Friday, September 17, 2021

Agricultural Pheromones Market Growth by Emerging Trends, Analysis, & Forecast to 2026

Thursday, September 16, 2021

Feed Antioxidants Market to Witness Unprecedented Growth in Coming Years

Upcoming Growth Trends in the Water Soluble Packaging Market

Wednesday, September 15, 2021

Growth Strategies Adopted by Major Players in the Food Processing & Handling Equipment Market

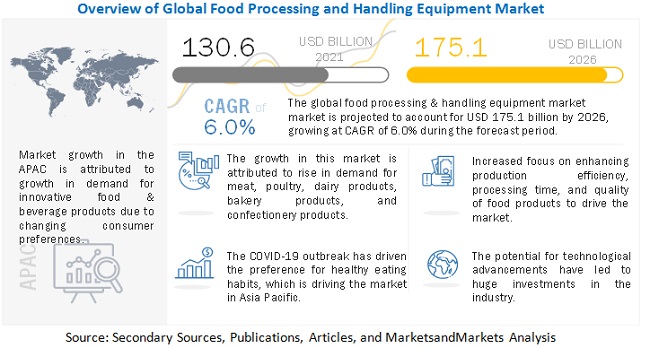

The report "Food Processing & Handling Equipment Market by Type (Food Processing Equipment, Food Packaging Equipment, and Food Service Equipment), Application, Form (Solid, Liquid, and Semi-Solid), and Region - Global Forecast to 2025", The global food processing & handling equipment market is estimated to be valued at USD 137.2 billion in 2019 and is projected to reach USD 196.6 billion by 2025, growing at a CAGR of 6.2%. Advancements in the food processing & packaging equipment industry, innovation in processing technology, and continuous growth in the demand for processed food are some factors that are expected to support the growth of the food & beverage processing equipment market. With the growing preference for healthy food and functional foods, manufacturers are expected to adopt new equipment to fulfill the demand for healthy functional foods & beverages. The expansion of food manufacturing capacities and growth of the food processing industry in emerging economies are also expected to support the growth of the food processing & handling equipment market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=145960225

The bakery & confectionery products segment is estimated to account for the largest share in the market in 2019.

By application, the bakery & confectionery products segment is estimated to account for the largest share in the food processing & handling equipment market in 2019. Processing equipment such as industrial ovens, molders, formers, mixers, blenders, and cutters form an integral part of bakery & confectionery products manufacturing, and their high demand is mainly due to the highly fragmented bakery & confectionery market and high prevalence and demand for these products in both developed and developing countries. The demand for ultra-processed bakery products is high in developed countries such as the UK, Germany, the US, Canada, and Spain. These countries represent an established bakery industry and are experiencing a rise in the popularity of premium and innovative bakery products such as pastries, glazed & chocolate coated donuts, sugar & chocolate coated cookies, and chocolate pies. Such countries are focused on the production of bakery items to meet the increasing demand. This demand for bakery products is facilitating the increasing use of bakery processing equipment.

The meat & poultry segment is projected to witness strong growth due to the rising demand for convenience food products.

The growing demand for convenience food products is one of the major drivers that has effected a surge in demand for food processing & handling equipment for the meat & poultry industry. The preference for convenience food products, including meat and poultry, is increasing due to busy life schedules of people and the increasing working women population. The demand for convenience food products has surged, as they are easy to cook and consume less time, which, in turn, has boosted the demand for meat & poultry processing equipment market during the forecast period. The growing number of organized retailers is increasing the sale of ready-to-eat meals, including meat and poultry food products, which, in turn, is fueling the demand for food processing & handling equipment for the meat & poultry industry.

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period.

Asia Pacific is projected to be the fastest-growing regional market for food processing & handling equipment in 2019. The region is expected to experience a sharp rise in the demand for advanced food processing machinery that helps reduce processing time and enhance the efficiency of manufacturing operations. The expected growth in the number of food processing units in this region is further projected to boost the supply and consumption of food & beverage processing equipment. The food processing sectors in countries such as China, India, Australia, and New Zealand are export-oriented; also, the processing sector is of prime importance in these countries, as the players here are focusing on technology adoption and automation. This is expected to have a positive impact on the food & beverage processing equipment market in the region.

Key Market Players:

The key players in the market are GEA (Germany), Buhler Ag (Switzerland), Alfa Laval (Sweden), JBT Corporation (US), SPX FLOW (US), Robert Bosch (Germany), IMA Group (Italy), Middleby Corporation (US), and Dover Corporation (US), Robert Bosch (Germany), IMA Group (Italy), Tetra Laval (Switzerland), Multivac (Germany), Middleby Corporation (US), Welbilt, Inc. (US), and Electrolux (Sweden). These players, along with the other players, adopted various business strategies such as new product launches, expansions, and joint ventures & agreements in the last few years, to meet the growing demand for food processing & handling equipment market.

Tuesday, September 14, 2021

Growth Strategies Adopted by Major Players in the Proanthocyanidins Market

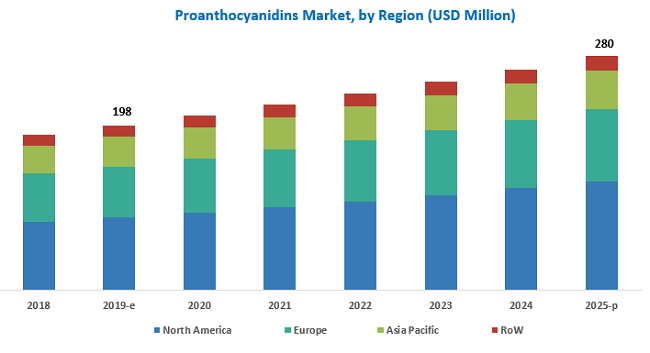

The report "Proanthocyanidins Market

by Source (Cranberry, Grape Seed, and Pine Bark), Application (Pharmaceuticals

& Dietary Supplements, Personal Care & Cosmetics, and Functional Food

& Beverages), Type (Type A and Type B), and Region - Global Forecast to

2025", The proanthocyanidins market is estimated at USD 198 million in

2019 and is projected to grow at a CAGR of 6.0% from 2019 to 2025, to reach USD

280 million by 2025. Proanthocyanidins are rich in antioxidants and provide

several health benefits to consumers; for instance, they help in healing

wounds, improve bone strength, aid in skin-related issues including skin

cancer, and also offer cardiovascular benefits. Hence, they are significantly

witnessing high demand among manufacturers in the personal care, food &

beverages, and cosmetic industries. Proanthocyanidins are witnessing a surge in

demand as it finds various applications in the personal care, dietary

supplement, cosmetics, and food & beverage industries. The global

proanthocyanidins market is primarily driven by the health benefits and

therapeutics effects offered by this ingredient and its increasing applications

in the production of personal care and cosmetic products.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=61943557

By type, the type A segment is projected to be the fastest-growing

segment in the proanthocyanidins market during the forecast period.

The type A segment in the market is projected to be the

fastest-growing segment as it is used in various applications such as

pharmaceuticals, personal care, cosmetics, and food supplements. Leading

players such as Naturex (France), and Nexira (France), offer various type A

proanthocyanidins that cater to pharmaceutical and personal care applications.

By source, the cranberry segment is projected to dominate the

proanthocyanidins market during the forecast period.

The cranberry segment is projected to account for the

largest market share in the market for proanthocyanidins during the forecast

period as it offers several health benefits that make it a versatile ingredient

for use in the food, pharmaceuticals, and personal care industries. Type A

proanthocyanidins derived from cranberries have a unique molecular structure

that exhibits potent bacterial antiadhesion activities, which help in

maintaining personal hygiene.

By application, the pharmaceuticals & dietary supplements

segment is projected to dominate the proanthocyanidins market during the

forecast period.

The pharmaceuticals & dietary supplements segment is

estimated to account for the largest market share, followed by the functional

food & beverages and personal care & cosmetics segments. With the rise

in the aging population, consumers are becoming more conscious and aware of

various diseases that can be prevented by consuming natural foods and

supplements. This concern has driven the growth of the pharmaceuticals &

dietary supplements segment in the proanthocyanidins market. Health-conscious

consumers prefer balanced diet alternatives that include health supplements

derived from natural extracts such as proanthocyanidins.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=61943557

The North American region is projected to account for the largest

market share during the forecast period.

The North American proanthocyanidins market is projected

to account for the largest share by 2025. The region has traditionally been a

major consumer of proanthocyanidins. The rise in the aging population,

increased consumption of healthy food, and growing demand for pharmaceuticals

are the major factors driving the market in North America. Functional foods,

which provide health benefits beyond basic nutrition, have gained higher

importance in the last decade. Typically, food marketed as functional food contains

ingredients (such as Proanthocyanidins) with specific health benefits.

Consumers are seeking added health benefits from the food consumed, and

increasing awareness among them is driving the growth of the functional food

& beverage segment in the proanthocyanidins market.

This report includes a study of marketing and development strategies along with the product portfolios of leading companies in the proanthocyanidins market. It includes the profiles of leading companies such as Naturex (France), Indena SPA (Italy), Nexira Inc. (France), Polyphenolics (US), Xian Yuensun Biological Technology Co.,Ltd. (China), Natac (Spain), and Eevia Health (Finland).

Monday, September 13, 2021

Growth Opportunities in the Protective Cultures Market

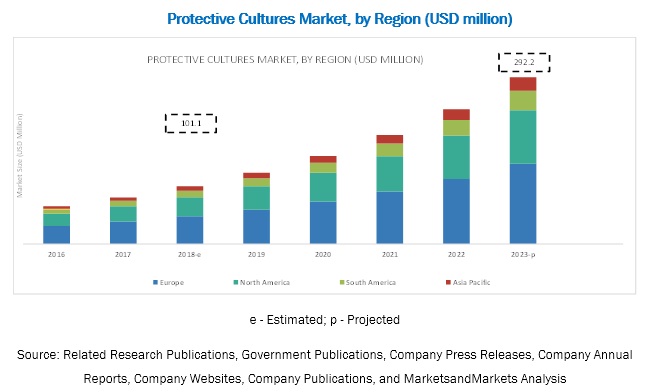

The report "Protective Cultures Market by Product Form (Freeze-dried and Frozen), Target Microorganism (Yeasts & Molds and Bacteria), Application (Dairy & Dairy Products, Meat & Poultry Products, and Seafood), Composition, and Region - Global Forecast to 2023", The market for protective cultures is estimated at USD 101.1 million in 2018; it is projected to grow at a CAGR of 23.6% to reach USD 292.1 million by 2023.

The yeast & molds segment is estimated to account for a larger market share, in terms of value, in 2018

Microorganisms are recorded as the major contaminants that degrade food products. Fermented products are more prone to spoilage by microorganisms. The common spoilage microorganisms include yeasts, molds, and bacteria. Molds is the primary food spoilage agent in dairy products. Yeasts mainly grow inside a food product, while molds typically grow on the surface. Molds mostly grow at a pH of 3 to 8. The protective cultures market for the growth control of yeasts & molds is projected to witness a faster growth of 23.9% during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=4070383

The genetically modified segment is estimated to witness the fastest growth in the protective cultures market, in terms of value, in 2018

The genetic modification of protective cultures improves the quality and production of oil. The high demand for competitive and economically priced vegetable oil has led to an increase in the preference for genetically modified seeds. Genetically engineered protective cultures are being used as an important ingredient in the functional foods industry. This widespread demand and an increase in the application areas are some of the factors, due to which the market is projected to witness faster growth.

The dairy & dairy products segment, by application, is estimated to account for the largest market share, by value, in 2018

Based on application, the dairy & dairy products segment is expected to dominate the food and beverage protective cultures market due to the wide consumption of dairy products such as cheese, yogurt, and butter across the globe. The cheese industry is also one of the major application areas of protective cultures. Companies such as Chr Hansen and DuPont Danisco have a significant presence in the dairy & dairy products segment with a wide array of dairy protective cultures.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=4070383

The increasing demand for protective cultures in the North American and European regions is driving the growth of the protective market.

Europe accounted for the largest share of the market. The dominant status of Europe can be attributed to the strong dairy industry in the region. . The strong demand for milk products in the global market and the decision to increase output have had a positive impact on the European dairy market. The support from the European dairy market has played a key role in driving the growth of the protective cultures market.

Key Market Players:

The key players in this market include Chr Hansen (Denmark), DowDuPont (US), Sacco S.R.L (Italy), CSK Food Enrichment B.V. (Netherlands), THT S.A. (Belgium), Dalton Biotechnologies (Italy), Biochem S.R.L (Italy), Meat Cracks Technology GmbH (Germany), Royal DSM N.V. (Netherlands), Bioprox (France), Aristomenis D. Phikas & Co SA. (Greece), and Soyuzsnab Group of Companies (Russia). The key market players, along with other players, adopted various business strategies such as new product launches, expansions, and agreements & partnerships in the last few years to meet the growing demand for protective cultures.

Flavor Systems Market Growth by Emerging Trends, Analysis, & Forecast to 2023

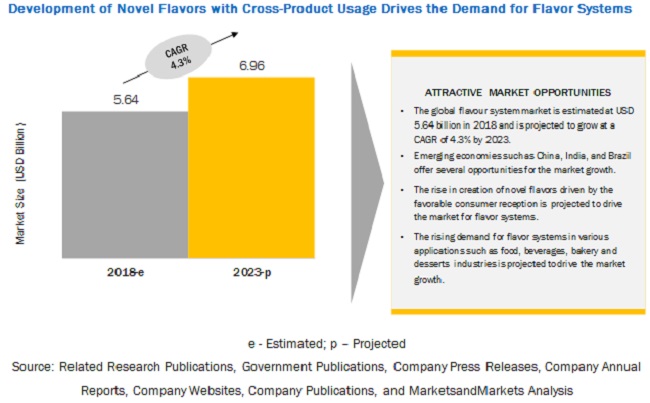

The report "Flavor Systems Market by Type (Brown, Dairy, Herbs & Botanicals, Fruits & Vegetables), Application (Beverages, Savories & Snacks, Bakery & Confectionery Products, Dairy & Frozen Desserts), Source, Form, and Region - Global Forecast to 2023", is estimated to be valued at USD 5.64 billion in 2018 and is projected to reach a value of USD 6.96 billion by 2023, growing at a CAGR of 4.3% during the forecast period. Factors such as the Creation of novel flavors driven by favorable consumer reception and cross product usage of flavors are driving the growth of this market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=237716072

By Source, the Nature-identical segment is projected to be the fastest-growing segment in the flavor systems market during the forecast period.

Nature-identical substances are chemically identical to any substance that are naturally present in materials of plant and animal origins, and are therefore a more preferred choice, for both, manufacturers of end-products, and consumers alike. Most commercial flavorants are nature-identical substances, as these tend to be more stable in nature than natural flavoring extracts, while being a more cost-effective option, hence are projected to witness rapid growth in demand during the forecast period.

By application, the beverages segment is projected to dominate the flavor systems market during the forecast period.

Flavors of fruits & vegetables and spices are widely being utilized and blended with beverages such as coffee and chocolate shake to create a worming aroma and taste, and also to create a sweet and spicy warm fall flavor. Other flavors such as mint flavors are added in beverages to create refreshing flavor and aromatic taste. Such innovations and customization in beverage products and flavor variety in line with consumer demands, is projected to boost the growth for flavor enhancers in the beverage segment.

The increasing demand for flavor systems in the North American and European regions is driving the growth of the flavor systems market.

In Europe, the growth of flavor systems is attributed to the growth in the. Beverages, bakery and dairy & frozen desserts industry, with growing demand for flavor enhancers in confectionery products. Soft drinks, dairy products, frozen products, and other alcoholic and non-alcoholic beverages are the most innovative food sectors in the region, offering significant opportunities for the growth of flavoring systems. Furthermore, the growing consumption of bakery & confectionery products and savories & snack products, and the demand for their product variety has resulted in intensifying demand for flavor systems in these food products. The innovation in food applications, with the use of flavor systems in these industries, has resulted in new product development and increased consumption of flavor systems in different food applications in this region.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=237716072

The demand for flavor systems in North America is driven by the increasing demand and creation of innovative flavor systems for processed food products as the region is among the largest consumers of processed food products. The market growth is further driven by the presence of a significant number of flavoring systems manufacturers in the region catering to the growing domestic as well as international market demand. Furthermore, the constantly evolving consumer demand for flavor varieties in end products together with the strategy of flavor systems market players to work in close proximity of their customers further aids the growth and development of the flavor systems market in the North American region.

Key Market Players:

Givaudan (Switzerland), International Flavors & Fragrances (IFF) (US), Firmenich (Switzerland), Symrise (Germany), and Mane SA (France) are the leading players in the flavor systems market. Major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.