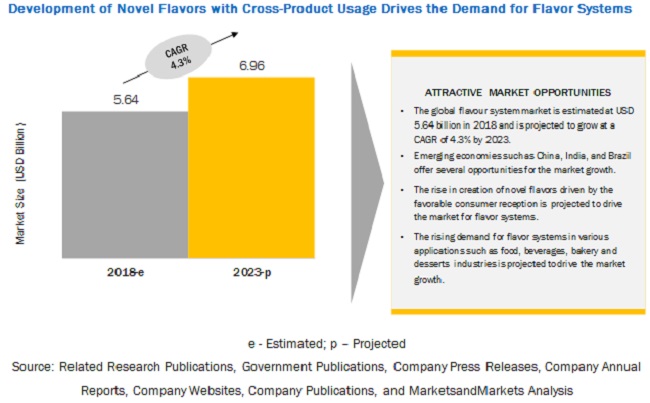

The report "Flavor Systems Market by Type (Brown, Dairy, Herbs & Botanicals, Fruits & Vegetables), Application (Beverages, Savories & Snacks, Bakery & Confectionery Products, Dairy & Frozen Desserts), Source, Form, and Region - Global Forecast to 2023", is estimated to be valued at USD 5.64 billion in 2018 and is projected to reach a value of USD 6.96 billion by 2023, growing at a CAGR of 4.3% during the forecast period. Factors such as the Creation of novel flavors driven by favorable consumer reception and cross product usage of flavors are driving the growth of this market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=237716072

By type, brown segment is projected to dominate the flavor systems market during the forecast period.

Brown flavors are the most commonly used flavor variant, used across a number of applications. Brown flavors stand inclusive of flavors, such as, chocolate, coffee, nut, nougat, caramel, and vanilla. Additionally, they could also stand inclusive of a number of novel tastes, such as, egg-nog, salted caramel, brownie, that are optimized from chocolate, nougat, macademia, caramel, etc. Thus, due to its usages in wide variety of food and beverages application, brown flavor segment is projected dominate the global flavor systems market during the forecast period.

By form, liquid segment is projected to dominate the flavor systems market during the forecast period.

The major advantage associated with the usage of liquid flavor enhancers, is that these flavors can be easily mixed together, and will achieve a homogeneous distribution of each component in the finished flavor. Moreover, Liquid and water containing flavors can also be encapsulated following their conversion to semi-solid or pasty forms, to be used across a number of applications.

The increasing demand for flavor systems in the North American and European regions is driving the growth of the flavor systems market.

In Europe, the growth of flavor systems is attributed to the growth in the. Beverages, bakery and dairy & frozen desserts industry, with growing demand for flavor enhancers in confectionery products. Soft drinks, dairy products, frozen products, and other alcoholic and non-alcoholic beverages are the most innovative food sectors in the region, offering significant opportunities for the growth of flavoring systems. Furthermore, the growing consumption of bakery & confectionery products and savories & snack products, and the demand for their product variety has resulted in intensifying demand for flavor systems in these food products. The innovation in food applications, with the use of flavor systems in these industries, has resulted in new product development and increased consumption of flavor systems in different food applications in this region.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=237716072

The demand for flavor systems in North America is driven by the increasing demand and creation of innovative flavor systems for processed food products as the region is among the largest consumers of processed food products. The market growth is further driven by the presence of a significant number of flavoring systems manufacturers in the region catering to the growing domestic as well as international market demand. Furthermore, the constantly evolving consumer demand for flavor varieties in end products together with the strategy of flavor systems market players to work in close proximity of their customers further aids the growth and development of the flavor systems market in the North American region.

Key Market Players:

Givaudan (Switzerland), International Flavors & Fragrances (IFF) (US), Firmenich (Switzerland), Symrise (Germany), and Mane SA (France) are the leading players in the flavor systems market. Major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.