Sunday, August 29, 2021

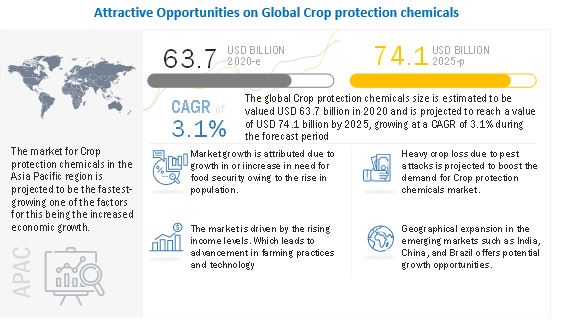

Crop Protection Chemicals Market: Growth Opportunities and Recent Developments

Thursday, August 26, 2021

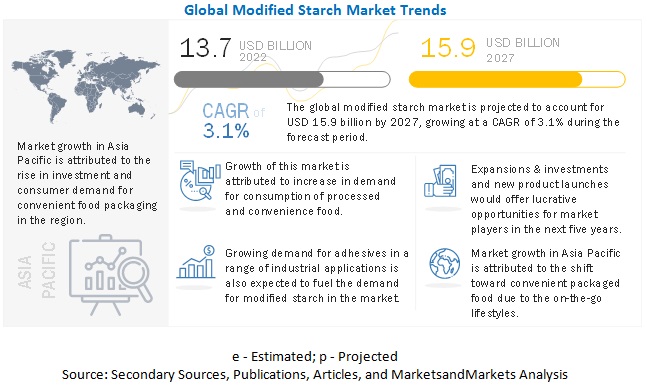

Modified Starch Market to Showcase Continued Growth in the Coming Years

According to

MarketsandMarkets "Modified Starch

Market by Raw Material (Corn, Cassava, Potato, and Wheat),

Application (Food & Beverages (Bakery & Confectionery, Processed Foods,

Beverages, and Other Food Applications), Industrial, and Feed), Form, and

Region - Global Forecast to 2025", the global modified

starch market size is estimated to be valued at USD 13.1 billion in 2020 and

projected to reach USD 14.9 billion by 2025, recording a CAGR of 2.7%, in terms

of value. The functional properties of modified starch and their ease of

incorporation in a wide range of applications are driving the global modified

starch market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=511

The corn segment

accounted for the largest share in the modified starch market

Based on raw material,

corn dominated the modified starch market. Corn is a staple food, and it is

preferred across the globe due to its importance in the diets of several

countries. It is used extensively as a thickening agent in soups and

liquid-based foods such as sauces, gravies, and custards.

The food & beverages

segment is projected to account for a major share in the modified starch market

during the forecast period

By application, the

modified starch market is segmented into food & beverages, industrial, and

feed. The food & beverage segment is further classified into bakery &

confectionery products, processed food, beverages, and others, which includes

snacks and soups. Modified starches have been developed for a significant

period, and their applications in the food & beverage industry are

increasingly gaining importance. Modified starches are considered as food

additives that are prepared by treating starch or their granules with chemicals

or enzymes, causing the starch to be partially degraded.

The Asia Pacific region

dominated the modified starch market with the largest share in 2019, and it is

also expected to grow with the highest CAGR

The modified starch

market in Asia Pacific is dominant due to the increasing demand for processed

food because of a shift in lifestyle trends. People are looking for

ready-to-eat meal options as they are leading a busy life.

Asia Pacific is also the

fastest-growing market as industrial applications and technologies involved in

starch processing are changing rapidly in the region. The demand for modified

starch is increasing as various industries are incorporating in their

manufacturing processes and products. Also, key players are increasingly

investing in the Asia Pacific modified starch market.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=511

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as Archer Daniels Midland Company (ADM) (US), Cargill (US), Ingredion (US), Tate & Lyle (UK), Roquette Frères (France), Avebe U.A (the Netherlands), Grain Processing Corporation (US), Emsland (Germany), AGRANA (Austria), SMS Corporation (Thailand), Global Bio-Chem Technology Group (Hong Kong), SPAC Starch (India), Qindao CBH Company (China), Tereos (France), and KMC (Denmark), Beneo (Germany), Angel Starch Food Pvt. Ltd. (India), Shubham Starch Chem Pvt Ltd. (India), Everest Starch India Pvt Ltd. (India), Sheekharr Starch Pvt Ltd. (India), Sanstar Bio-Polymers Ltd. (India), Universal Biopolymers (India), Sonish Starch Technology Ltd. (Thailand), Venus Starch Suppliers (India), and Gromotech Agrochem Pvt. Ltd. (India).

Latest Regulatory Trends Impacting the Enteric Disease Testing Market

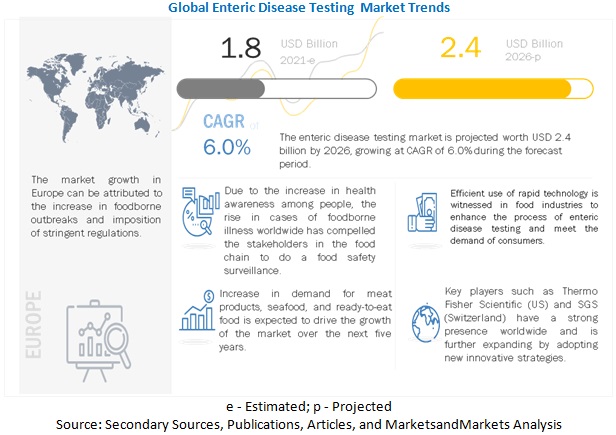

The report "Enteric Disease Testing Market by

Technology (Traditional and Rapid), End Use (Food (Meat, Poultry, Seafood,

Dairy, Processed Foods, and Fruits & Vegetables) and Water), Pathogen

Tested, and Region - Global Forecast to 2026", The market

for enteric disease testing is estimated at USD 1.8 billion in 2021; it is

projected to grow at a CAGR of 6.0% to reach USD 2.4 billion by 2026. The

increase in global food production impacts the food enteric disease testing

market growth by increasing the number of food safety controls in each step from

raw material procurement till the product reaches the consumers. Further, food

manufacturers are willing to pay for testing and certification and have

included this practice in their manufacturing cycles. With consumers becoming

increasingly aware about the food and water-borne illnesses and stringent

regulations to meet international standards, there is growing demand for

enteric disease testing market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=139763313

Salmonella pathogen is estimated to account for the largest

market share in the by pathogen for enteric disease testing market.

Increasing instances of food contamination and foodborne

poisoning are the major reasons for the growth of the enteric disease testing

market. Pathogens such as Salmonella are highly occurring contaminants in

cereals & grains and are also known as enteric bacteria often caused by

birds or rodents during harvesting. Salmonella also causes contamination in

meat, poultry, fruits, and vegetables. A several number of cases are found for

diarrhea and cholera, resulting in several deaths caused by Salmonella infected

food. These factors are paving way for growth of testing for Salmonella within

the enteric disease testing market.

By technology, the rapid testing technology sub-segment is

estimated to account for the fastest growth in the enteric disease testing

market.

The rapid technology market has been proved as a driver

for the enteric disease testing market owing to the attributes such as low

turnaround time, higher accuracy, sensitivity, and ability to test a wide range

of contaminants in comparison to traditional technology. Increasing food trade

across borders, rising food consumption, changing lifestyles of consumers, and

demand for convenience & processed food have led to the growing demand for

enteric disease testing in countries around the world, especially in the

booming markets of Europe.

The meat, poultry and seafood sub-segment by end use is

estimated to account for the largest market share of enteric disease testing market

over the forecast period.

The meat, poultry, and seafood segment is estimated to

dominate the enteric disease testing market in 2021. Due to easy susceptibility

to microbial and other contaminations along with the growing number of tests

for meat, poultry, seafood products has resulted in the growth of the market.

Stringent government policies & regulations for meat, poultry, and seafood

products and assurance of safe meat to consumers have led to consistent enteric

disease testing with checkpoints at different stages to eliminate any

incidences of meat contamination.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=139763313

Europe is projected to be the fastest-growing market for

the forecast period.

The market in this region is primarily driven by growth in

the German and UK markets. It is also driven by European food policies that

have been extensively emphasized by the National Reference Laboratories (NRLs)

and the European Reference Laboratories (EURLs) to maintain food standards and

protect consumer health. Campylobacter has been the most commonly reported food

outbreak, with an increase in confirmed human cases in the European Union (EU).

The market is further fueled by the presence of major enteric disease testing

companies such as SGS SA (Switzerland), Eurofins Scientific (Luxembourg), and

Intertek Group plc (UK), which are continuously investing and collaborating for

the development of better and faster testing technologies to aid conformity to

various enteric disease regulations.

Key Market Players:

Key players in this market include

SGS SA (Switzerland), Eurofins Scientific (Luxembourg), Intertek Group plc

(UK), Bureau Veritas (France), ALS Limited (Australia), and TÜV SÜD (Germany).

Key players in this market are focusing on increasing their presence through

mergers & acquisitions and new product developments, specific to consumer

tastes in these regions. These companies have a strong presence in Europe and

North America. They also have manufacturing facilities along with strong

distribution networks across these regions.

Wednesday, August 25, 2021

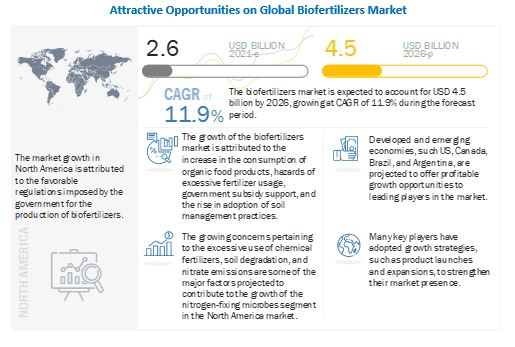

Biofertilizers Market Will Hit Big Revenues In Future

The report "Biofertilizers Market by Form (Liquid, Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Type (Nitrogen-fixing, Phosphate solubilizing & Mobilizing, Potash Solubilizing & Mobilizing), Crop Type, and Region - Global Forecast to 2026" The global biofertilizers market size is estimated to be valued at USD 2.6 billion in 2021 and is expected to reach a value of USD 4.5 billion by 2026, growing at a CAGR of 11.9% in terms of value during the forecast period. Factors such as growth in consumer preference for organic food products, adoption of soil fertility management practices, serious concerns regarding the control of nitrate emissions and eutrophication in the aquatic environment, and government promotions for the use of organic fertilizers are some of the factors driving the growth of the biofertilizers market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

COVID-19 Impact on the Biofertilizers Market:

The global market has witnessed a relatively stable market growth post-COVID-19 pandemic, with a similar trend of high demand in 2020. Biofertilizers can be developed easily, and therefore, are run by domestic manufacturers. As the produce can be manufactured by local companies, the supply chain has not been affected much due to the crisis. Therefore, local manufacturers are projected to dominate the market in most of the countries. There has been a significant increase in food crop production, such as soybean, in South America, fruits & vegetables in European countries, rice in Asian countries. In addition, there is repetitive cultivation due to the increased need in each country to step up domestic food production. Hence, biofertilizer is an effective tool, which helps in replenishing soil nutrition and has gained a high demand in the market. In addition, due to the ban on harmful chemical pesticides, the growth of the market for biofertilizers has not dropped significantly. With the relaxation of restrictions by the government, the market for biofertilizers is projected to grow significantly in the future.

Driver: Growth in the organic food industry

Consumers nowadays are becoming highly concerned about food safety issues, the rising residue levels in food, and environmental issues, due to the rising concerns about their health. This rise in awareness has induced them to prefer chemical-free food products. As a result, major supermarket chains such as Wal-Mart and Cosco are increasing their product offerings of organic foods. The restaurant industry in many developed countries is also offering organic food menus to serve health-conscious consumers. The growth in the organic food industry is triggering the demand for biofertilizers and organic manures, as these are pre-requisites of organic farming. With the outbreak of the COVID-19 pandemic, people have become more conscious about healthy organic food products, which has driven the market growth of biological inputs, such as biofertilizers. These factors have increased organic retail sales in many countries, such as the US, Germany, China, Switzerland, and Denmark.

Seed treatment by mode of application drives the market during the forecast period

By mode of application, the seed treatment segment is projected to have the highest CAGR during the forecast period. In seed treatment, biofertilizers such as Rhizobium, Azotobacter, and Azospirillum. are applied as coatings on seeds. This is the most common method of applying biofertilizers, as it is easy and generally effective under most conditions. This helps to encapsulate small amounts of functional microorganisms on it, which enables the plant to provide nitrogen for the roots, to uptake the nutrients. Seed treatment is extensively carried out for legume seeds for the purpose of nitrogen fixation.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=856

North America is the fastest-growing market during the forecast period in the global market

The North American market is projected to dominate the market due to the rising demand for organic products, increasing acceptance of biofertilizers among rural farmers, and high adoption of advanced irrigation systems such as drip & sprinkler irrigation for fertigation. A stringent regulatory environment in addition to a growing preference for the usage of biofertilizer products has led to the favorable growth of the market. Industrialization, mining, and urbanization have led to a decrease in arable land in North America.

Key Marker Players:

Key players in this market include Novozymes A/S (Denmark), Vegalab SA (Switzerland), UPL Limited (India), Chr. Hansen Holding A/S (Denmark), Kiwa Bio-Tech (China), Lallemand Inc. (US), Rizobacter Argentina S.A. (Argentina), T. Stanes & Company Limited (India), IPL Biologicals Limited (India), Nutramax Laboratories Inc. (US), Symborg (Spain), Kan Biosys (India), Mapleton Agri Biotech Pty Ltd (Australia), Seipasa (Spain), AgriLife (India), Manidharma Biotech Pvt Ltd (India), Biomax Naturals (India), Jaipur Bio Fertilizers (India), Valent BioSciences (US), Aumgene Biosciences (India), Agrinos (US), Criyagen (India), LKB BioFertilizer (Malaysia), Varsha Bioscience and Technology India Pvt Ltd. (India), and Valagro (Italy).

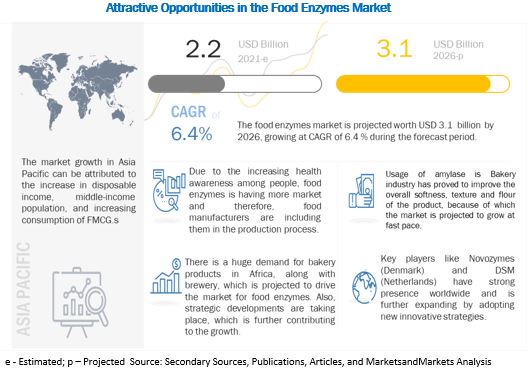

Sustainable Growth Opportunities in the Food Enzymes Market

The report "Food Enzymes Market by Type (Carbohydrases, Proteases, Lipases, Polymerases & Nucleases), Source, Application (Food & Beverages), Formulation, and Region(North America, Europe, Asia Pacific, and South America) – Global Forecast to 2026" The food enzymes market is estimated to be valued at USD 2.2 billion in 2021 and is projected to reach USD 3.1 billion by 2026, recording a CAGR of 6.4%, in terms of value. The growing demand for diverse range of food products, clean label trend, and increase in disposable income are the factors that are projected to drive the growth of the food enzymes market globally.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=800

COVID-19 Analysis:

The impact of COVID-19 food enzymes is expected to be significant, as the current pandemic has highlighted the significance of safe, healthy, and nutritious eating. While ingredient sales span across the countries, key companies in the food enzymes market have also begun to establish regional production. R&D and sales department and are also optimizing supply chains for the distribution of raw materials. Amidst the COVID-19 outbreak, food ingredient companies are facing significant challenges to address the increased demand for food enzymes to include changing tastes and preferences. A rapid and unexpected spike in demand for functional foods during the pandemic resulted in manufacturers, suppliers, and retailers struggling to ensure a continued supply of raw materials in the market. Disruptions in the supply chain during the COVID-19 lockdown across the countries were challenging for the market.

Drivers: Increasing demand for processed food

The global demand for processed foods is on the rise owing largely to the growing economies in the Asian continent. China and India are the major drivers behind the substantial growth of the processed food market. The middle-class population is increasing and the rise in their disposable incomes, coupled with a hectic lifestyle, contributes to the growth of this market. Food enzyme applications extend the freshness of end products, thereby prolonging the shelf life of convenience foods while also preserving their flavor, color, and texture.

Threats: Changes in food enzymes safety regulations in Europe

The European market for food enzymes held a share of about 30.0% of the global market in 2015. As enzymes are naturally present in ingredients used to make food, earlier, their safety and toxicity were not of much concern. However, the advent of large-scale production of food enzymes through strains of genetically modified microorganisms has led to increased scrutiny on the use of enzymes in Europe’s food & beverage industry. In the past, the regulation of enzymes used as processing aids was not carried out at the EU level. Of the member states, only Denmark and France evaluated these processing aids before their use in the food & beverage industry. This inconsistency in the assessment criteria of food enzymes among nations prompted the framing of a new EU legislation.

Asia Pacific is projected to grow at highest CAGR during the forecast period

The increasing purchasing power of consumers due to the economic development in APAC countries has led to an increase in the demand for high-quality processed food. Hence, due to their characteristics as essential healthy food additives, the market for enzymes in food & beverages is projected to grow. The changes in consumer preferences and liberalization of trade have further fueled the demand for foods like meat and meat products in the country.

Key Market Players:

Key players in the global market include DuPont (US), Associated British Foods plc (UK), DSM (Netherlands), Novozymes (US), and Kerry Group (Ireland), Advanced Enzyme Technologies Ltd (India), Amano Enzyme Inc. (Japan) and CHR. Hansen Holdings A/S (Denmark). These major players in this market focus on increasing their presence through expansions, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities, along with strong distribution networks across these regions.

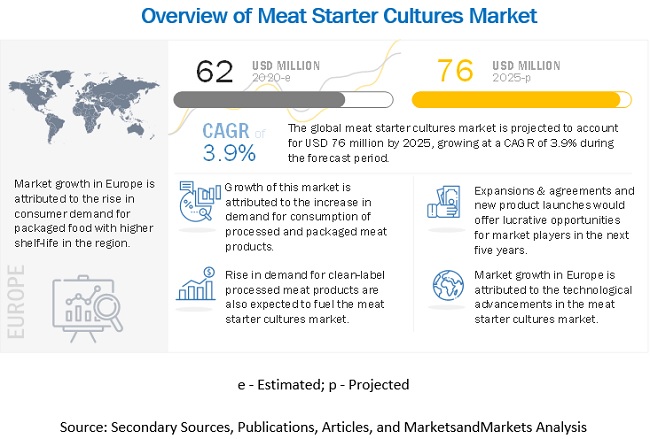

Meat Starter Cultures Market to Witness Unprecedented Growth in Coming Years

According to

MarketsandMarkets, the "Meat Starter Cultures Market by

Application (Sausages, Salami, Dry-cured meat, and Others), Microorganism (Bacteria,

and Fungi), Composition (Multi-strain mix, Single strain, and Multi-strain),

Form, and Region - Global Forecast to 2025" size is

estimated to be valued at USD 62 million in 2020 and projected to reach USD 76

million by 2025, recording a CAGR of 3.9%, in terms of value. The functional

properties of meat starter cultures and their benefits while incorporation in a

wide range of applications are driving the global meat starter cultures market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=43153327

Restraints: Stringent government

regulations for the use of starter cultures in processed meat products

Stringent regulations have proved to

be a major hindrance stifling the market for

starter cultures. Some of the global organizations involved in

providing regulatory norms include the World Trade Organization (WTO), European

Food and Feed Cultures Association (EFFCA), and other regulatory bodies. The

regulations for starter cultures as listed by the different organizations

include the following:

World Trade Organization

The World Trade Organization (WTO)

has laid down stringent rules and regulations for the import and export of

living microbes. The manufacturer has to obtain an environment clearance

certificate, quality certificate, and some other related certifications before

manufacturing microorganisms at the industrial level. Since the starter culture

industry involves high risk with respect to the health and environment, it

would not be easy for new manufacturers to enter the starter culture market.

There have been special regulatory measures present for companies to discard

the culture and biological effluent after the production.

European Food Safety Authority &

Qualified Presumption of Safety

The uses of bacteria must conform to

the general food safety standards, such as the European General Food Law

(European Parliament and the Council, 2002). The European Food Safety Authority

(EFSA) had announced five ‘generic’ approaches for the safety assessment of

microorganisms in food with a history of safe use. This approach includes a

qualified presumption of safety (QPS) in food. QPS derives basic knowledge of

the microorganisms that includes its pathogenicity, taxonomy, familiarity, and

application in food. The Scientific Committee of EFSA indicates that a thorough

knowledge of the microorganism is sufficient for awarding the QPS status for

numerous species from the groups of lactic acid bacteria and yeast.

By application, sausages

segment is projected to account for the largest share in the meat starter

cultures market during the forecast period

By application, the

market is segmented into sausages, salami, dry-cured meat, and others (such as

pepperoni and other processed meat products). The meat sausages segment, akin

to most other non-processed fresh meats and meat preparations, comprises

perishable food products, and most sausage manufacturers have been looking for

additional safety or longer shelf life, either in terms of less spoilage or

delayed oxidation. Meat starter cultures are used to provide additional safety

and delay spoilage by shifting the uncontrolled fermentation that spoils the

meat to a controlled fermentation by safe bacteria. Meat starter cultures

ferment the sausages and preserve their flavor, texture, color, and increase

their shelf-life by averting wastage.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=43153327

The European region

dominated the meat starter culture market with the largest share in 2019.

The meat starter cultures

market in Europe is dominant due to the increasing demand for processed meat

products with higher shelf-life because of a shift in lifestyle trends. People

are looking for ready-to-cook meal options as they are leading a busy life. The

consumption of sausage has been prominent in these countries, resulting in a

rise in demand for meat starter cultures for their production. The leading

companies dominating the meat starter cultures market include Chr. Hansen

(Denmark), Kerry Group (Ireland), and DSM (Netherlands); have a robust presence

in Europe due to higher demand for packaged meat in these regions.

North America is the

fastest-growing market as the technological advancements involved in monitoring

and using meat starter cultures are available in the region, and meat

manufacturers have been adapting to the changing technologies. The demand for

meat starter cultures is increasing as consumers have been inclined toward

organic and clean-label meat products. Also, key players are increasingly investing

in the North American meat starter culture market.

This report includes a

study on the marketing and development strategies, along with the product

portfolios of leading companies. It consists of profiles of leading companies,

such as Chr. Hansen (Denmark), DSM (Netherlands), Kerry (Ireland), DuPont (US),

Frutarom (Israel), Galactic (Belgium), Lallemand (Canada), Proquiga (Spain),

Westcombe (UK), Biochem SRL (Italy), RAPS GmbH (Germany), DnR Sausages

Supplies. (Canada), Sacco System (Italy), Canada Compound (Canada), Biovitec

(France), Genesis Laboratories (Bulgaria), Meat Cracks (Germany), THT S.A.

(Belgium), Stuffers Supply Co. (Canada), MicroTec GmbH (Germany), and Codex-Ing

Biotech (US).

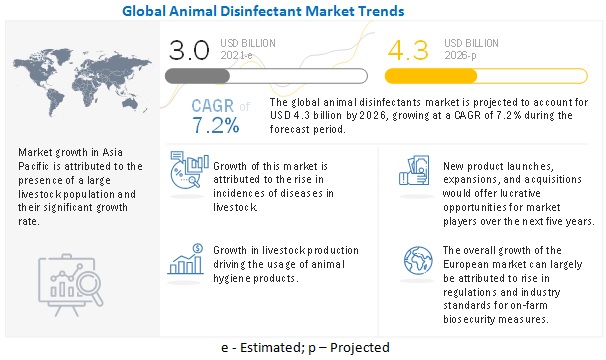

Animal Disinfectants Market: Growth Opportunities and Recent Developments

According to

MarketsandMarkets "Animal Disinfectants

Market by Application (Dairy Cleaning, Swine, Poultry, Equine,

Dairy & Ruminants, and Aquaculture), Form (Liquid and Powder), Type

(Iodine, Lactic Acid, Hydrogen Peroxide), and Region - Global Forecast to

2026", The global animal disinfectants market size is

estimated to be valued at USD 3.0 billion in 2021. It is projected to reach USD

4.3 billion by 2026, recording a CAGR of 7.2% during the forecast period. The

market has a promising growth potential due to several factors, including the

rising awareness regarding hygiene and sanitation amidst this COVID-19 pandemic

and increasing demand for meat and other animal products.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38718363

COVID-19 Impact on the Animal

Disinfectant Market

The impact of COVID-19 lockdown was

tremendous in scale across the globe and profound especially in the key

consumption markets for animal disinfectants. The demand for disinfectant

products channelized for the livestock sector has remained high, with manufacturing

plants for both disinfectants and water treatment being utilized at almost full

capacity for companies such as Lanxess. However, the supply-chain disruptions

in the key emerging markets, especially Mexico and Central America, negatively

impacted the sales, albeit for a temporary period. The last mile connectivity

to small and medium-scale livestock farms suffered a setback due to weakness in

the distribution channels. Prominent players in the market such as Neogen

expect a surge in demand with markets opening up gradually, and thus,

capacity-building remains among the major focus areas. Key giants have also

embarked on inorganic growth strategies by acquiring regionally-prominent

disinfectant manufacturers and thereby strengthening their geographical

outreach. Livestock disinfectant companies are also intensifying their efforts

to develop a plethora of anti-bacterial, anti-fungal, and anti-viral solutions

in the wake of growing concerns for zoonotic diseases.

Restraint: High entry

barriers for players

The high costs associated with the development and

registration of animal disinfectant products can result in small to

medium-scale companies losing out to larger players. Another barrier for

smaller players entering the market is the dynamic nature of the market itself,

which has recently witnessed prominent players intensively seeking to

consolidate their position through inorganic growth attempts such as acquiring

smaller market players. New companies showing disruptive potential become the

key targets for acquisitions by larger players such as Neogen Corp. and CID

Lines.

Prominent players in the market are intensively seeking to

increase their market share with the combination of inorganic and organic

growth trajectories with former holding precedence in the form of growing

number of acquisitions witnessed in recent years. The regulatory framework in

the developed markets of North America and Western Europe is very stringent,

with growing focus on good hygiene practices (GHP) which are cost-intensive thereby

hindering the entry of small to medium-scale enterprises.

On the basis of

application, dairy cleaning segment is expected to retain its dominance in the

foreseeable period

Dairy cleaning is a terminal biosecurity measure, which is

carried out at regular intervals. Due to the cost factor for larger cattle

herds, the use of dairy cleaning has a greater significance in the developed

markets. Countries in regions such as Europe and North America maintain

large-scale farms and dairy farms required to maintain proper dairy cleaning

measures to ensure the efficacy of the livestock and the equipment.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=38718363

Asia Pacific is projected

to be the fastest-growing region in the animal disinfectant market.

The animal disinfectant market in Asia Pacific is driven

by growing inclination towards animal-based food products that have prompted

stakeholders in supply-chain to ramp up their production and intensify rearing

leading to greater demand for cleaning and hygiene products, including

disinfectants. The region has also witnessed growing regulatory focus on the

Good Hygiene Practices (GHP) that are embedded as part of various mandatory

regulations to be followed at dairy, poultry, swine, equine and aquaculture

sectors. Markets in South East Asia such as Singapore and Malaysia are

providing vital cues to improve hygiene infrastructure in animal husbandry and

this trend is largely adopted by other countries in the region such as

Thailand, Vietnam, Indonesia where there is a strong need to implement robust

disinfection protocols.

Key Market Players

Key global market players offer wide range of animal disinfectant products to improve animal health and performance. Prominent livestock disinfectant manufacturers have strong presence in the European and North America countries. The key companies in the animal disinfectant market are Neogen Corporation (US), GEA (Germany), Lanxess AG (Germany), Zoetis (US), Kersia Group (France), and CID Lines (Belgium). Various strategies, such as expansions, mergers & acquisitions, and new product launches, were adopted by the key companies to remain competitive in the animal disinfectant market.