https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=196308436

Friday, January 28, 2022

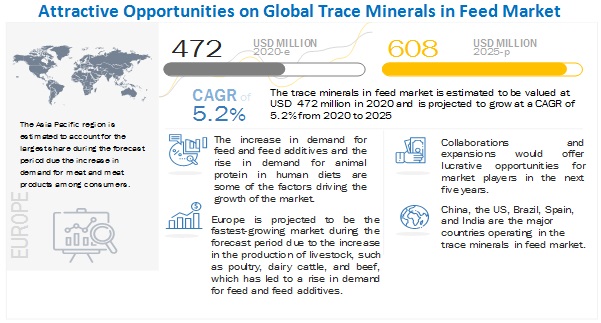

Trace Minerals in Feed Market Will Hit Big Revenues In Future

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=196308436

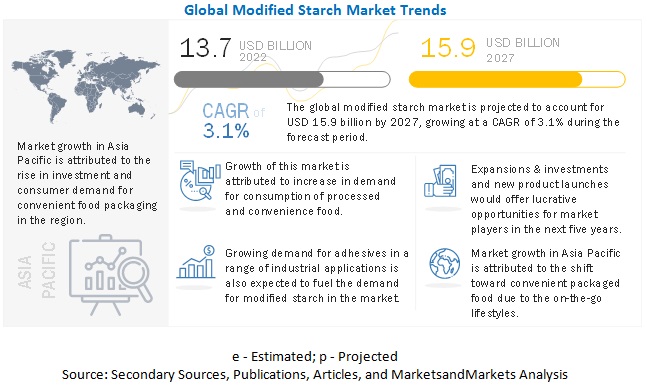

Modified Starch Market Projected to Garner Significant Revenues by 2025

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=511

Feed Yeast Market to See Major Growth by 2025

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=108142106

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=108142106

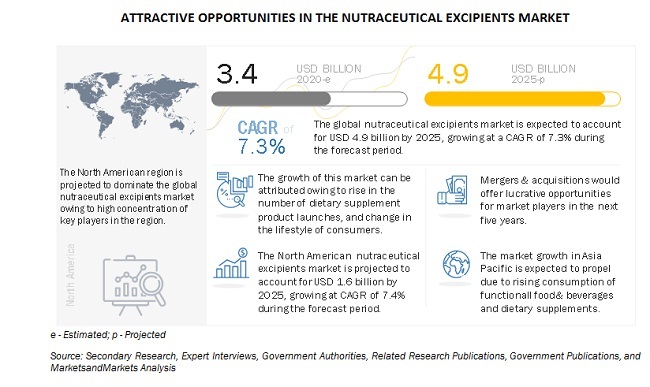

Growth Opportunities in the Nutraceutical Excipients Market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=247060367

Wednesday, January 19, 2022

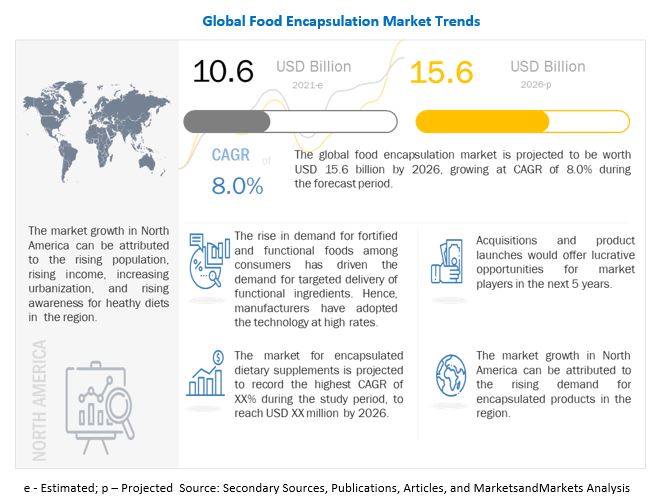

Food Encapsulation Market Projected to Garner Significant Revenues by 2026

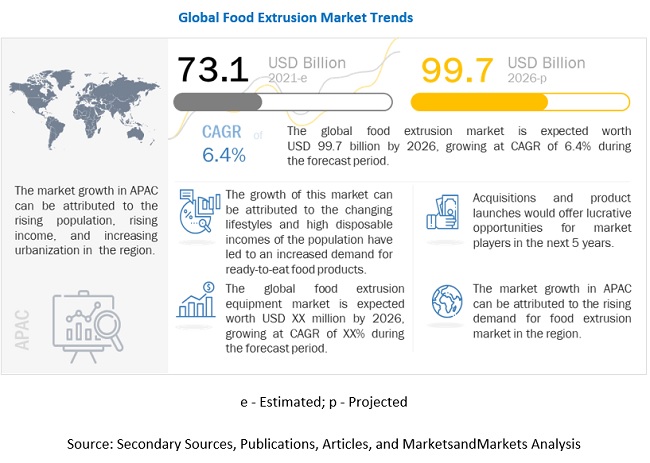

Food Extrusion Market to Showcase Continued Growth in the Coming Years

Tuesday, January 18, 2022

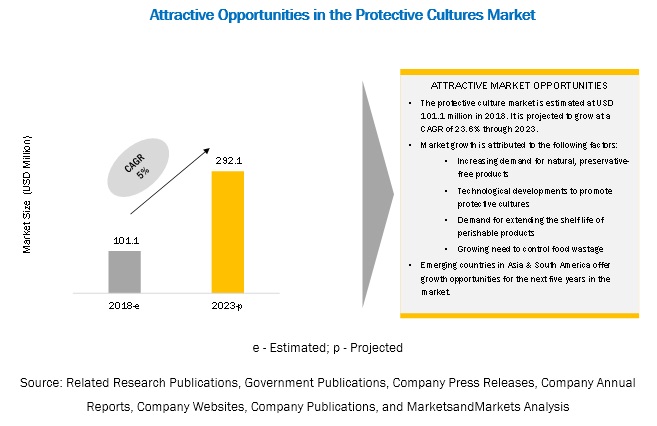

Latest Regulatory Trends Impacting the Protective Cultures Market

The report "Protective Cultures Market by Product Form (Freeze-dried and Frozen), Target Microorganism (Yeasts & Molds and Bacteria), Application (Dairy & Dairy Products, Meat & Poultry Products, and Seafood), Composition, and Region - Global Forecast to 2023", The market for protective cultures is estimated at USD 101.1 million in 2018; it is projected to grow at a CAGR of 23.6% to reach USD 292.1 million by 2023.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=4070383

The yeast & molds segment is estimated to account for a larger market share, in terms of value, in 2018

Microorganisms are recorded as the major contaminants that degrade food products. Fermented products are more prone to spoilage by microorganisms. The common spoilage microorganisms include yeasts, molds, and bacteria. Molds is the primary food spoilage agent in dairy products. Yeasts mainly grow inside a food product, while molds typically grow on the surface. Molds mostly grow at a pH of 3 to 8. The protective cultures market for the growth control of yeasts & molds is projected to witness a faster growth of 23.9% during the forecast period.

The genetically modified segment is estimated to witness the fastest growth in the protective cultures market, in terms of value, in 2018

The genetic modification of protective cultures improves the quality and production of oil. The high demand for competitive and economically priced vegetable oil has led to an increase in the preference for genetically modified seeds. Genetically engineered protective cultures are being used as an important ingredient in the functional foods industry. This widespread demand and an increase in the application areas are some of the factors, due to which the market is projected to witness faster growth.

The dairy & dairy products segment, by application, is estimated to account for the largest market share, by value, in 2018

Based on application, the dairy & dairy products segment is expected to dominate the food and beverage protective cultures market due to the wide consumption of dairy products such as cheese, yogurt, and butter across the globe. The cheese industry is also one of the major application areas of protective cultures. Companies such as Chr Hansen and DuPont Danisco have a significant presence in the dairy & dairy products segment with a wide array of dairy protective cultures.

The freeze-dried segment, by product form, is estimated to account for the largest market share, by value, in 2018

The freeze-dried segment in the protective cultures market is projected to grow at a higher CAGR and account for the largest market share during the forecast period. Protective cultures are highly unstable during storage and need to be preserved well to extend their shelf life. Freeze-dried protective cultures are considered the most convenient form for their application in various industries.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=4070383

The multi-strain mixed segment, by composition, is estimated to account for the largest market share, by value, in 2018

Based on composition, the market of multi-strain mixed protective cultures is projected to hold the largest market share by 2023, owing to the fact that each microorganism in these cultures performs specific functions, and hence, there is no need to use multiple single-strain cultures. Europe is projected to grow at the highest CAGR of 23.5% during the forecast period Europe accounted for the largest share of the protective cultures market and was valued at USD 38.4 million in 2017. The dominant status of Europe can be attributed to the strong dairy industry in the region. The combined output of the EU-28 countries in the global dairy industry contributes 44.0% to the global dairy production. According to the USDA, the European Union produced 115.6 million liters of milk in 2017, marking an increase of 2.0% as compared to the previous year’s output.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the protective cultures market. It includes the profiles of leading companies such as Chr Hansen (Denmark), DowDuPont (US), Sacco S.R.L (Italy), CSK Food Enrichment B.V. (Netherlands), THT S.A. (Belgium), Dalton Biotechnologies (Italy), Biochem S.R.L (Italy), Meat Cracks Technology GmbH (Germany), Royal DSM N.V. (Netherlands), Bioprox (France), Aristomenis D. Phikas & Co SA. (Greece), and Soyuzsnab Group of Companies (Russia).