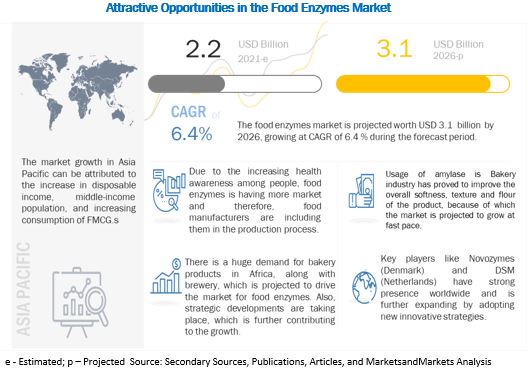

The report "Food Enzymes Market by Type (Carbohydrases, Proteases, Lipases, Polymerases & Nucleases), Source, Application (Food & Beverages), Formulation, and Region(North America, Europe, Asia Pacific, and South America) – Global Forecast to 2026", The food enzymes market is estimated to be valued at USD 2.2 billion in 2021 and is projected to reach USD 3.1 billion by 2026, recording a CAGR of 6.4%, in terms of value. The growing demand for diverse range of food products, clean label trend, and increase in disposable income are the factors that are projected to drive the growth of the food enzymes market globally.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=800

The microorganism segment is projected to witness significant growth during the forecast period.

Based on source, the food enzymes market is segmented into microorganism, plants, and animal. The microorganism segment is projected to witness the fastest growth during the forecast period, as enzymes obtained from microbial sources lead to low production costs and are stable than other sources. They can be produced through fermentation techniques in a cost-effective manner with less time and space requirement, and because of their high consistency, process modification and optimization are easily done.

The carbohydrases segment is projected to account for a major share in the food enzymes market during the forecast period

By type, the food enzymes market is segmented into carbohydrases, proteases, lipases, polymerases & nucleases, and other enzymes (such as catalases, laccases, oxidases, phosphatases, kinases, esterases, and pectinases). Carbohydrases are classified into amylases, cellulases, and other carbohydrases (such as pectinases, lactases, mannanases, and pullulanases). Amylase is used in the baking industry as the addition of amylase to the dough, enhances the fermentation rate which results in the reduction of the viscosity of dough, further improving the volume and texture of the product. Due to easy modification and optimization processes, there is a huge usage of amylase in the food & beverage industry.

The North American region dominated the food enzymes market with the largest share in 2020, whereas Asia Pacific is expected to witness the highest growth rate.

The food enzymes market in North America was dominant due to the increasing demand for enzymes in food applications. Technological innovations in machinery, optimization of production, logistics, and globalization of business have made the food & beverage industry one of the essential sectors in North America. However, the shift of food operations from developed regions, such as North America and Europe, to Asia Pacific, has further contributed to the growth of the food enzymes market in the Asia Pacific region.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=800

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as DuPont (US), Associated British Foods plc (UK), DSM (Netherlands), Novozymes (US), CHR. Hansen Holdings A/S(Denmark), Kerry Group (Ireland), Jiangsu Boli Bioproducts Co., Ltd. (China), Biocatalysts Ltd. (UK), Puratos Group (Belgium), Advanced Enzyme Technologies Ltd (India), Amano Enzyme Inc. (Japan), Enzyme Development Corporation (US), ENMEX, S.A. de C.V. (Mexico), Aumgene Biosciences (India), Creative Enzymes (US), SUNSON Industry Group Co., Ltd (China), AUM Enzymes (India), Xike Biotechnology Co. Ltd. (China), and Antozyme Biotech Pvt Ltd (India).