The Report

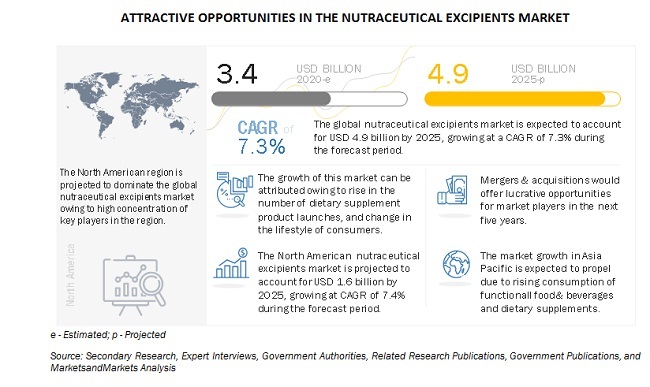

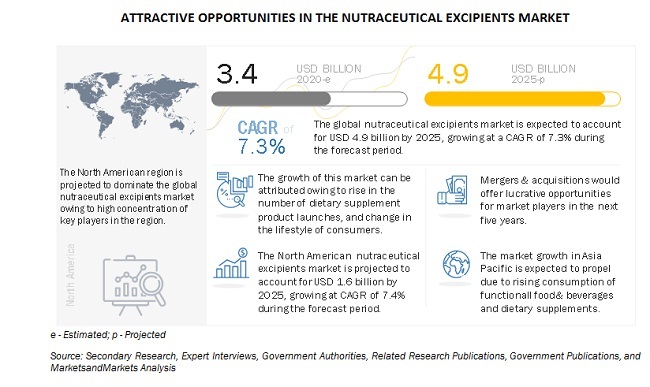

"Nutraceutical Excipients Market by Functionality (Binders, Fillers & Diluents, Coating Agents, and Flavoring Agents), End Product (Prebiotics, Probiotics, Proteins & Amino Acids, and Vitamins), Form (Dry and Liquid), and Region - Global Forecast to 2025", The global nutraceutical excipients market size is estimated to account for about USD 3.4 billion in 2020 and projected to reach a value of nearly USD 4.9 billion by 2025, growing at a CAGR of 7.3% from 2020 to 2025. The market for nutraceutical excipients market has been growing in accordance with the rise in demand and consumption for nutraceuticals, around the globe. The consumption of dietary supplements in the form of tablets and capsules has been witnessing an upsurge demand in recent times, owing to the growing awareness for health benefits offered by these products that helps to support the wellbeing of the consumers. The key driving factors of the nutraceutical excipients market include increasing consumer concerns regarding maintaining a balanced diet and growing consumer awareness about several diseases caused due to lack of intake of necessary nutrients as a result of imbalanced dietary lifestyles. Food fortification is one of the major trends, which is also fueling the nutraceutical excipients market in the functional food & beverage industry.

“Impact of COVID-19 on the current market size and forecast.”

COVID-19 pandemic has led multiple operations to cease. The global nutraceutical excipients market is increasingly impacted due to the uncertain circumstances that have occurred worldwide. The effects of COVID-19 primarily affect the supply chain of final products, as well as raw material ingredients of global manufacturers. As its major applications are concentrated in products belonging to dietary supplements, followed by food & beverages, the market is projected to witness a slow-down until the local and national governments do not ease import and export regulations. Overall, this market is dominated by the global players that have manufacturing facilities in certain regions and operations/supply across countries.

The market for nutraceutical excipients in North America is projected to record high growth due to the increase in consumption and concentration of key players in the region. However, post-COVID-19, by the third or fourth quarter of 2020, the market for nutraceutical excipients will witness immense growth due to the high consumption of nutraceuticals in the daily dietary lifestyles of consumers. The North American market is projected to witness a substantial increase in demand, as a result of the rise in awareness pertaining to these health-benefiting supplements, as well as the number of cases and casualties, resulting in high demand for immunity boosters and other supplements. Thus, the growth rate is projected to decline during the ongoing pandemic but will increase two-folds after the projected quarters.

Restraint: Decrease in returns on R&D investments and high costs of clinical trials and registration.

Excipients and nutraceutical products are clinically and chemically developed, and hence, require extensive R&D investments, clinical trials, and approvals from respective authorities in different countries/regions. In addition, developing such products is not a short-term activity, as it includes the formulation, trial & testing, and commercializing it into the market. However, high R&D investments do not give equal returns in terms of productivity, as even after successful molecule discovery, the cost of bringing a new nutraceutical product and a new excipient into the market is significantly high. In addition, other players in the market develop alternate and cheaper solutions, amidst the trial and testing procedures of one product or solution by another company, which leads to wastage of time, money, and efforts required to come to the later stages of that product, thereby disrupting the complete process of new product development. At the same time, the risk of failure also remains high. The cost of proving the effectiveness of an excipient through clinical trials is also relatively expensive and can be a major hindrance to the development of novel excipients in the market.

Opportunity: High use of excipients with multifunctional properties is witnessed as an emerging trend among key players.

Multifunctional excipients are a class of excipients that include pre-processed and co-processed excipients that provide added functionalities to the formulation. For example, Silicified Micro-Crystalline Cellulose is a processed combination of MCC and colloidal silicon dioxide. These functionalities include flowability, compressibility, particle size distribution, shape, and porosity. The term multifunctional excipient is also extended to products that serve multiple roles in the formulation of dietary supplement and functional food & beverage line of products; for example, Ludipress is a co-processed product containing lactose, Kollidon, and Kollidon-CL, which serves the role of DC diluent with binder and disintegrant properties.

The demand for excipients with improved functionalities in the nutraceutical industry remains high, while also minimizing the drawbacks of incorporated excipients. According to the International Pharmaceutical Excipient Council (IPEC), a co-processed excipient is “a combination of two or more compendial or non-compendial excipients designed to physically modify their properties in a manner not achievable by simple physical mixing, and without significant chemical change.”

By form, the dry segment is estimated to account for the largest share in the market in 2020.

The dry form of nutraceutical excipients accounted for a larger market share, as compared to the liquid form. The popularity of the dry form can be attributed to its cost-effectiveness and convenience in multiple applications. An increase in demand for dry beverage mixes with additional nutrients, including customized mixes and consumer preference for fortified beverages are fueling the growth of the dry segment in the market.

North America is estimated to dominate the nutraceutical excipients market in 2020

North America accounted for the largest market share in 2019. The nutraceutical excipients market in North America is dominating, owing to the concentration of the global players such as DuPont (US), Kerry (Ireland), Cargill (US), and Ingredion (US). The market for nutraceutical excipients here is mature, and hence, the growth is moderate compared to other regions. Other factors contributing to the growth of nutraceutical excipients in North American region include the busy lifestyle of consumers, prevalence of chronic diseases due to hectic lifestyles, and an increase in awareness among consumers regarding the health benefits of nutritional foods, including food supplements, which has driven the demand for functional food products. In addition, the use of technological advancements and new product launches have made excipients available for a wide range of applications in the fortified food & beverage, dietary supplements, and nutraceuticals sectors, which is projected to drive the growth of the market in the region.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies in the nutraceutical excipients market. The key players in the nutraceutical excipients market include DuPont (US), BASF SE (Germany), Kerry Group PLC (Ireland), Ingredion Plc (US), Sensient Technologies (US), Associated British Foods (UK), Roquette Freres (France), Meggle Group Wasser (Germany), Cargill Inc (US), Ashland Global Holdings Inc (US), Seppic (France), Shin-Etsu Chemical Co Ltd (Japan), Fuji Chemical Industries Co Ltd (Japan), Pharmatrans Sanaq AG (Switzerland), Pioma Chemicals (India), Gattefosse (India), W.R.Grace & Co (US), Omya (Switzerland), Grain Processing Corp (US), and Gangwal Chemicals Pvt Ltd (India). The nutraceutical excipients market also consists of key start-up players, which include IMCD (Netherlands), Hilmar Ingredients (US), Innophos Holdings Inc (US), JRS Pharma (Germany), Biogrund GmbH (Germany), Pharma Line Intl Corp (South Korea), Jigs Chemical (India), Panchamrut Chemicals (India), Azelis Chemical Ltd (Europe), and Daicel Group (Japan).