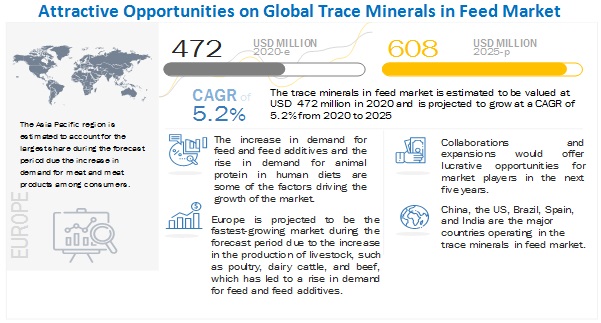

The report "Trace Minerals In Feed Market by Type (Iron, Zinc, Manganese, Copper, Cobalt, Chromium, Other Types), Livestock , Chelate Type (Amino Acids, Proteinates, Polysaccharides, Other Chelate Types), Form, And Region – Global Forecast To 2025", The global trace minerals in feed market size is estimated to be valued at USD 472 million in 2020 and is expected to reach a value of USD 608 million by 2025, growing at a CAGR of 5.2% during the forecast period. Factors such as the rise in production of compound feed, and the increase in the importance of protein-rich diets among consumers across the globe opened new avenues for trace minerals in feed market. The major feed producing countries in the world include China, the US, Brazil, Mexico, Spain, India, and Russia. The where the demand for chicken and red meat has been growing. This in these countries, which has also contributed to the growth of the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=196308436

Poultry, by livestock, is estimated to hold the largest share in the trace minerals in feed market during the forecast period

The poultry segment accounts for the largest share and is also projected to grow at the fastest rate during the forecast period. There has been a significant increase in demand for poultry meat and other byproducts across the globe. People are therefore engaging in animal rearing and animal husbandry to fulfil this global demand. The most effective way to achieve the highest production is to supply these birds with trace minerals, such as zinc, copper, and manganese, to increase their performance, which has led to an increase in demand for trace minerals. Trace minerals are indispensable components in poultry diets. They are required for growth, bone and feather development, and enzyme structure. The immune functions of all poultry species depend on trace minerals. This drives the growth of trace minerals in feed market across the globe.

Amino acids, by chelate type, is estimated to account for the largest market share during the forecast period

Amino acids are considered an ideal chelator due to their ability to be easily absorbed in the animal body. This is due to the attachment of amino acids to the mineral molecules that create a more stable structure, which helps the minerals survive in the acidic environment of the stomach. Furthermore, trace minerals are protected from various bacteria present in the body of animals, and enzymes are unable to degrade it. It also inhibits the antagonistic action between metal ions and decreases the breaking down of vitamins in the feed. This is due to their ability to be easily absorbed in the body for the normal functioning of protein synthesis. This increases the absorption of minerals directly in the intestinal wall, along with amino acid ligands, to which they are bonded.

Dry, by form, is estimated to account for the largest market share during the forecast period

The dry segment accounted for the largest share in 2019, as trace mineral products in the dry form enable the hygienic supply of these ingredients, and the feeding system is comparatively easy to manage. Furthermore, the ease of mixing dry form of trace minerals into the total feed, relative cost-effectiveness as compared to the liquid form, and its long shelf life are some of the other key factors encouraging its use in dry form. Trace minerals are mostly available in the dry form, as they are easy to mix with feed products in the appropriate quantity. For instance, the powdered copper and zinc could be mixed in the ratio of a billion parts of copper or just one part of zinc. Additionally, other minerals and trace minerals in powdered form could be mixed in similar ratios, without causing a reaction. Furthermore, chelated trace minerals in the dry form find application in various livestock. In addition, when mixed with dry feed, they are often absorbed more efficiently by the body, if supplied rather than used as supplements.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=196308436

Asia Pacific is estimated to hold the largest market share during the forecast period

The trace minerals in feed market is estimated to grow significantly in the Asia Pacific region due to the rise in demand for poultry meat and poultry byproducts as well as ruminants from the major economies such as China, India, Japan and other South East Asian countries as they experience a surge in the increase in a number of health-conscious consumers. With the increase in awareness amongst consumers about the essential nutrients requirement in daily diet, have increased the demand for protein rich meat. In Asia Pacific, trends around healthy lifestyles and prevention among older consumers trying to avoid expensive healthcare costs and extend healthy lifespans are generating growth opportunities dietary supplements. Thus, causing Trace minerals in feed to flourish in the region.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the Trace minerals in feed market. It consists of the profiles of leading companies such Cargill, Incorporated (US), (US), BASF SE (Germany), Bluestar Adisseo Co., Ltd (China), Koninklijke DSM N.V. (Netherlands), Nutreco N.V. (Netherlands), Alltech (US), Zinpro (US), Orffa (Netherlands), Novus International (US), Kemin Industries, Inc. (US), Lallemand, Inc. (Canada), Virbac (France), Global Animal Nutrition (US), Dr. Paul Lohmann Gmbh & Co. KGAA (Germany), Biochem Zusatzstoffe (Germany), Veterinary Professional Services Ltd. (Vetpro) (New Zealand), Chemlock Nutrition Corporation (US), dr. eckel animal nutrition gmbh & co.kG (Germany), Vetline (India), Green Mountain Nutritional Services Inc. (US), Biorigin (Brazil), Tanke (China), JH Biotech, Inc. (US), QualiTech, Inc. (US)..