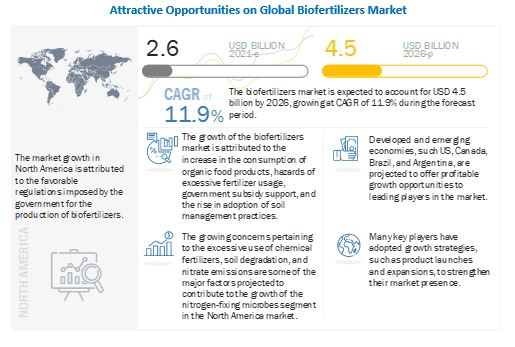

The report "Biofertilizers Market by Form (Liquid, Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Type (Nitrogen-fixing, Phosphate solubilizing & Mobilizing, Potash Solubilizing & Mobilizing), Crop Type, and Region - Global Forecast to 2026" The global biofertilizers market size is estimated to be valued at USD 2.6 billion in 2021 and is expected to reach a value of USD 4.5 billion by 2026, growing at a CAGR of 11.9% in terms of value during the forecast period. Factors such as growth in consumer preference for organic food products, adoption of soil fertility management practices, serious concerns regarding the control of nitrate emissions and eutrophication in the aquatic environment, and government promotions for the use of organic fertilizers are some of the factors driving the growth of the biofertilizers market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

COVID-19 Impact on the Biofertilizers Market:

The global market has witnessed a relatively stable market growth post-COVID-19 pandemic, with a similar trend of high demand in 2020. Biofertilizers can be developed easily, and therefore, are run by domestic manufacturers. As the produce can be manufactured by local companies, the supply chain has not been affected much due to the crisis. Therefore, local manufacturers are projected to dominate the market in most of the countries. There has been a significant increase in food crop production, such as soybean, in South America, fruits & vegetables in European countries, rice in Asian countries. In addition, there is repetitive cultivation due to the increased need in each country to step up domestic food production. Hence, biofertilizer is an effective tool, which helps in replenishing soil nutrition and has gained a high demand in the market. In addition, due to the ban on harmful chemical pesticides, the growth of the market for biofertilizers has not dropped significantly. With the relaxation of restrictions by the government, the market for biofertilizers is projected to grow significantly in the future.

Driver: Growth in the organic food industry

Consumers nowadays are becoming highly concerned about food safety issues, the rising residue levels in food, and environmental issues, due to the rising concerns about their health. This rise in awareness has induced them to prefer chemical-free food products. As a result, major supermarket chains such as Wal-Mart and Cosco are increasing their product offerings of organic foods. The restaurant industry in many developed countries is also offering organic food menus to serve health-conscious consumers. The growth in the organic food industry is triggering the demand for biofertilizers and organic manures, as these are pre-requisites of organic farming. With the outbreak of the COVID-19 pandemic, people have become more conscious about healthy organic food products, which has driven the market growth of biological inputs, such as biofertilizers. These factors have increased organic retail sales in many countries, such as the US, Germany, China, Switzerland, and Denmark.

Seed treatment by mode of application drives the market during the forecast period

By mode of application, the seed treatment segment is projected to have the highest CAGR during the forecast period. In seed treatment, biofertilizers such as Rhizobium, Azotobacter, and Azospirillum. are applied as coatings on seeds. This is the most common method of applying biofertilizers, as it is easy and generally effective under most conditions. This helps to encapsulate small amounts of functional microorganisms on it, which enables the plant to provide nitrogen for the roots, to uptake the nutrients. Seed treatment is extensively carried out for legume seeds for the purpose of nitrogen fixation.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=856

North America is the fastest-growing market during the forecast period in the global market

The North American market is projected to dominate the market due to the rising demand for organic products, increasing acceptance of biofertilizers among rural farmers, and high adoption of advanced irrigation systems such as drip & sprinkler irrigation for fertigation. A stringent regulatory environment in addition to a growing preference for the usage of biofertilizer products has led to the favorable growth of the market. Industrialization, mining, and urbanization have led to a decrease in arable land in North America.

Key Marker Players:

Key players in this market include Novozymes A/S (Denmark), Vegalab SA (Switzerland), UPL Limited (India), Chr. Hansen Holding A/S (Denmark), Kiwa Bio-Tech (China), Lallemand Inc. (US), Rizobacter Argentina S.A. (Argentina), T. Stanes & Company Limited (India), IPL Biologicals Limited (India), Nutramax Laboratories Inc. (US), Symborg (Spain), Kan Biosys (India), Mapleton Agri Biotech Pty Ltd (Australia), Seipasa (Spain), AgriLife (India), Manidharma Biotech Pvt Ltd (India), Biomax Naturals (India), Jaipur Bio Fertilizers (India), Valent BioSciences (US), Aumgene Biosciences (India), Agrinos (US), Criyagen (India), LKB BioFertilizer (Malaysia), Varsha Bioscience and Technology India Pvt Ltd. (India), and Valagro (Italy).