billion by 2025, recording a CAGR of 6.1%, in terms of value. The market is mainly driven by factors such as the increasing demand for protein functionalities, awareness about healthy diets and nutritional food, new technological development in the protein ingredients industry, growth in demand for superior personal care and healthcare products, and rising consumption of animal by-products. Europe will dominate the global market due to the high consumption of animal protein in the region. Further, the increasing emphasis of the European population on healthier lifestyles will lead to the growth of the market in the region.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=114688236

Impact of COVID-19 on the Protein Ingredients Market

The rapid spread of COVID-19 and the equally rapid government response to restrict the movement of the majority of the population in different countries have dramatically changed the consumption patterns, which has also impacted the food & agriculture industries.

The significant changes in consumer purchasing behavior are gradually transforming the food industry. Due to rising health concerns, consumers have started avoiding the consumption of meat and poultry. They are now more inclined toward protein substitute products to fill in the gap. The sales of immunity-related ingredients have spiked globally. These trends have fueled the demand for protein-based products as protein is one of the most important constituents that help in building immunity. However, the coronavirus has caused a severe disruption in the supply chain and has influenced the supply of ingredients and raw materials. Companies are constantly trying to handle the situation and be ready for any further disruption.

Drivers: Increasing demand for proteins as nutritional and functional ingredients

Protein ingredients sourced from animals and plants are well-known for their emulsification, gelation/viscosity, water-binding/hydration, foaming, aeration, and other functional properties. These functionalities, along with the nutritional aspects of proteins, are a major advantage to end-user industries, and are, thus, one of the major market drivers. In end-user industries such as cosmetic & personal care, protein ingredients are primarily used for their conditioning and moisturizing properties in the hair and skincare industries. In major applications such as food & beverages, the use of protein ingredients continues to grow with the increasing demand for improved functionalities. The ability of protein ingredient manufacturers to design and develop specific isolates, concentrates, and other forms of protein ingredients for various applications is likely to drive the growth of the protein ingredients market during the forecast period.

COVID-19 is expected to boost the demand for protein ingredients at a higher rate in the global market as people across the globe are more health-conscious and finding ways to strengthen their immunity.

By form, the dry segment is projected to grow at a higher rate in the protein ingredients market during the forecast period

The global market, by form, has been segmented into dry and liquid. The dry form is projected to grow at a higher CAGR during the forecast period. This form of protein ingredients is largely preferred by manufacturers of food & beverage, feed, and pharmaceutical products as they have better stability and ease of handling & storage compared to the liquid form. Furthermore, they have a longer shelf life compared to the liquid form.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=114688236

The European market accounted for the largest share in the protein ingredients market. This dominance is attributed to the high consumption in this region. The consumption in Europe is more than twice the global average consumption. The high-protein trend in food & beverages and personal care & cosmetics is gaining a foothold in Germany, as protein claims on food and drink launches continue on their growth path. The increasing prevalence of health-related problems, along with high importance being laid on the quality, taste, and freshness of foods is modifying the demand for food, owing to which the market for protein ingredients is projected to witness growth.

Key Market Players:

Key players in this market include Cargill (US), ADM (US), DuPont (US), Kerry Group (Ireland), Omega Protein Corporation (US), FrieslandCampina (Netherlands), Fonterra Co-operative Group Limited (New Zealand), Arla Foods (Denmark), Roquette (France), Gelita AG (Germany), Kewpie Corporation (Japan), AGRANA (Austria), AMCO Proteins (US), Hilmar Ingredients (US), Axiom Foods (US), Burcon Nutrascience (Canada), Rousselot (Netherlands), Foodchem International Corporation (China), A&B Ingredients (US), and Reliance Private Label Supplements (US).