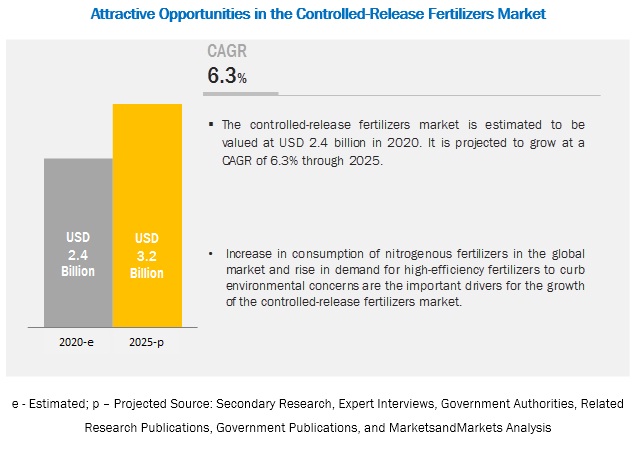

The global controlled-release

fertilizers market is estimated at USD 2.4 billion in 2020 and is

projected to reach USD 3.2 billion by 2025. The market is projected to grow at

a rate of 6.3% during the forecast period. Factors driving the market include

an increase in demand for highly efficient fertilizers, favorable government

regulations, a rise in demand for high-value crops, and an increase in the

number of investments from key players in this market. The growing

environmental concerns associated with nutrient loss through soil leaching and

runoffs from fields on the using excess conventional fertilizers are

effectively addressed by these fertilizers.

Download

PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

The agricultural segment

is projected to be the faster-growing segment in the controlled-release

fertilizers market during the forecast period.

As the market demand shifts towards the usage from NPK

fertilizers to controlled-release fertilizers in the developing economies,

there is an increase in demand for controlled-release fertilizers. The

manufacturers are continuing research efforts to develop cheaper and better

coatings/materials to reduce the overall cost and encourage the adoption of

this technology.

The fertigation segment of

controlled-release fertilizers is projected to account for the largest market

share, by mode of application

The controlled-release fertilizers

market, by application method, was dominated by the fertigation segment.

Fertigation is a technique that has been adopted by major countries. In this

technique, the fertilizer is included with irrigation water and applied through

systems. This technique witnesses better application than broadcasting and

subsurface placement. Owing to the increasing irrigated land, fertigation is

highly preferred as a suitable application method adopted in both developed and

developing countries across the globe for the application of these fertilizers.

Also, the labor costs are reduced to a large extent through the adoption of

these techniques, which also adds to their increasing demand.

The Asia Pacific is

projected to witness significant growth during the forecast period

The Asia Pacific accounted for the largest share. The

region is projected to grow at the highest CAGR of 6.2% & 6.0% in terms of

value & volume, respectively, during the forecast period. The increasing

growth of high-value crops and raising awareness among farmers about the

environmental benefits of controlled-release fertilizers are expected to

provide more scope for market expansion. The government policies adopted by

Asia Pacific countries and the large subsidies, in certain countries up to 100%

for marginal farmers, provided on fertilizers are the major factors triggering

the growth of this market in the region. R&D investments in the development

of coated fertilizers and the installation of new production capacities by key

players are expected to boost the market in the next five years.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=136099624

Key

Market Players

Key companies in the controlled-release fertilizers market

are Nutrien Ltd. (Canada), Yara International ASA (Norway), ICL (Israel),

ScottsMiracle-Gro (US), Koch Industries (US), Helena Chemical (US), Kingenta

(China), SQM (Chile), Haifa Chemicals (Israel), JCAM AGRI. (Japan), COMPO EXPERT

(Germany), Nufarm Ltd. (Australia), The Andersons Inc. (US), Van Iperen

International (Netherlands), Mosaic Company (US), OCI Nitrogen (Netherlands),

AgroLiquid (US), DeltaChem (Germany), SK Specialties (Malaysia), and Pursell

Agri-Tech (US). New product launches, expansions, agreements, and acquisitions

have been the areas of focus of these manufacturers to gain better penetration

in the developing markets of the Asia Pacific and South America.